|

|

|

|

|||||

|

|

Remote and continuous patient monitoring is moving from a niche capability to a core pillar of modern healthcare, driven by aging populations, staffing shortages, and a push toward data-driven care both inside hospitals and at home. Against this backdrop, Owlet, Inc. OWLT and Masimo Corporation MASI represent two very different ways to invest in the same secular trend. Both companies specialize in monitoring vital signs such as oxygen saturation and heart rate, but they address distinct patient populations and operate at very different stages of scale and maturity.

Owlet is a small-cap, growth-oriented pediatric health company best known for its FDA-cleared Dream Sock, which monitors infants’ oxygen levels and pulse rates at home. Masimo, by contrast, is an established med-tech leader with deep penetration in hospitals worldwide, offering a broad portfolio of sensors, monitors and consumables that generate recurring revenue streams. Comparing these two stocks now is timely as Owlet is transitioning from a consumer hardware company to a data- and subscription-driven pediatric health platform, while Masimo is executing a strategic refocus on its core healthcare business following portfolio simplification and operational realignment.

Despite their size and market differences, both companies are benefiting from heightened regulatory scrutiny, growing acceptance of continuous monitoring, and increasing integration of AI into medical devices. With diverging recent share-price performance, contrasting valuation profiles and improving earnings outlooks, Owlet and Masimo offer investors a compelling case study in growth versus stability within the medical monitoring space. Let’s dive deep and closely compare the fundamentals of the two stocks to determine which one is a better investment now.

Owlet’s investment appeal is rooted in its transformation from a one-time hardware seller into a regulated pediatric digital-health platform with recurring revenue potential. In the third quarter of 2025, Owlet delivered what management described as the best quarter in its history, posting record revenue growth of roughly 45% year over year, expanding gross margins more than 50%, and generating its first quarterly operating profit. Management emphasized that these results reflect not only strong demand for the Dream Sock but also improving cost discipline and scale benefits as volumes increase.

A major competitive advantage for Owlet is regulatory differentiation. The Dream Sock is currently the first and only FDA-cleared over-the-counter infant monitoring device on the market, a point underscored by the FDA’s recent warning against unauthorized infant monitors. This regulatory clarity has effectively raised barriers to entry, strengthening Owlet’s brand trust with parents, retailers, and healthcare partners. Management believes this positioning will drive continued market-share gains, particularly during peak selling periods and as international regulatory approvals expand, including recent clearance in India that opens a new growth market beginning in 2026.

Beyond hardware, Owlet’s long-term upside increasingly hinges on software and services. The Owlet360 subscription platform surpassed 85,000 paying subscribers by the end of the third quarter, with attach rates exceeding 25% and steady improvements in retention. Management plans to layer in AI-driven insights, camera-based analytics, and eventually telehealth capabilities through Owlet OnCall, positioning the company to monetize its growing installed base more effectively over time. This shift toward recurring, higher-margin revenue could materially reshape Owlet’s earnings profile over the next few years.

Still, Owlet faces challenges typical of an emerging med-tech player. Tariffs have pressured gross margins, and while recent profitability is encouraging, earnings remain sensitive to execution, regulatory timelines, and consumer spending trends. Scaling healthcare-channel reimbursement and telehealth partnerships will also require sustained investment and flawless execution. Even so, the company’s improving earnings trajectory and expanding addressable market suggest a favorable risk-reward profile for investors willing to tolerate volatility.

Masimo offers a markedly different investment proposition: scale, stability, and entrenched hospital relationships. The company is a global leader in noninvasive monitoring technologies, with a business model built around recurring consumables, long-term contracts, and continuous innovation in sensor accuracy and reliability. In 2025, Masimo delivered solid operational execution despite macro and tariff headwinds, culminating in preliminary full-year revenue of roughly $1.52 billion and non-GAAP earnings per share (EPS) at the high end of guidance.

A key positive for Masimo is its strategic refocus on core healthcare operations following the divestiture of its Sound United consumer-audio business. Management highlighted strong contract wins, rising unrecognized contract revenue, and accelerating demand for advanced monitoring solutions in hospitals, supported by AI-enabled sensors and next-generation wearable technologies. These trends reinforce Masimo’s durable competitive moat and high switching costs among hospital customers.

Masimo’s margin profile also stands out. In the third quarter of 2025, the company expanded operating margins by 450 basis points year over year, driven by operational efficiencies and cost optimization, partially offset by tariff impacts. Strong cash flow generation allowed Masimo to aggressively repurchase shares, returning approximately $350 million to shareholders over recent quarters and enhancing per-share earnings growth.

However, Masimo’s challenges lie in growth acceleration and investor sentiment. According to the third quarter of 2025 earnings call, revenue growth expectations for 2026 are in the mid-single-digit range, reflecting the company’s maturity and hospital budget constraints. While innovation in AI-enabled monitoring and wearables provides optionality, Masimo’s near-term upside may be capped compared with faster-growing peers. Ongoing tariff uncertainty and litigation-related complexities also remain overhangs, even as management works to mitigate their financial impact.

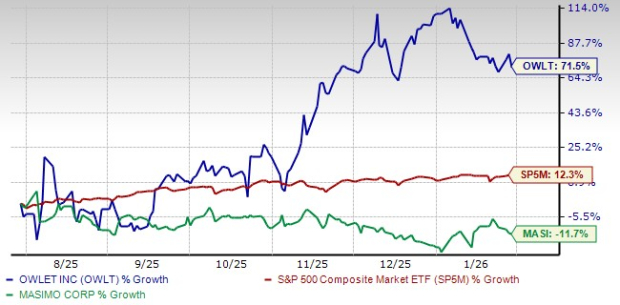

Over the past six months, Owlet shares have surged 71.5%, dramatically outperforming both Masimo, whose shares plunged 11.7%, and the broader S&P 500, which gained 12.3%. This divergence reflects investor enthusiasm for Owlet’s accelerating growth and improving profitability, contrasted with more tempered expectations for Masimo’s near-term expansion.

OWLT Vs MASI Stock Performances

On a forward 12-month price-to-sales basis, Owlet trades at approximately 1.75X, a notable discount to Masimo’s 4.54X multiple. The gap underscores the market’s willingness to pay a premium for Masimo’s scale and stability, while Owlet’s valuation suggests meaningful upside if its growth and margin expansion continue.

OWLT Vs MASI Valuations

Earnings estimate trends further highlight the contrast. Over the past 30 days, the Zacks Consensus Estimate for Owlet’s 2026 loss per share has narrowed sharply to 25 cents from 48 cents, implying a significant improvement from the estimated 2025 loss, alongside projected 21.1% revenue growth.

OWLT Estimates

Masimo’s 2026 EPS estimate has edged up modestly to $5.77, reflecting steady but slower earnings growth of about 5.9%, with revenues expected to rise 6.6%.

MASI Estimates

Both Owlet and Masimo have credible ways to gain exposure to the expanding medical monitoring market, but they cater to different investor profiles. Masimo offers a proven business model, strong margins and predictable cash flows, making it an attractive choice for investors seeking stability and moderate growth. Owlet, however, stands out for its sharper growth trajectory, regulatory differentiation, expanding subscription base, and rapidly improving earnings outlook.

Given Owlet’s accelerating fundamentals, improving profitability and discounted valuation, this Zacks Rank #1 (Strong Buy) stock appears to offer superior upside potential at this stage of the cycle compared to Masimo, carrying a Rank #2 (Buy). For investors comfortable with higher risk in exchange for higher growth, Owlet looks like the more compelling opportunity today. You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-27 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite