|

|

|

|

|||||

|

|

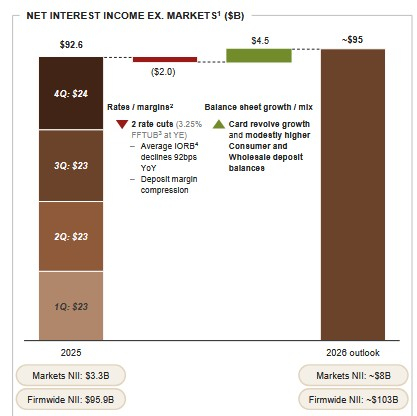

Following a decent 2025 net interest income (NII) performance, JPMorgan JPM expects the momentum to continue this year. In 2025, the Federal Reserve lowered interest rates by 75 basis points (bps), following a 50-bp cut in 2024. Despite this, the bank reported a 3% rise in 2025 NII, driven by 11% loan growth and lower funding costs.

Building on this, JPMorgan expects NII in 2026 to be approximately $103 billion, or up more than 7% year over year. It assumes two rate cuts, interest on reserve balance (IORB) falling about 92 bps year over year and deposit margin compression as headwinds. To counter that, the company points to modest improvement in Consumer and Wholesale deposit balances. Further, higher-yielding revolving card balances are expected to help cushion NII as benchmark rates drift lower, particularly if funding costs stay contained.

A part of the lift is likely to come from Markets NII. JPM pegs 2026 NII, excluding Markets, at roughly $95 billion, implying Markets NII of around $8 billion, an area that can be more variable than the core lending-and-deposit engine.

2026 NII Expectation

On the other hand, Bank of America BAC expects 2026 NII to rise 5-7% year over year, following 7% increase in 2025. The company continues to benefit from a supportive rate backdrop, productivity gains from technology investments and the earnings resilience of a diversified franchise. Also, Citigroup C guides 5-6% NII growth for 2026, after delivering 11% year-over-year growth in 2025. The bank’s outlook is underpinned by a steadier rate environment and constructive balance sheet trends.

Coming back to JPMorgan, on Jan. 7, it signed an agreement to become the new issuer of the Apple Card, which has approximately $20 billion in receivables. While the deal will strengthen the bank’s position in the credit card operation, the phased transition (expected to be over in two years and subject to regulatory approvals) is unlikely to impact the company’s NII this year to a great extent.

Another factor to watch is the proposed cap on the credit card interest rates at 10%. Although nothing has been finalized, JPMorgan’s NII could be pressured by compressing yields on high-margin revolving balances, a major growth driver in its NII outlook. On the conference call with analysts, the bank’s Chief Financial Officer, Jeremy Barnum, said, "If it were to happen, it would be very bad for consumers, very bad for the economy.” The company could respond by tightening credit and limiting balance growth, which would further weigh on NII.

Moreover, with Markets expected to contribute meaningfully to drive NII in 2026, the path will hinge on interest rates, deposit competition and trading-related balance sheet dynamics.

Hence, before making any investment decision, let’s take a closer look at the other factors that are likely to influence JPMorgan’s fundamentals and growth prospects.

The shift toward easier monetary policy will support client activity, deal flow and asset values. Thus, JPMorgan’s non-interest income streams will likely see robust improvement.

Underwriting & Advisory Fees: Lower borrowing costs will continue to support corporate financing activity and encourage debt issuance, M&As and equity offerings. After a muted deal-making environment in 2022 and 2023, rate cuts along with clarity on other macro factors have sparked a solid resurgence in capital markets, boosting JPMorgan’s advisory and underwriting fees. The company continues to rank #1 for global IB fees, garnering a wallet share of 8.4% in 2025. Looking ahead, while persistent macroeconomic and geopolitical uncertainty remains a key risk, a healthy deal pipeline, resilient M&A demand and JPMorgan’s leadership position it for stronger IB fee growth as macro conditions become more supportive.

Markets Revenues (FICC & Equities): Rate transitions often fuel volatility in fixed income, currencies and commodities. Thus, JPMorgan, with the industry’s leading trading desk, stands to gain from increased client hedging and speculative activity. Equities trading is also expected to benefit from higher volumes as investors reposition portfolios for a lower-rate environment. While structural normalization in trading activity is inevitable over time, the bank’s broad product coverage positions it to capture upside during volatility spikes.

Wealth & Asset Management Fees: Declining yields generally push investors to equities and alternative assets. JPMorgan’s asset management business benefits from rising assets under management (AUM) and higher fee revenues as markets rally. Stronger investor sentiment is expected to drive inflows into the company’s private banking and wealth platforms.

With 5,083 branches as of Dec. 31, 2025, more than any other U.S. bank and a presence in all 48 contiguous states, JPM continues to invest in brick-and-mortar to strengthen its competitive edge in relationship banking, despite the digital shift. In 2024, JPMorgan opened nearly 150 branches and plans to add 500 more by 2027 to deepen relationships and boost cross-selling across mortgages, loans, investments and credit cards.

JPMorgan isn’t alone in branch expansion. Bank of America is growing its financial center network, with plans to open 150 more centers by 2027, despite most interactions being digital.

Additionally, JPMorgan has expanded through strategic acquisitions, including a larger stake in Brazil’s C6 Bank, partnerships with Cleareye.ai and Aumni, and the 2023 purchase of First Republic Bank. These moves boosted profits and supported its strategy to diversify revenues and grow digital and fee-based offerings.

As of Dec. 31, 2025, JPM had a total debt of $500 billion (the majority of this is long-term in nature). The company's cash and due from banks and deposits with banks were $343.3 billion on the same date. The company maintains long-term issuer ratings A-/AA-/A1 from Standard and Poor’s, Fitch Ratings and Moody’s Investors Service, respectively.

Hence, JPMorgan continues to reward shareholders handsomely. It cleared the 2025 stress test impressively and announced an increase in its quarterly dividend by 7% to $1.50 per share, as well as authorized a new share repurchase program worth $50 billion. As of Dec. 31, 2025, almost $33.8 billion in authorization remained available.

This was the second time that JPMorgan hiked its quarterly dividends in 2025. In March, it raised its quarterly dividend by 12% to $1.40 per share. In the last five years, it hiked dividends six times, with an annualized growth rate of 10.05%.

Similar to JPM, Bank of America and Citigroup cleared the 2025 stress test. Following this, Bank of America raised its quarterly dividend 8% to 28 cents per share and authorized a new $40 billion share repurchase program. Citigroup also announced a dividend hike of 7% to 60 cents per share. It is continuing with the previously announced buyback plan, which had $6.8 billion worth of authorization remaining as of Dec. 31, 2025.

Lower rates will likely support JPMorgan's asset quality, as declining rates will ease debt-service burdens and improve borrower solvency. The overall effect is expected to be moderate and vary by loan segment and macro conditions. Variable-rate consumer and leveraged corporate portfolios might see the most direct benefit, reflecting the lower risk of near-term credit losses as rates fall.

JPMorgan expects that lower rates will help stabilize or even modestly improve overall credit performance, especially in consumer and corporate loan books, as long as the U.S. economy remains resilient. Hence, JPMorgan expects the card service NCO rate to be roughly 3.4% “on favorable delinquency trends driven by the continued resilience of the consumer.”

JPMorgan stock currently trades at a discount to the industry. The stock is currently trading at a price-to-book (P/B) of 2.39X, slightly below the industry’s 2.44X. Further, the company’s P/B ratio is lower than its high over the past five years, reflecting some level of undervalued trading compared with historical norms.

JPM’s P/B

On the other hand, if we compare JPMorgan’s current valuation with Bank of America and Citigroup, it appears expensive. At present, Bank of America has a P/B of 1.37X, while Citigroup is trading at a P/B of 1.06X.

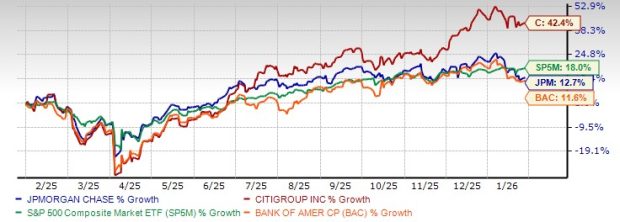

Additionally, in the past year, shares of JPMorgan have gained 12.7% compared with a 18% rise for the S&P 500 Index. Meanwhile, Bank of America and Citigroup have gained 11.6% and 42.4%, respectively, in the same time frame.

One-Year Price Performance

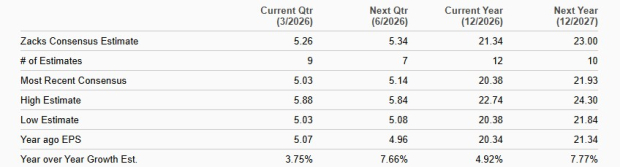

Earnings estimates for JPMorgan for 2025 and 2026 have been revised upward over the past month. The positive estimate revision depicts bullish analyst sentiments for the stock. The Zacks Consensus Estimate for JPM’s 2026 and 2027 earnings implies a 4.9% and 7.8% year-over-year increase, respectively.

Earnings Estimates

Despite this year’s impressive NII growth projection, non-interest income upside and manageable credit quality, weak earnings prospects suggest a steep rise in non-interest expenses. Management expects adjusted non-interest expense to be $105 billion for this year, up more than 9% from 2025.

The jump will likely be primarily due to an increase in growth and volume-related spending (like compensation costs, costs for branching/expansion and costs related to credit card business growth), along with an increase in expenses related to investments in technology and AI. Further, structural inflation-related costs like higher real estate and general operating overhead expenses will result in a rise in overall expenses.

Nonetheless, JPMorgan remains well-placed for growth backed by its robust capital markets business, dominant IB position, solid NII growth expectations and continued expansion through branch openings and strategic plans. The company’s size, diversification, track record and recent performance make it a reasonable core holding for a multi-year horizon.

However, you must keep an eye on interest-rate moves, macroeconomic headwinds and the banking sector broadly, because these could sway valuations and price movement more than the company’s individual performance. If you own this Zacks Rank #3 (Hold) stock, retain it, while others may wait for a better entry point. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 35 min | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite