|

|

|

|

|||||

|

|

Rising global aircraft deliveries, expanding airline fleet and growing demand for maintenance, repair and overhaul services are driving growth across the aviation services industry. These trends, supported by a steady recovery in global air travel and ongoing defense modernization programs, are strengthening investor interest in aerospace service providers such as Astronics Corporation ATRO and AAR Corp. AIR.

Astronics specializes in advanced aircraft electrical systems, lighting technologies and connectivity solutions that support passenger experience upgrades and cockpit modernization across commercial and military platforms. AAR operates as a diversified aviation services company, providing aftermarket support, parts supply and integrated solutions to airlines, government customers and defense contractors worldwide.

With continued technological innovation, a stronger focus on aircraft efficiency and gradually easing supply-chain challenges, aviation support companies are gaining increased attention. Against this backdrop, ATRO and AIR remain key names for investors assessing opportunities in the sector. This naturally raises the question of which stock appears better positioned. Let us take a closer look to find out.

Astronics is benefiting from healthy demand across both defense and commercial aerospace markets. Rising global defense spending continues to support military aircraft programs, while the recovery in air travel is prompting airlines to invest in cabin power access and in flight connectivity solutions. These trends align well with the company’s core product offerings.

The company recently shared its preliminary results for 2025, which reflect this positive momentum. Preliminary fourth-quarter revenues came in between $236 million and $239 million, above management’s guidance. Full-year revenues were approximately $860 million, marking solid year-over-year growth. Order activity remained strong, with preliminary quarterly bookings of about $257 million and full-year orders of roughly $924 million, supporting revenue visibility.

These favorable industry conditions are expected to continue. Astronics’ preliminary revenue outlook for 2026 of $950-$990 million points to further growth, supported by sustained defense spending and continued airline investment in aircraft upgrades. Higher production volumes should also contribute to improved profitability and stronger cash flow.

AIR’s recent performance has been supported by solid quarterly results and continued investment in operational and technology initiatives, which have helped sustain investor confidence. In January 2026, the company reported its second-quarter fiscal 2026 results, delivering revenue growth of 16% and a 31% increase in net adjusted earnings compared with the year-ago period.

AIR continues to enhance its market position through facility expansion and ongoing technology initiatives. The company has completed the expansion of its Airframe MRO facility in Oklahoma City, increasing capacity to meet growing demand from commercial and government customers, as well as MROs and OEMs. This added capacity is expected to support improved service delivery and long-term revenue growth.

AIR is also seeing positive momentum in its Trax business. Trax recently extended a multi-year contract with Air Atlanta Icelandic. After upgrading to Trax’s eMRO platform in 2024, the airline will now adopt eMobility and cloud hosting solutions. These additions are expected to improve maintenance efficiency, streamline operations and support regulatory compliance, strengthening AIR’s technology portfolio and recurring revenue base.

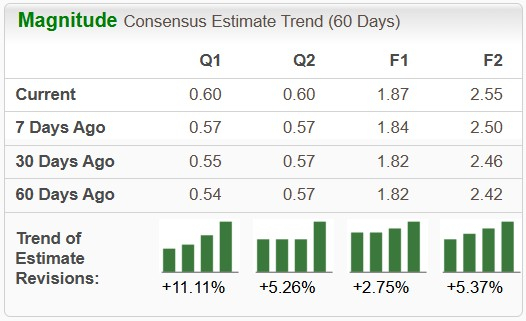

The Zacks Consensus Estimate for ATRO’s 2026 sales and earnings per share (EPS) implies an improvement of 12.5% and 36.4%, respectively, from the year-ago quarter’s reported figures. ATRO’s near-term EPS estimates have improved over the past 60 days.

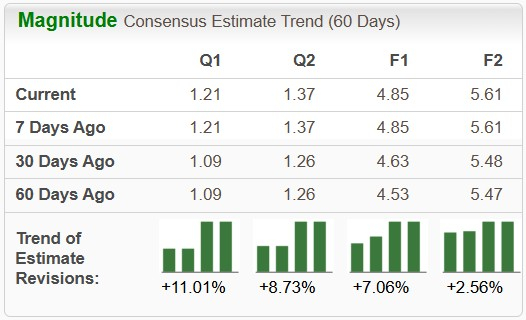

The Zacks Consensus Estimate for AIR’s fiscal 2026 sales implies a year-over-year improvement of 15.2%, while that for EPS suggests a 24% surge. The stock’s near-term EPS estimates have improved over the past 60 days.

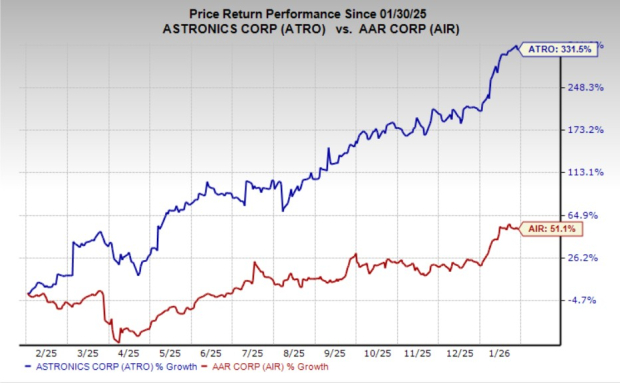

In the past year, ATRO has outperformed AIR. While ATRO’s shares surged 331.5%, AIR rose 51.1%.

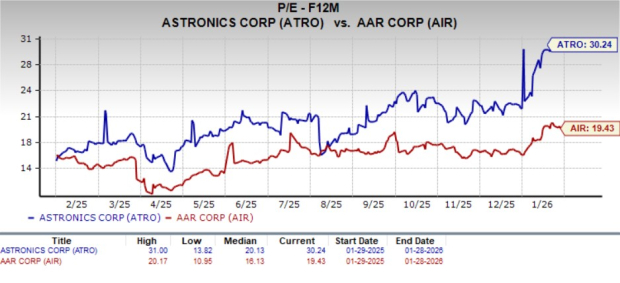

Astronics is trading at a premium, with its forward 12-month price/earnings of 30.24X being more than AIR’s forward price/earnings of 19.43X.

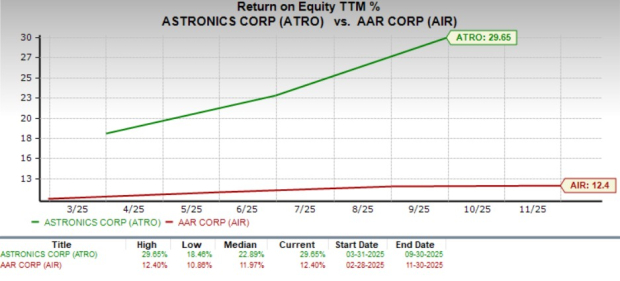

The image below reflects the return on equity (ROE) for ATRO and AIR. This shows that ATRO is better at converting its equity financing into profits compared with AIR.

While both Astronics and AAR are well positioned to benefit from favorable aerospace industry trends, the former appears better placed for near-term outperformance. Strong demand across commercial and defense markets, solid order momentum and an improving earnings outlook support ATRO’s growth trajectory.

AAR continues to benefit from healthy MRO demand and ongoing operational and technology initiatives, supporting steady business performance. However, Astronics’ stronger growth visibility and momentum make it the more compelling near-term pick.

At present, Astronics Corp. sports a Zacks Rank #1 (Strong Buy), while AAR Corp. carries a Zacks Rank #2 (Buy).

You can see the complete list of today’s Zacks Rank #1 stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 9 hours | |

| 10 hours | |

| 11 hours | |

| Mar-07 | |

| Mar-06 | |

| Mar-06 |

Google Grabs Attention, But Funds Go Crazy For This 'Pick-And-Shovel' AI Stock

AIR

Investor's Business Daily

|

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-03 | |

| Mar-03 | |

| Mar-02 | |

| Feb-27 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite