|

|

|

|

|||||

|

|

Both Skillsoft SKIL and Udemy UDMY are online learning platforms focusing on workforce development and lifelong learning. While SKIL is zeroing in on corporate digital learning solutions, Udemy operates a vast marketplace of professional and personal development courses. These stocks are direct competitors in the flourishing e-learning and corporate training domain.

This comparative analysis will allow investors to settle on the stock that deserves a place in their portfolio.

Skillsoft’s growth trajectory was turbulent over the past few quarters. Notably, the company registered a sequential marginal rise in its revenues in the third quarter of fiscal 2026, while it recorded a 6% year-over-year decline. This detriment was particularly attributed to an 18% year-over-year dip in the Global Knowledge (GK) segment’s revenues, which accounted for 22% of the top line. While this performance raises caution, investors might find management’s decision to review strategic alternatives for the GK segment promising.

The GK segment was responsible for a $20.8-million non-cash goodwill impairment loss, leading to a $4.9-million adjusted net loss. Hence, a potential sale will hinder its balance sheet from shrinking the market. The Talent Development Solutions (TDS) segment witnessed a 2% year-over-year decline. However, management stands highly optimistic about SKIL’s AI-native roadmap through Percipio, which signed its first four large enterprise customers, indicating early success.

This AI inclination resulted in a 2.4% year-over-year dip in content and software development expenses. On the selling and marketing expenses front, a 7.1% year-over-year drop was observed on the back of headcount reduction. General and administrative expenses plummeted 11.9% year over year due to lower headcount and vendor spending.

A sharp decline in these expenses resulted in $28 million in adjusted EBITDA. While the adjusted EBITDA margin dipped 130 basis points (bps) from the year-ago quarter, we must acknowledge the margin resilience despite the double-digit decline in GK revenues. While investor hesitance is obvious, stripping down the GK segment will lead the company to leverage its high-margin SaaS platform, stabilizing its long-term margin.

Udemy showed consistency in its revenue generation over the past few quarters. In the third quarter of 2025, the company managed to register $195.7 million in its top line, a marginal year-over-year rise, with subscription revenues growing 8% year over year, which represented 74% of revenues. UDMY’s customer-centric strategy paid off, as evidenced by a lofty 88% year-over-year upsurge in paid subscribers in the consumer segment and a 2% hike in total customers in the enterprise segment.

This impressive performance can be attributed to AI integration and the strategic pivot to high-value recurring revenue streams. The CEO mentioned that the combination of AI with human expertise strengthens UDMY’s platform solution and widens its market opportunity. Capturing the opportunities requires the company to scale exponentially, which is evident from its year-over-year adjusted EBITDA margin expansion by 600 bps to 12%, led by operational discipline and mix shift toward high-margin subscriptions and the gross margin surging 600 bps year over year.

These positives might not steer clear of the near-term challenges. While Udemy Business revenues gained 5% year over year in the third quarter of 2025, net dollar retention stood at 93%, a headwind from the downsizing of legacy COVID-era contracts and customer optimization. Furthermore, while the company managed to boost paid subscribers by 88% year over year, revenues moved up marginally, which might lead investors to question the efficacy of Udemy’s customer-first and recurring-revenues strategies.

Moreover, competition is fierce in the online learning space, with LinkedIn Learning posing the greatest threat due to its world’s largest professional social network. Having said that, Udemy might be compelled to improve its operations, which could eventually topple it from its growth-profitability balance.

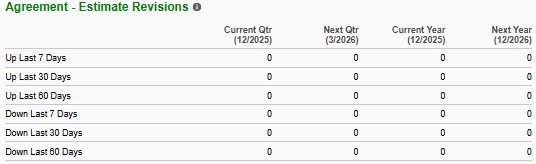

The Zacks Consensus Estimate for Skillsoft’s fiscal 2026 sales is pegged at $512.2 million, a 3.6% dip from the preceding year. The consensus mark for EPS is set at $4.17, plummeting 3.7% year over year. One estimate for fiscal 2026 has increased over the past 60 days, with no downward revisions.

The Zacks Consensus Estimate for Udemy’s 2026 sales is pinned at $806 million, up 2.2% year over year. For EPS, the consensus mark is kept at 48 cents, declining 5.5% year over year. There have been no changes or revisions to analyst estimates lately.

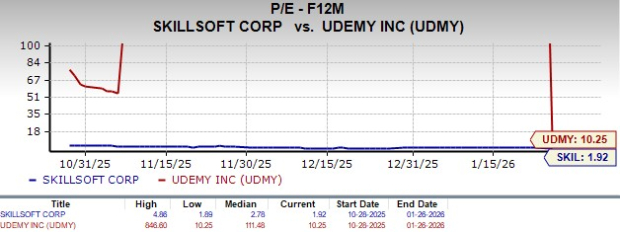

Skillsoft is trading at a 12-month forward price-to-earnings ratio of 1.92, which is lower than its 3-month median of 2.78. Udemy’s 12-month forward price-to-earnings ratio is 10.25, below its 3-month median of 111.48. SKIL trades at a lower price than UDMY, making it more appealing to investors.

Despite Skillsoft’s year-over-year dip in revenues, the TDS segment appears resilient with a high margin. Management’s proactive move to review alternatives to the GK segment is a growth catalyst that might lower the balance sheet drag. It would position the company as a leaner AI-first entity.

While Udemy runs a steady growth engine with an 88% year-over-year surge in paid subscribers, it does not translate into a compelling revenue hike. Furthermore, it shoulders competitive pressure from LinkedIn Learning, affecting its ability to maintain growth and profitability.

Hence, we recommend that investors add SKIL to their portfolio as it trades cheaper than UDMY, allowing them to enjoy greater returns in the long run as the market realizes SKIL’s true value. Also, we urge investors to retain UDMY for now until customer and subscriber growth justifies top-line improvement.

SKIL flaunts a Zacks Rank #1 (Strong Buy) and UDMY carries a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Mar-04 | |

| Mar-03 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-24 | |

| Feb-24 | |

| Feb-20 | |

| Feb-19 | |

| Feb-18 | |

| Feb-15 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite