|

|

|

|

|||||

|

|

Avanos Medical, Inc. AVNS is well-poised for growth in the coming quarters, courtesy of its impressive product line. The optimism, led by a decent third-quarter fiscal 2025 performance and continued robust product performance, is expected to contribute further. However, tariff risks and foreign exchange volatility persist.

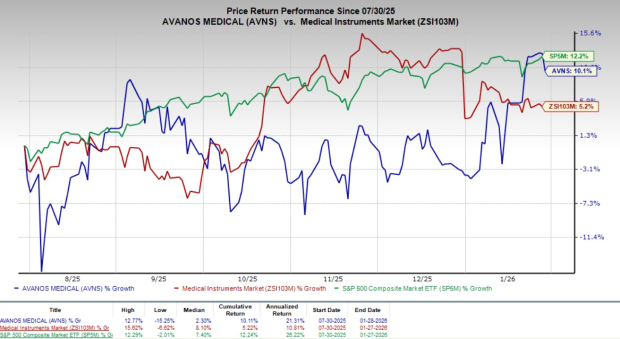

Over the past six months, this Zacks Rank #3 (Hold) stock climbed 10.1% compared with an 5.2% growth of the industry. The S&P 500 Composite rallied 12.2% in the same time frame.

The renowned medical device solutions provider has a market capitalization of $610.4 million. Avanos’ earnings yield of 8.2% compares favorably with the industry’s yield being 0.6%.

Strong Performance in Segments:Avanos Medical highlighted strong performance in its strategic segments as a key growth driver, led by Specialty Nutrition Systems (SNS) and Pain Management and Recovery (PMR). In the fiscal third quarter, SNS delivered 14.5% organic, above-market growth, with double-digit expansion across neonatal enteral feeding. Management emphasized sustained demand for enteral feeding products, continued United States expansion of CORTRAK, strong uptake of the CORGRIP tube retention system and strength in neonatal solutions, reinforcing SNS as a durable growth engine.

The PMR segment also posted positive growth, driven by double-digit growth in radiofrequency ablation, supported by higher generator placements and increased procedure volumes. International momentum for COOLIEF, aided by favorable reimbursement trends in markets such as the U.K. and Japan, further supports organic growth prospects.

Strategic M&A & Portfolio Optimization:Avanos Medical emphasized strategic mergers and acquisitions and portfolio optimization as central to enhancing its growth and profitability profile. The company completed the acquisition of Nexus Medical, a privately held medical device company that expands Avanos Medical’s presence in the neonatal and pediatric care markets and provides entry into an attractive $70-million market. The acquisition is accretive to revenue growth and earnings per share, reinforcing its disciplined, bolt-on acquisition strategy within core segments.

At the same time, Avanos Medical continued to reshape its portfolio by divesting underperforming assets, notably the hyaluronic acid business, which no longer met return and growth thresholds. In addition, the transition of the Game Ready U.S. rental business to a strategic partner allows AVNS to focus on higher-margin core channels, improving profitability and reallocating resources toward faster-growing strategic initiatives.

Cost Optimization & Operational Efficiency:Avanos Medical outlined cost optimization and operational efficiency initiatives aimed at strengthening margins and accelerating execution. Management has implemented actions to streamline the organizational and management structure, improve decision-making, and enhance the effectiveness of its R&D operations, while maintaining commercial performance.

These efforts are expected to generate $15-$20 million in annualized run-rate cost savings by the end of 2026. A key component of this strategy is a restructured R&D model, shifting to a hybrid approach that combines internal development for near-term projects with selective external partnerships for longer-dated programs. The company believes this approach will improve accountability, reduce complexity and speed time to market for new products, supporting organic growth without relying solely on acquisitions.

Tariff-Related Challenges:Avanos Medical identified tariff-related challenges as a headwind that could continue to pressure margins into 2026. The company is taking active steps to reduce the impacts of tariffs on its business and profit margins, such as executing multiple mitigation strategies, including tighter cost controls, selective pricing initiatives, use of temporary tariff exemptions across parts of the portfolio and active lobbying efforts through industry groups, such as AdvaMed.

AVNS is investing more in its supply chain to move manufacturing out of China, which will increase capital spending, but the company expects to completely move neonatal syringe production out of China by mid-2026, which should help reduce future tariff exposure. Although these actions are necessary, they are adding short-term pressure on free cash flow and temporarily increasing costs. The company expects to complete the relocation of neonatal syringe production by mid-2026, meaning tariff-related impacts on earnings are likely to persist until that transition is fully completed.

Potential Normalization of Inventory & Market Tailwinds: AVNS cautioned that some of the strong growth in its SNS segment in the fiscal third quarter was influenced by temporary factors that are unlikely to repeat. Results benefited from higher-than-expected distributor orders tied to the company’s transition to a go-direct model in the U.K., which temporarily lifted volumes.

Upcoming comparisons will be more challenging, as prior-year results included one-off tailwinds, such as a large international order and sales opportunities created by a competitor’s supply disruptions. As a result, the company expects inventory levels to normalize and growth to moderate in the fourth quarter fiscal 2025 and into fiscal 2026, though remaining above overall market growth rates. This normalization may lead to slower reported growth versus recent quarters despite continued underlying demand strength.

Execution Risks in R&D & M&A: Avanos Medical acknowledged that its growth strategy involves execution risks related to both R&D and M&A. A shift to a hybrid R&D model, combining internal development with outsourced partners, is aimed to improve speed to market and accountability, but the effectiveness of this new structure will depend on successful coordination and execution. Any delays or challenges in external partnerships could slow product development and commercialization timelines.

On the M&A front, while the company remains focused on disciplined, synergistic bolt-on acquisitions within Specialty Nutrition Systems, it also noted that future deals will require careful integration to ensure expected revenue growth and earnings accretion are achieved. Missteps in execution or integration could dilute near-term financial benefits and partially offset anticipated gains.

AVANOS MEDICAL, INC. price | AVANOS MEDICAL, INC. Quote

Avanos is witnessing a stable estimate revision trend for 2026. In the past 60 days, the Zacks Consensus Estimate for earnings has been unchanged at $1.08 per share.

The Zacks Consensus Estimate for the company’s fourth-quarter fiscal 2025 revenues is pegged at $176.1 million, indicating a 1.9% decline from the year-ago quarter’s reported number. Earnings estimate of 24 cents per share implies a 44.2% year-over-year decline.

Some better-ranked stocks in the broader medical space that have announced quarterly results are Veracyte VCYT, AtriCure ATRC and Boston Scientific BSX.

Veracyte, sporting a Zacks Rank #1 (Strong Buy) at present, reported third-quarter 2025 adjusted earnings per share (EPS) of 51 cents, which surpassed the Zacks Consensus Estimate by 59.4%. Revenues of $131.8 million beat the Zacks Consensus Estimate by 5.5%.

You can see the complete list of today’s Zacks #1 Rankstocks here.

VCYT has an estimated earnings recession rate of 3% for 2026 compared with the industry’s 17.7% rise. The company beat earnings estimates in the trailing four quarters, the average surprise being 45.1%.

AtriCure reported a third-quarter 2025 adjusted loss of 1 cent per share, beating the Zacks Consensus Estimate by 90.9%. Revenues of $134.3 million beat the Zacks Consensus Estimate by 2.1%. It currently flaunts a Zacks Rank #1.

ATRC has an estimated earnings growth rate of 91.7% for 2026 compared with the industry’s 16.9% rise. The company beat earnings estimates in the trailing four quarters, the average surprise being 67.1%.

Boston Scientific reported a third-quarter 2025 adjusted EPS of 75 cents, which surpassed the Zacks Consensus Estimate by 5.6%. Revenues of $5.07 billion beat the Zacks Consensus Estimate by 1.9%. It currently carries a Zacks Rank #2 (Buy).

BSX has an estimated long-term earnings growth rate of 16.4% compared with the industry’s 13.1% growth. The company’s earnings beat estimates in the trailing four quarters, the average surprise being 7.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite