|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Caterpillar Inc. CAT reported adjusted earnings per share of $5.16 for the fourth quarter of 2025, which beat the Zacks Consensus Estimate of $4.67 by a margin of 10%. The bottom line was 0.4% higher than the year-ago quarter.

The company delivered record quarterly revenues, driven by higher volumes across all segments. These gains were partially offset by elevated tariff-related costs. Even though modest, the quarter marked a return to positive earnings growth for Caterpillar following five consecutive quarters of declines.

Including one-time items, Caterpillar’s earnings per share were $5.12, a 11% decline from the reported figure of $5.78 in the year-ago quarter.

Caterpillar reported revenues of around $19.1 billion, which surpassed the Zacks Consensus Estimate of $17.95 billion by a margin of 6.4%. The company achieved growth across all segments, with the total figure representing an all-time quarterly record.

The top line increased 17.9% year over year due to higher sales volume of $2.7 billion (contributing 18% growth), reflecting improved sales of equipment to end users and the impact from changes in dealer inventories. Pricing was a favorable $38 million (0.2%) and currency impact added another $124 million (0.8%).

Our model had projected volume growth of 13.6%, an unfavorable price impact of 0.4% and a negative currency impact of 0.3%.

Caterpillar witnessed revenue growth in all regions, led by 26% in North America, followed by 19% in EAME and 12% in Latin America, while revenues were flat year over year in Asia Pacific.

Caterpillar reported a sequential backlog growth of $11.3 billion in the quarter. Its backlog is currently at an all-time high of $51.2 billion.

Cost of sales increased 29% year over year to approximately $13.3 billion, primarily driven by unfavorable manufacturing costs, including the impact of higher tariffs.

Gross profit was down 1.5% to $5.79 billion from the prior-year quarter. The gross margin was 30.3% compared with 36.3% in the year-ago quarter.

Selling, general and administrative (SG&A) expenses moved up 6% year over year to around $1.88 billion. Research and development (R&D) expenses were up 8% to $562 million.

CAT reported an operating profit of $2.66 billion, a 9% decline from the year-ago quarter as elevated manufacturing costs and SG&A and R&D expenses offset the gains from higher volumes. The operating margin was 13.9%, a 410-basis-point contraction from the year-ago quarter.

Adjusted operating profit was around $2.98 billion, up 0.6% from the year-ago quarter. The adjusted operating margin was 15.6% compared with 18.3% in the fourth quarter of 2024.

Machinery, Power & Energy sales rose 19% year over year to around $18.2 billion, attributed to higher volumes on increased sales of equipment to end users.

Construction Industries' total sales were up 15% year over year to $6.92 billion on higher sales volume and favorable currency impact, offset by unfavorable price realization.

Regionally, sales were up 23% in North America, 18% in EAME and 6% in Latin America, offset by a 7% dip in Asia/Pacific. The segment’s total sales were lower than our estimate of $7.495 billion.

Total sales in the Resource Industries segment were up 13% year over year to $3.35 billion on higher sales volumes. Sales in EAME, Latin America and North America were up 34%, 12% and 32%, respectively, but were offset by 15% decline in sales in Asia/Pacific. The segment’s fourth-quarter total sales were higher than our projection of $2.99 billion.

Sales of the Power & Energy segment were around $9.4 billion, a 23% increase from last year’s quarter, aided by higher sales volumes, favorable currency impacts and price realization. Our estimate for the segment’s sales for the quarter was $8.26 billion.

The segment reported sales growth in Power Generation (44%), Oil and Gas sector (24%), Industrial (4%) and Transportation sectors (7%). Regionally, sales were up 30% in North America, 21% in Latin America, 16% in EAME and 22% in Asia/Pacific.

The Machinery, Power & Energy segment reported an operating profit of around $2.57 billion, down 12% year over year. Our model’s projection was $2.26 billion.

The Power & Energy segment reported a 25% year-over-year increase in operating profit to $1.84 billion, higher than our estimate of $1.57 billion.

The Construction Industries segment’s operating profit was down 12% year over year to $1.03 billion. Our projection was $1.39 billion.

The Resource Industries segment’s operating profit slumped 24% year over year to around $0.36 billion. Our estimate for the segment’s operating profit was $0.43 billion.

Financial Products’ total revenues rose 7% from the year-ago quarter to $1.09 billion. The segment reported a profit of $262 million, marking a 58% increase year over year. Our model had projected revenues of $1.07 billion and an operating profit of $239 million for the fourth quarter of 2025.

Caterpillar generated an operating cash flow of $11.7 billion in 2025 compared with $12.7 billion in the prior year.

The company returned around $7.9billion in cash to shareholders as dividends and share repurchases through 2025. CAT ended 2025 with cash and equivalents of around $10 billion, higher than the cash holding of around $6.9 billion at 2024-end.

Caterpillar reported adjusted earnings per share of $19.06 for 2025, which beat the Zacks Consensus Estimate of $18.64. The bottom line was, however, down 13% compared with the year-ago quarter.

Including one-time items, Caterpillar’s earnings per share were $18.81, a 15% decline from the reported figure of $22.05 in the year-ago quarter.

Caterpillar reported revenues of around $68 billion, an all-time record for it. Revenues were up 4% higher year over year and surpassed the Zacks Consensus Estimate of $66.4 billion.

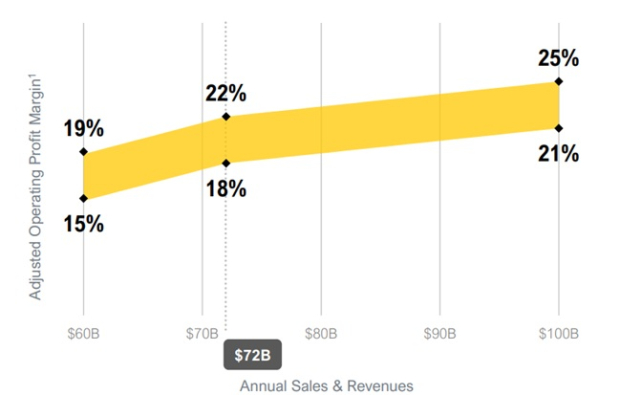

The company projects adjusted operating margins of 15–19% at revenue levels of around $60 billion. If revenues reach $72 billion, operating margins are expected to be at 18–22%, while revenues of $100 billion could support margins in the range of 21–25%. This is shown in the chart below.

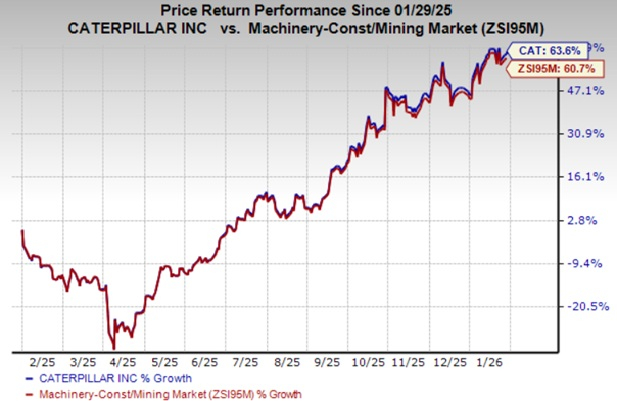

Over the past year, Caterpillar stock has gained 63.6% compared with the industry’s 60.7% growth.

Caterpillar carries a Zacks Rank #3 (Hold) at present. You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Terex Corporation TEX is slated to release fourth-quarter 2025 results next week. The Zacks Consensus Estimate for Terex’s fourth-quarter 2025 earnings is pegged at $1.12 per share, suggesting year-over-year growth of 45.5%. Terex has a trailing four-quarter average surprise of 24.3%.

The consensus estimate for Terex’s revenues for the quarter is $1.33 billion, suggesting 6.9% growth from the year-ago quarter.

Komatsu KMTUY is expected to report its fourth-quarter 2025 results later this week. The Zacks Consensus Estimate for Komatsu’s quarterly earnings is currently pegged at 60 cents per share. This suggests a 22% decline from the year-ago quarter. Komatsu has a trailing four-quarter average surprise of 11.3%.

Astec Industries ASTE is expected to release its fourth-quarter 2025 results next month. The Zacks Consensus Estimate for Astec’s earnings is pegged at 74 cents per share, indicating 37.8% decline from the year-ago quarter. The consensus estimate for Astec’s top line is pegged at $363.8 million, indicating a 1% rise from the prior year’s actual.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite