|

|

|

|

|||||

|

|

Caterpillar Inc. CAT is anticipated to witness a year-over-year decline in its bottom line despite higher revenues when it reports fourth-quarter 2025 results on Jan. 29, before the opening bell. The Zacks Consensus Estimate for CAT’s fourth-quarter 2025 earnings has moved up 1.5% over the past 60 days to $4.67 per share.

The consensus mark implies a 9.1% decline from the year-ago actual. This implies the sixth consecutive quarter of earnings decline for the company. The Zacks Consensus Estimate for Caterpillar’s revenues is pegged at $17.9 billion for the quarter, indicating 10.4% year-over-year growth.

CAT’s earnings outpaced the Zacks Consensus Estimate in two of the trailing four quarters while missing twice, the average surprise being 2.12%. This is depicted in the following chart.

Our proven model does not conclusively predict an earnings beat for Caterpillar this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that is not the case here.

Earnings ESP: CAT has an Earnings ESP of -2.86%. You can uncover the best stocks before they are reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

The manufacturing sector remained in contraction through the third quarter of 2025, as reflected in the Institute for Supply Management’s manufacturing index with a 48.7% reading in October, 48.2% in November and 47.9% in December. The New Orders Index also remained below 50% throughout this period. Concerns over tariffs led customers to scale back orders, a trend likely to have reflected in Caterpillar’s fourth-quarter order volumes.

CAT’s substantial backlog of $37.5 billion at the beginning of the fourth quarter of 2025 and higher aftermarket parts and service-related revenues are likely to have supported its top line.

All segments are expected to show volume improvement in the quarter. Overall, we expect a 13.6% contribution from volumes on fourth-quarter revenues, partly offset by a 0.4% decline in pricing and a 0.3% unfavorable currency impact.

Tariffs (estimated to be around $650-$800 million) are likely to have driven a 19.4% spike in the cost of sales. We anticipate an 11% increase in selling, general and administrative expenses and a 35% rise in research and development costs.

Factoring in the expected growth in revenues offset by higher costs, our model projects a 19% year-over-year decrease in adjusted operating income to $2.36 billion. We expect the operating margin to be 13.2% in the fourth quarter, implying a contraction from the 18.3% reported in the fourth quarter of 2024.

Our model projects the Resource Industries segment's external sales at $2.87 billion for the fourth quarter, indicating a 0.1% year-over-year rise. We expect a 2.9% rise in volume for the segment and an unfavorable 2.1% pricing and a negative 0.7% impact from currency translation.

The segment is expected to report an operating profit of $499 million, suggesting a 19.4% year-over-year decline. The segment’s operating margin is projected to be 16.4%, slightly higher than the 16.3% reported in fourth-quarter 2024.

The Construction Industries segment’s external sales are projected at $6.72 billion, indicating growth of 6.4% from the year-ago quarter’s actual. We expect a 24.9% improvement in volumes. However, pricing is expected to have been flat and we expect an unfavorable impact of 0.1% from currency translation.

The segment’s operating profit is projected to be $1.39 billion, indicating year-over-year growth of 18.7%. We project the segment’s margins at 18.7%, implying a slight contraction from the year-ago quarter’s 19.7%.

For the Energy and Transportation segment, we expect external sales to be $7.06 billion, suggesting an 8.4% rise from the year-ago quarter’s actual. Volume growth is projected to be 8.5% as improved demand in Power Generation, Oil and Gas, and Industrial is expected to have been offset by declines in Transportation. Pricing is expected to contribute 0.1% to the segment’s sales growth, while currency is expected to have had a negative 0.2% impact.

Our estimate for the segment’s operating profit is $1.57 billion for the fourth quarter of 2025, suggesting a 6.2% increase year over year. The operating margin is projected to be 22.2%, slightly lower than the 22.7% reported in the fourth quarter of 2024.

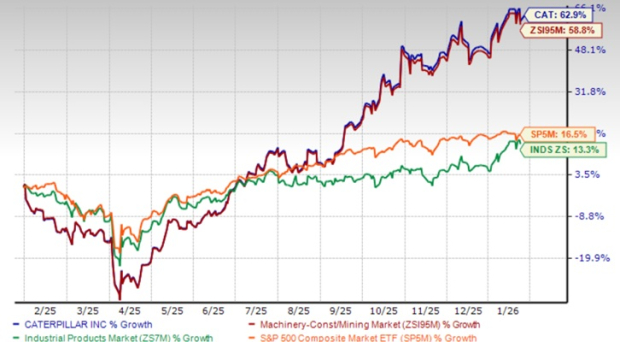

CAT has gained 62.9% in the past year against its industry’s 58.8% growth. It has also outperformed the broader Zacks Industrial Products sector’s 13.3% growth and the S&P 500’s climb of 16.5%.

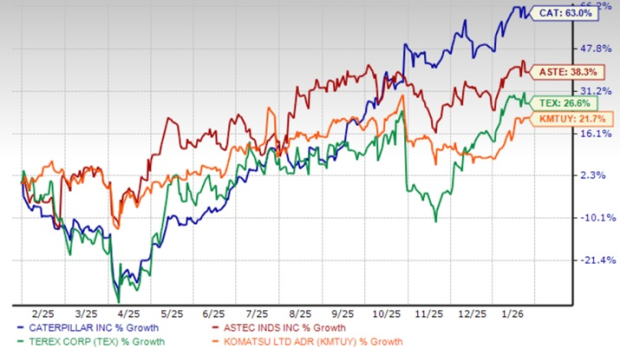

CAT stock has outpaced other players in the industry, like Terex TEX, Astec Industries ASTE and Komatsu KMTUY.

In the past year, Terex, Astec and Komatsu have gained 21.7%, 26.6% and 38.3% respectively.

Caterpillar is currently trading at a forward 12-month P/E of 27.84X, at a premium compared with the industry’s 25.29X.

The stock is also not cheap when compared with Terex, Astec and Komatsu, all of which are trading at 10.75X, 14.54X and 13.56X, respectively. Notably, Terex, Astec and Komatsu are trading below the industry’s average.

Despite the current market weakness, Caterpillar’s long-term demand prospects are supported by increased infrastructure spending and the ongoing shift toward clean energy. Its strong market presence, diverse portfolio and innovation position it for improved performance going forward. Expanding its service revenues, which generate higher margins, is a strategic move. A strong balance sheet enables it to invest in growth while making share repurchases and paying dividends. While tariffs are expected to have raised costs, CAT’s pricing and cost-cutting efforts can help counter the impacts.

CAT's performance has always been closely watched by investors, as it serves as a key economic barometer for the sector. Caterpillar’s fourth-quarter revenues are expected to reflect the improvement in volumes in all of its segments. Earnings are anticipated to have declined due to higher costs. The company is, thus, likely to report an earnings decline despite higher revenues.

No matter how the upcoming quarterly results play out, investors who already own CAT should retain its shares in their portfolios to benefit from its solid long-term fundamentals. However, given its premium valuation and the expected decline in earnings, new investors can wait for a better entry point.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 8 hours | |

| 8 hours | |

| 16 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite