|

|

|

|

|||||

|

|

Capital One Financial Corporation’s COF credit card business stands out as a core earnings engine, underpinned by its scale, data-driven underwriting and strong brand presence in the U.S. consumer finance market. Credit cards have been central to COF’s business model and remain its largest revenue source. Historically, the credit card segment accounted for more than 70% of COF’s revenues, driven by net interest income (NII) from revolving balances and interchange/fee income on card spending.

While in May 2024, the company ended its card partnership with Walmart, its 2017 acquisition of Cabela's Incorporated’s credit card operations bodes well. Moreover, post the Discover Financial acquisition (closed May 2025), Capital One became one of the largest U.S. credit card issuers by balances, significantly boosting scale and revenues.

In 2025, the credit card segment’s net revenues witnessed a year-over-year rise of 40.5%. Loans held for investment within the segment increased 72% year over year, while purchase volumes improved 27%. Despite an intensely competitive environment, strong growth opportunities in card loans and purchase volumes are expected to continue, thus supporting the segment’s performance.

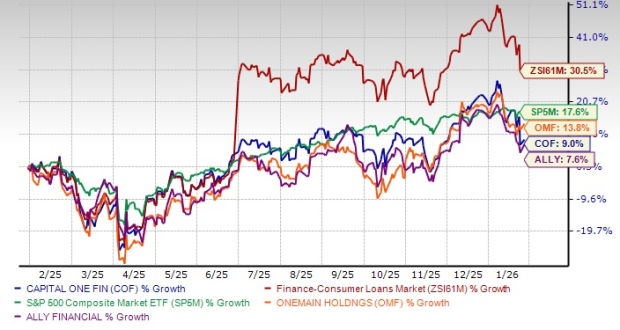

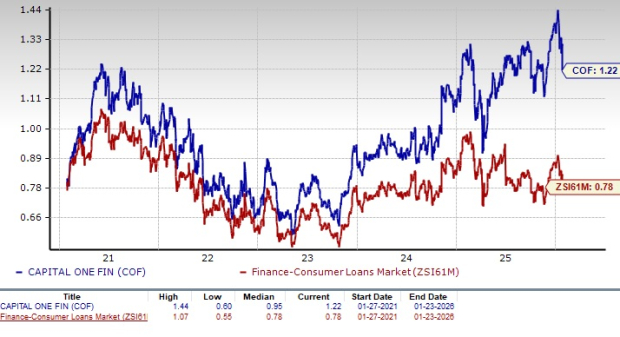

While the company’s price performance suffered recently because of macro concerns like the proposed credit card rate caps, its shares have gained 9% in the past year, with the majority of the rally coming following the completion of the Discover deal. The industry to which the stock belongs has gained 30.5%, whereas the S&P 500 Index has rallied 17.6%. Looking at COF’s peers, Ally Financial ALLY and OneMain Holdings, Inc. OMF, it appears that while the COF stock has outperformed Ally Financial, it has underperformed OneMain in a year.

While Capital One looks well-positioned for long-term growth, supported by its robust credit card business, it is better to have a look at the company’s fundamentals before making any investment decision.

Inorganic Expansion Efforts: Capital One has been pursuing opportunistic acquisitions over the years, which have been driving its revenues. A few days ago, COF announced a $5.15-billion deal to acquire fintech firm Brex, expanding into corporate cards and business payments beyond traditional consumer credit. In May 2025, it acquired Discover Financial in an all-stock transaction valued at $35.3 billion, reshaping the landscape of the credit card industry, creating a behemoth and unlocking substantial value for shareholders (the deal is expected to be more than 15% accretive to adjusted EPS by 2027).

In 2023, COF acquired Velocity Black, bolstering the delivery of exceptional consumer experiences attributable to its innovative technology. Other notable acquisitions include ING Direct USA, HSBC's U.S. Credit Card Portfolio and TripleTree. These have been instrumental in transforming the company from a monoline credit card issuer into a diversified financial services firm with a significant presence in retail banking, commercial lending and digital banking platforms.

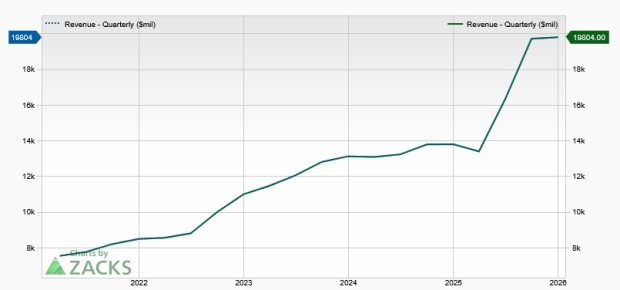

Revenue Strength: Capital One’s NII has witnessed a compound annual growth rate (CAGR) of 13.4% over the five years ended 2025. Also, its net interest margin (NIM) expanded to 7.84% in 2025 from 6.88% in 2024 and 6.63% in 2023.

Moreover, though the company’s total revenues declined marginally in 2020, the metric witnessed a five-year (2020-2025) CAGR of 13.4%.

Thus, despite the three interest-rate cuts in 2025, along with expectations of more in 2026, Capital One’s NII and NIM are expected to keep benefiting from robust demand for card loans and Capital One’s efforts to scale businesses.

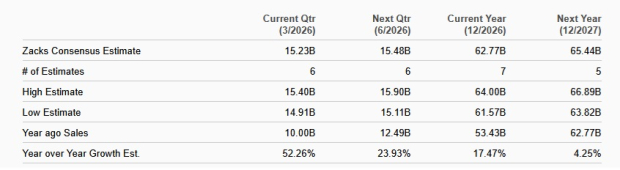

The Zacks Consensus Estimate for COF’s 2026 and 2027 revenues is pegged at $62.77 billion and $65.44 billion, respectively, which indicate year-over-year growth rates of 17.5% and 4.3%.

Solid Balance Sheet: As of Dec. 31, 2025, Capital One had total debt (securitized debt obligations plus other debt) of $51 billion. The total cash and cash equivalents balance was $57.4 billion. Additionally, the company holds investment-grade long-term senior debt ratings of Baa1, BBB and A- from Moody’s Investor Service, Standard and Poor’s, and Fitch Ratings, respectively. This renders the company favorable access to the debt market.

Capital One’s focus on maintaining a strong capital and balance sheet position supports its capital distribution activities. After slashing the quarterly dividend by 75% in 2020 based on the Federal Reserve’s requirements, COF restored it to 40 cents per share in the first quarter of 2021. In July 2021, the company hiked its dividend 50% to 60 cents per share and also announced a special dividend of 60 cents per share.

In November 2025, the company raised its quarterly dividend 33.3% to 80 cents per share. Also, Capital One has a share repurchase plan in place. In October 2025, its board of directors authorized the repurchase of up to $16 billion of shares, which began on Oct. 21. Given its earnings strength and solid liquidity position, the company’s enhanced capital distribution plans look sustainable.

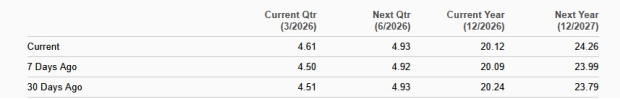

Analysts have a mixed stance regarding COF’s earnings growth prospects. Over the past month, the Zacks Consensus Estimate for the company’s 2026 earnings of $20.12 has been revised lower, while the estimate for 2027 of $24.26 has been revised higher.

The projected figures imply year-over-year growth of 2.6% and 20.6% for 2026 and 2027, respectively.

In terms of valuation, COF currently has a price-to-book ratio (P/B) of 1.22X, which is higher than the industry's 0.78X. This shows that the stock is trading at a premium.

Meanwhile, its peers Ally Financial and OneMain have a P/B ratio of 0.96X and 2.25X, respectively.

As one of the largest credit card issuers in the country, COF benefits from a diversified customer base that spans prime to subprime segments, allowing it to generate attractive yields while actively managing risk. Its long-standing investment in analytics and digital capabilities enables more precise credit decisioning, dynamic pricing and early identification of stress in borrower behavior, supporting resilient revenue generation across credit cycles.

However, if the 10% cap on credit card interest is implemented and enforced, Capital One’s interest income could drop significantly, since cards issued today often yield much more than 10%. Also, the company’s profit margins may shrink, potentially pressuring earnings.

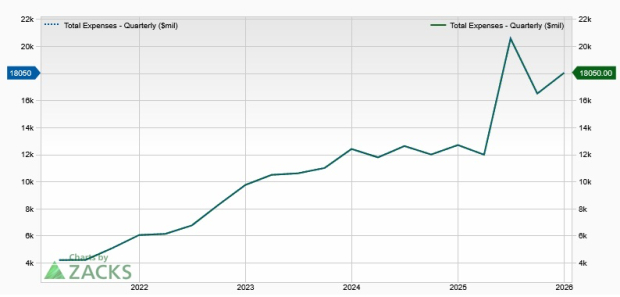

In addition to this concern, steadily rising expenses and weak credit quality remain major woes. Over the last five years (2020-2025), non-interest expenses witnessed a CAGR of 15.2% due to higher marketing costs and inflationary pressures. Given the company’s investments in technology and infrastructure, as well as inorganic expansion efforts, expense levels are expected to remain elevated.

COF’s near-term results can be influenced by provisioning trends and macro conditions. However, the long-term outlook is supported by disciplined risk management, strong consumer spending engagement and potential margin expansion from scale and integration benefits.

Thus, given its premium valuation, investors should not rush to buy the stock now and should wait for an attractive entry point. Yet, those who already own the stock should hold on to it as the company is less likely to disappoint in the long run. COF’s credit card franchise is expected to remain a central driver of earnings growth and shareholder value creation over the medium to long term.

Currently, COF carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 |

Heard on the Street: Credit Fears Are Spreading to Consumer Lending

COF -6.15%

The Wall Street Journal

|

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

American Express Hits Dow Jones On AI Doomsday 'Work Of Fiction'

COF -8.84%

Investor's Business Daily

|

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite