|

|

|

|

|||||

|

|

When it comes to everyday essentials, few rivalries are as quietly powerful as The Procter & Gamble Company PG versus The Clorox Company CLX. Both companies sit at the heart of the household staples aisle, yet they play the game from very different positions.

Procter & Gamble is a category-spanning giant, commanding market share across fabric care, home care, grooming and personal health through brands that dominate shelf space worldwide. Clorox, in contrast, is a category specialist, smaller in scale but formidable in focus, owning leading positions in disinfecting wipes, bleach and cleaning solutions where brand trust drives repeat demand.

This face-off is not just about size; it is about how scale versus specialization shapes market power, pricing leverage and long-term resilience in a shifting consumer landscape.

Procter & Gamble’s investment case rests on unmatched scale and entrenched market leadership within global consumer goods. The company commands roughly one-quarter of the global daily-use consumer staples market, with leading share positions across Fabric Care, Baby Care, Grooming, Oral Care and Home Care.

In first-quarter fiscal 2026, PG delivered its 40th consecutive quarter of organic sales growth, supported by broad-based category participation and geographic reach, even as global aggregate market share dipped 30 basis points amid heightened competition. Its portfolio of billion-dollar brands, Tide, Pampers, Gillette, Oral-B, Olay and SK-II, anchors strong shelf dominance and pricing power across income tiers and regions.

PG is doubling down on its “integrated superiority” model, combining product innovation, brand communication, retail execution, productivity and consumer value. Recent upgrades, such as Tide’s biggest liquid innovation in 20 years, Pampers restaging and premium expansion in Skin and Personal Care, underscore a portfolio designed to capture both premiumization and value-conscious consumers. Digital commerce and data-driven go-to-market investments, particularly in China and Latin America, are strengthening PG’s ability to target younger, urban and digitally native demographics while driving category growth and share recovery in key markets.

However, the near-term outlook is tempered by slowing category consumption in North America and Europe, elevated promotional intensity, margin pressure from reinvestment, and ongoing restructuring costs. These headwinds suggest limited upside in the short run, even as PG’s scale, brand equity and innovation engine reinforce a compelling long-term investment narrative.

Clorox operates as a focused category leader within household and lifestyle essentials, prioritizing depth over diversification. The company holds leading positions in U.S. disinfecting wipes and bleach, along with leading shares in trash bags, charcoal, water filtration, dressings and natural personal care. While Clorox represents only a low-single-digit share of the global consumer goods market, its strength lies in dominance within chosen categories, where brand trust, product efficacy and habitual usage support strong household penetration and shelf visibility. This concentrated portfolio anchors demand in everyday essentials that remain relevant across economic cycles.

Execution is centered on strengthening brand superiority and improving operating agility under the IGNITE strategy. Clorox is refining its portfolio through format and pack-size innovation, offering larger packs for the e-commerce channel while introducing smaller sizes and multi-purpose products to broaden accessibility.

Brand positioning increasingly speaks to time-constrained, health-conscious and younger consumers through design updates, scent innovation and convenience-led extensions across Glad, Brita, Burt’s Bees, and Cleaning. A companywide ERP implementation represents a structural upgrade, enabling sharper demand forecasting, better inventory visibility and more efficient fulfillment, while enhancing digital and omnichannel engagement.

Financial performance reflects a business investing in durability and consistency. The gross margin remains structurally healthy for a branded staples company, providing flexibility to support innovation, advertising and digital capabilities. Cash generation continues to fund reinvestment and brand support, reinforcing long-term competitiveness. With stable household penetration, resilient brand loyalty and a strengthening digital backbone, Clorox is positioning itself to sustain relevance in core categories while steadily enhancing execution and operating discipline over time.

The Zacks Consensus Estimate for Procter & Gamble’s fiscal 2026 sales and EPS implies year-over-year growth of 2.8% and 2.2%, respectively. EPS estimates for fiscal 2026 have moved up by a penny in the past seven days.

The Zacks Consensus Estimate for Clorox’s fiscal 2026 sales and EPS suggests year-over-year declines of 8.7% and 24.7%, respectively. EPS estimates for fiscal 2026 have moved down 0.7% in the past seven days.

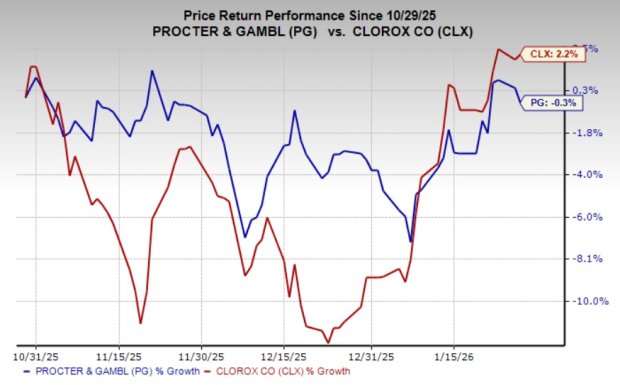

In the past three months, Procter & Gamble’s stock has lost 0.3%, while Clorox’s stock has risen 2.2%.

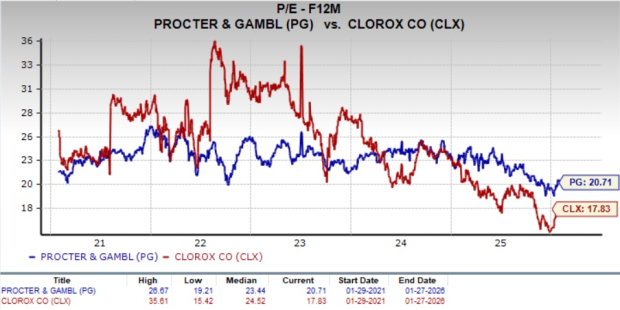

Procter & Gamble is trading at a forward 12-month price-to-earnings multiple of 20.71X, below its median of 23.44X in the last five years. Clorox’s forward 12-month P/E multiple sits at 17.83X, below its median of 24.52X in the last five years.

Clorox’s valuation appears attractive relative to Procter & Gamble. The stock trades at a clear discount to its long-term average earnings multiple, signaling room for multiple expansion as execution improves and operational momentum builds. Meanwhile, Procter & Gamble continues to command a premium despite trading below its historical norms.

Clorox shares have outperformed Procter & Gamble in recent months, reflecting improving investor sentiment. Taken together, the combination of a discounted valuation and emerging share-price momentum suggests meaningful upside potential if Clorox sustains progress and restores confidence.

Procter & Gamble brings unmatched breadth, global reach and brand depth, making it a long-term compounder anchored in stability and innovation. Its diversified portfolio and execution discipline provide resilience, but near-term pressures and a relatively higher valuation hurt expectations in the current environment. PG remains a high-quality name, though its strengths are already well recognized by the market.

Clorox, however, emerges as the stronger choice in this matchup. The stock has delivered better recent share performance, trades at a more attractive valuation relative to its history and peers, and is showing improving momentum as operational execution strengthens. Its focused portfolio, category leadership and sharpening growth initiatives offer clearer upside as confidence rebuilds. In this comparison, Clorox wins on relative value, recent momentum and recovery-driven growth potential, making it the more compelling pick at this stage of the cycle.

Procter & Gamble currently carries a Zacks Rank #4 (Sell), while Clorox has a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 2 hours | |

| 3 hours | |

| 10 hours | |

| Mar-08 | |

| Mar-07 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite