|

|

|

|

|||||

|

|

IT services provider DXC Technology (NYSE:DXC) met Wall Streets revenue expectations in Q4 CY2025, but sales were flat year on year at $3.19 billion. On the other hand, next quarter’s revenue guidance of $3.18 billion was less impressive, coming in 1% below analysts’ estimates. Its non-GAAP profit of $0.96 per share was 16.2% above analysts’ consensus estimates.

Is now the time to buy DXC? Find out by accessing our full research report, it’s free.

"We delivered third quarter results with solid profit margins, continued strong free cash flow generation and improved bookings. This reflects disciplined execution across our business," said DXC Technology President and CEO Raul Fernandez.

Born from the 2017 merger of Computer Sciences Corporation and HP Enterprise's services business, DXC Technology (NYSE:DXC) is a global IT services company that helps businesses transform their technology infrastructure, applications, and operations.

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $12.68 billion in revenue over the past 12 months, DXC is a behemoth in the business services sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices. However, its scale is a double-edged sword because it’s harder to find incremental growth when you’ve penetrated most of the market. To expand meaningfully, DXC likely needs to tweak its prices, innovate with new offerings, or enter new markets.

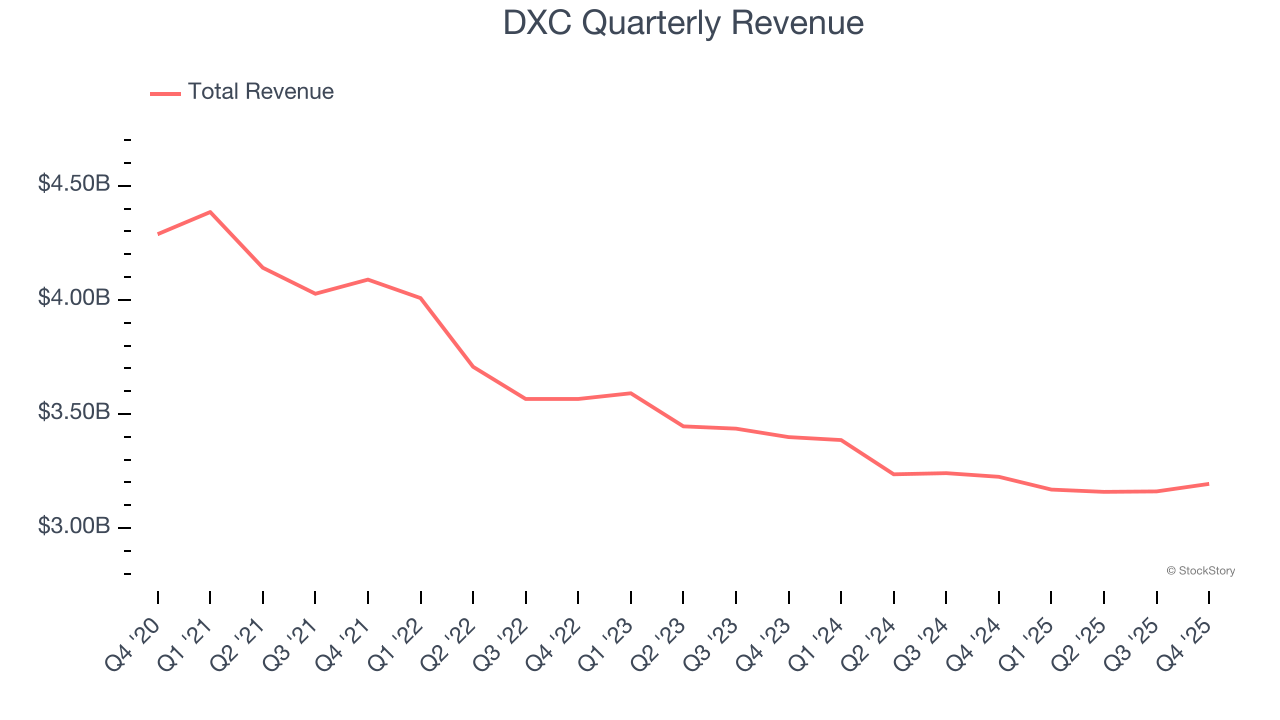

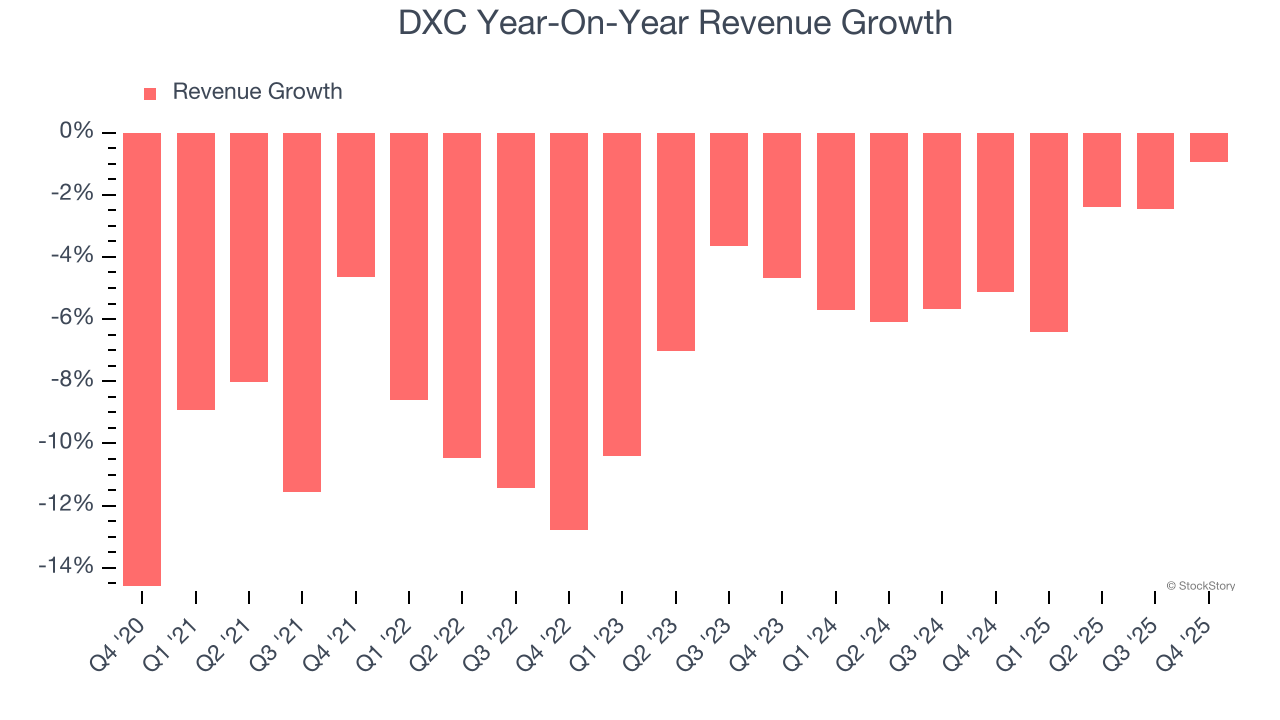

As you can see below, DXC struggled to generate demand over the last five years. Its sales dropped by 6.9% annually, a rough starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. DXC’s annualized revenue declines of 4.4% over the last two years suggest its demand continued shrinking.

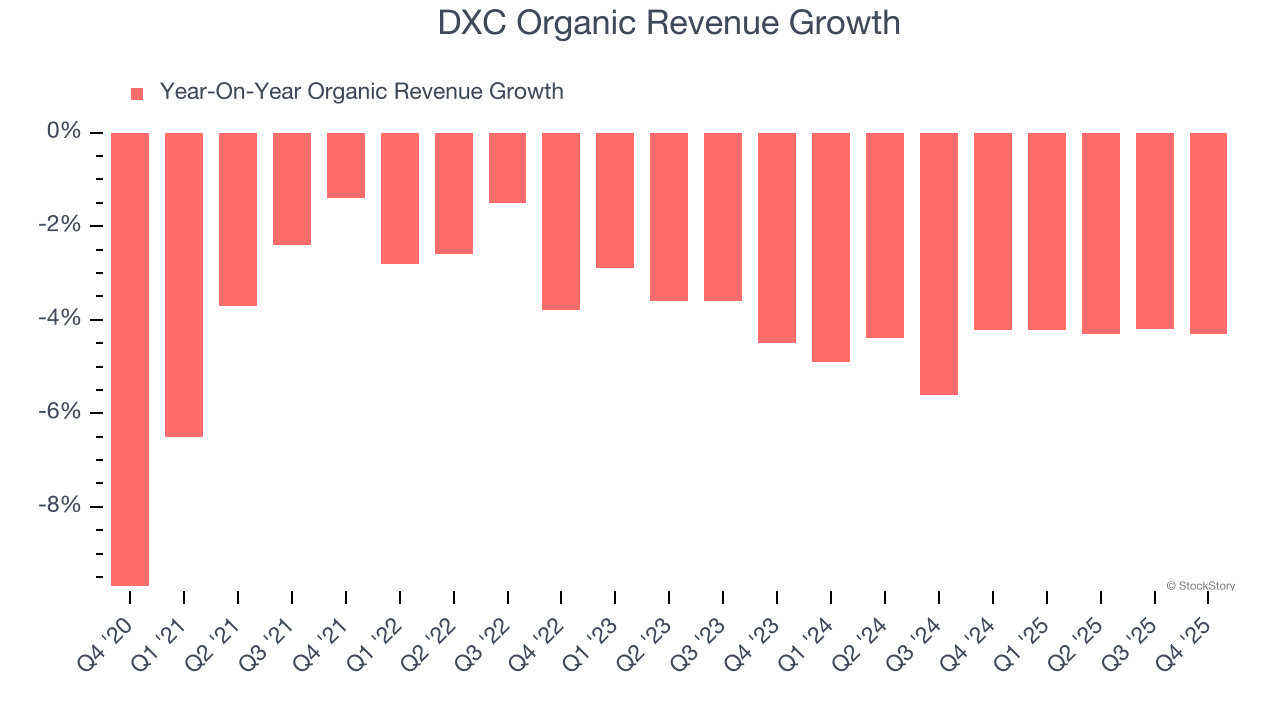

We can dig further into the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, DXC’s organic revenue averaged 4.5% year-on-year declines. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, DXC’s $3.19 billion of revenue was flat year on year and in line with Wall Street’s estimates. Company management is currently guiding for flat sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 1.5% over the next 12 months. Although this projection is better than its two-year trend, it’s tough to feel optimistic about a company facing demand difficulties.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

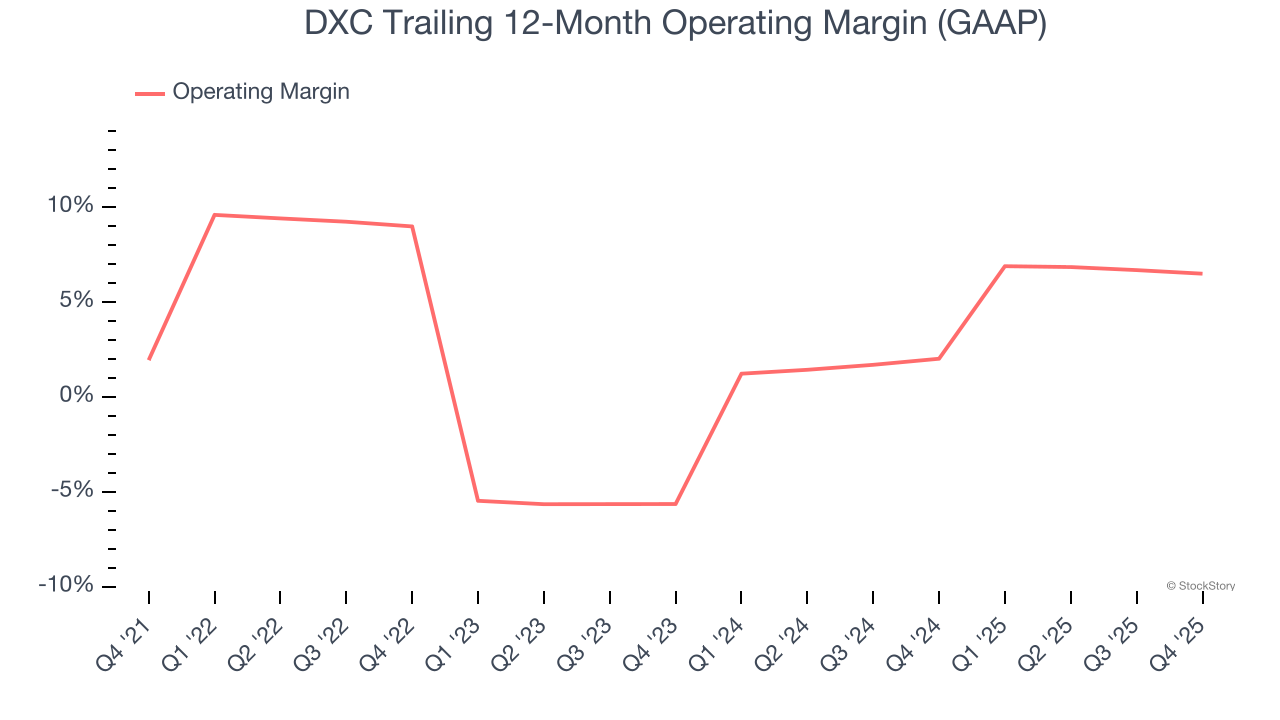

DXC was profitable over the last five years but held back by its large cost base. Its average operating margin of 2.7% was weak for a business services business.

On the plus side, DXC’s operating margin rose by 4.6 percentage points over the last five years.

This quarter, DXC generated an operating margin profit margin of 5.4%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

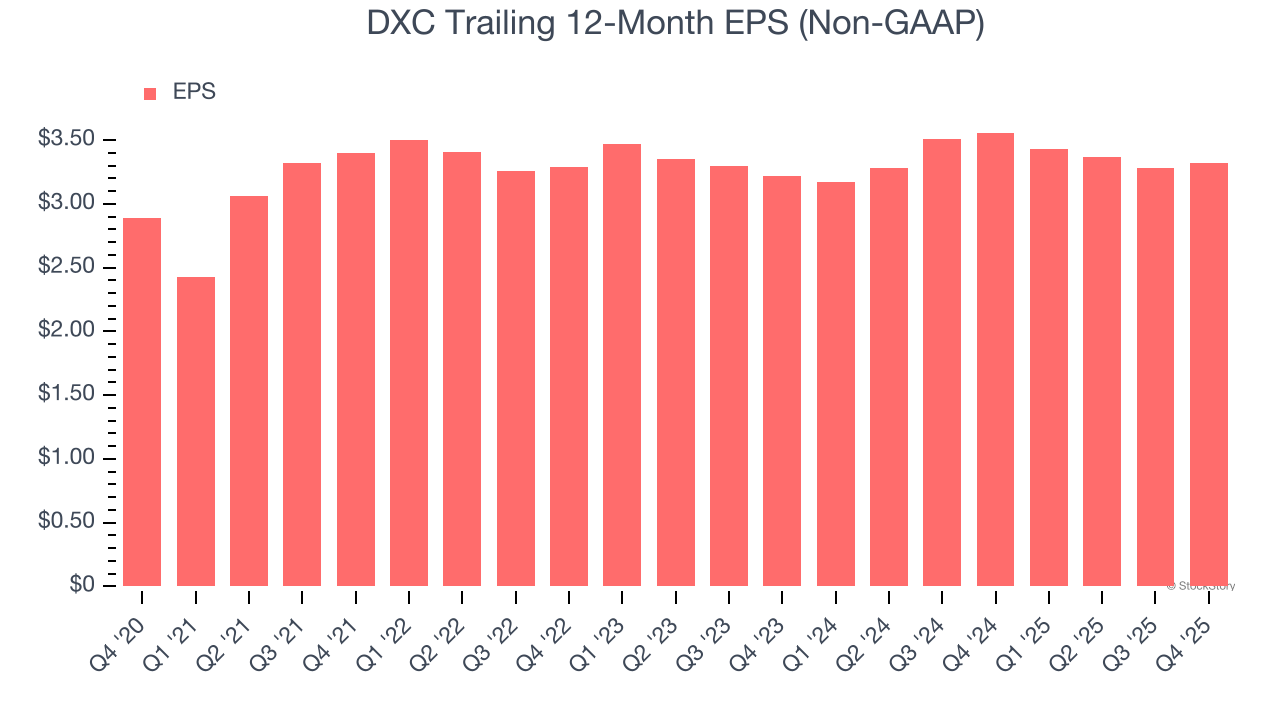

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

DXC’s EPS grew at a weak 2.8% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 6.9% annualized revenue declines and tells us management adapted its cost structure in response to a challenging demand environment.

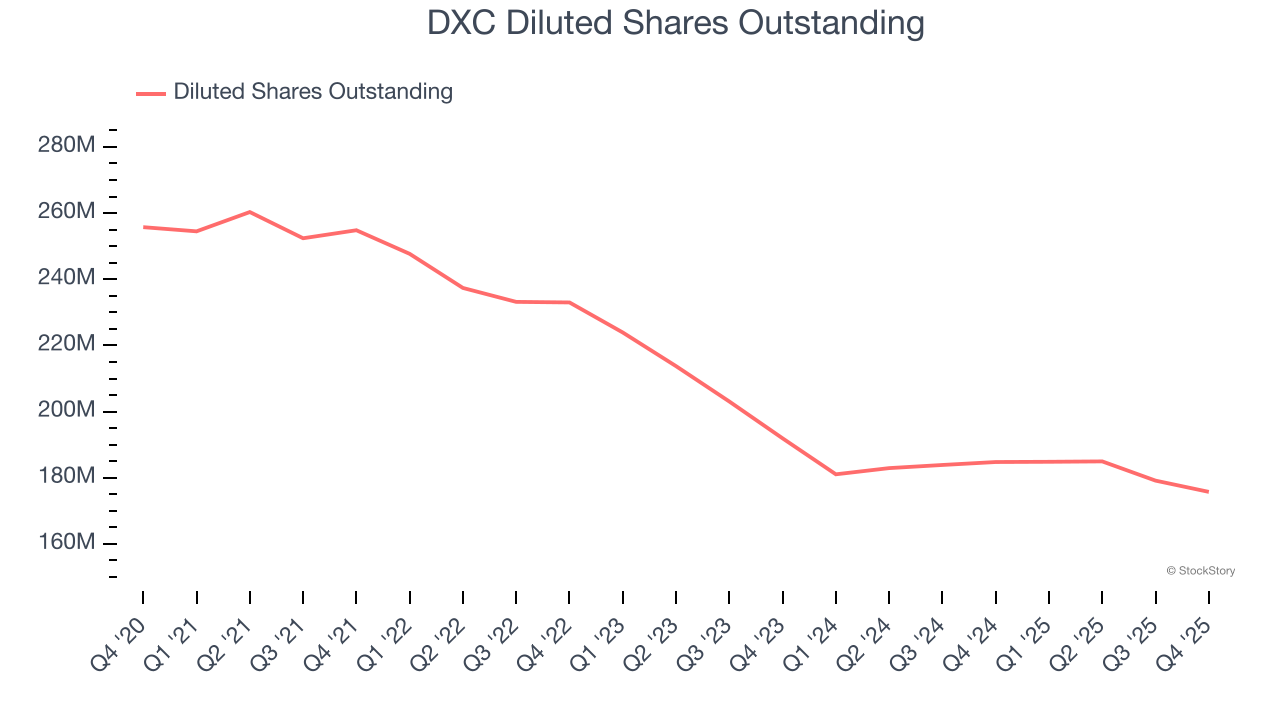

We can take a deeper look into DXC’s earnings to better understand the drivers of its performance. As we mentioned earlier, DXC’s operating margin was flat this quarter but expanded by 4.6 percentage points over the last five years. On top of that, its share count shrank by 31.3%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For DXC, its two-year annual EPS growth of 1.5% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q4, DXC reported adjusted EPS of $0.96, up from $0.92 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects DXC’s full-year EPS of $3.32 to shrink by 6.5%.

It was good to see DXC beat analysts’ EPS expectations this quarter. We were also happy its full-year EPS guidance narrowly outperformed Wall Street’s estimates. On the other hand, its EPS guidance for next quarter missed and its revenue guidance for next quarter fell slightly short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 3% to $13.99 immediately after reporting.

Is DXC an attractive investment opportunity right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here (it’s free).

| Feb-23 | |

| Feb-16 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-10 | |

| Feb-09 | |

| Feb-05 | |

| Feb-05 | |

| Feb-03 | |

| Feb-02 | |

| Feb-01 | |

| Jan-30 | |

| Jan-30 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite