|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how E.W. Scripps (NASDAQ:SSP) and the rest of the broadcasting stocks fared in Q3.

Broadcasting companies have been facing secular headwinds in the form of consumers abandoning traditional television and radio in favor of streaming services. As a result, many broadcasting companies have evolved by forming distribution agreements with major streaming platforms so they can get in on part of the action, but will these subscription revenues be as high quality and high margin as their legacy revenues? Only time will tell which of these broadcasters will survive the sea changes of technological advancement and fragmenting consumer attention.

The 7 broadcasting stocks we track reported a mixed Q3. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 0.8% below.

In light of this news, share prices of the companies have held steady as they are up 2.7% on average since the latest earnings results.

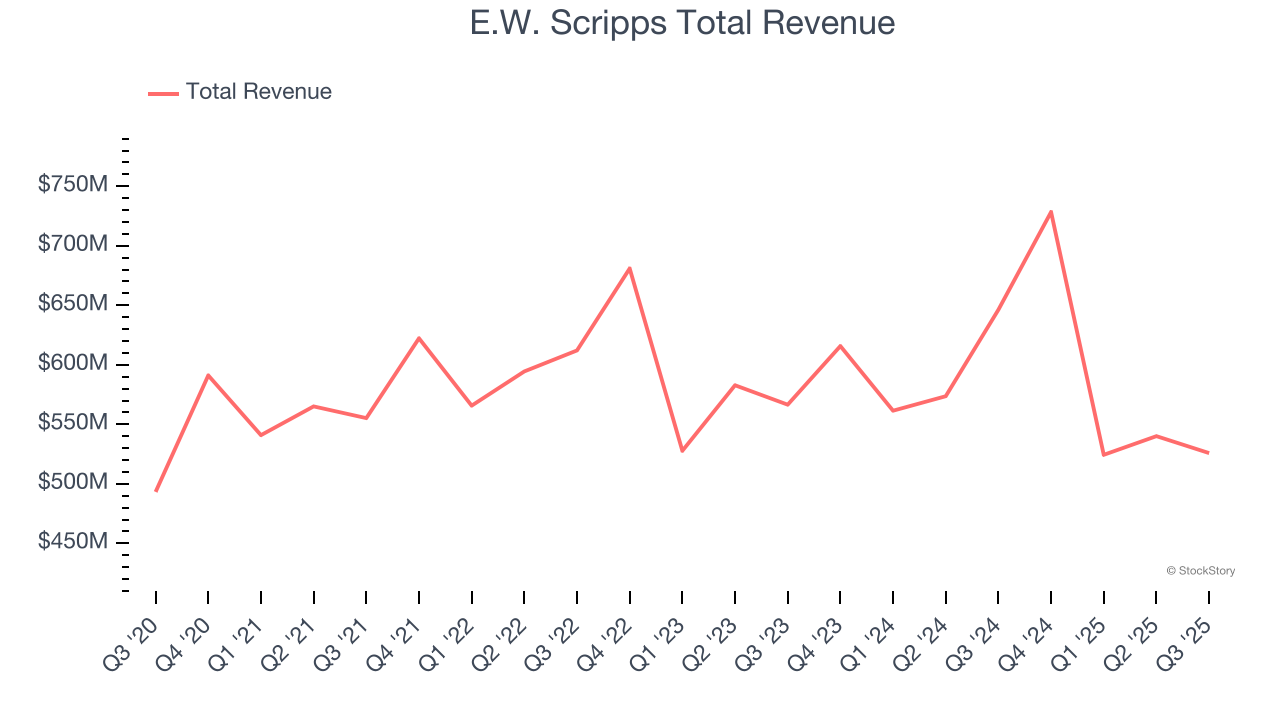

Founded as a chain of daily newspapers, E.W. Scripps (NASDAQ:SSP) is a diversified media enterprise operating a range of local television stations, national networks, and digital media platforms.

E.W. Scripps reported revenues of $525.9 million, down 18.6% year on year. This print was in line with analysts’ expectations, and overall, it was a satisfactory quarter for the company with a solid beat of analysts’ adjusted operating income estimates but a significant miss of analysts’ EPS estimates.

Local Media division core advertising revenue was up 2% in the third quarter, driven by the services category and overall growth in national advertising due to strong sales execution and Scripps’ sports strategy. During the fourth quarter, the company expects strong core revenue growth, buoyed by its new agreement with the National Hockey League’s Tampa Bay Lightning, continued growth across live sports markets and the comparison to last year’s political advertising displacement of core advertising. The Scripps Networks division continues to capitalize on the networks’ broad distribution on streaming platforms to grow connected TV revenue, up 41% in the quarter and helping to offset softness due to economic uncertainty. Networks revenue came in better than peers at about flat for Q3 and, combined with a 7% reduction in expenses, the division delivered a 27% margin. The WNBA season on ION wrapped successfully, with linear and connected TV revenue growing 92% over the 2024 season despite Caitlin Clark’s absence due to injury. Demand for the WNBA and other women’s sports on ION in this year’s upfront cycle was strong, with sports volume up 30% and commanding premium ad rates. Scripps recently announced the sale of two network-affiliated stations: WFTX in Fort Myers, Florida, to Sun Broadcasting, and WRTV in Indianapolis to Circle City Broadcasting, with total proceeds of $123 million. These transactions follow plans announced in July to swap stations across five markets in four states with Gray Media. This optimization of the Scripps portfolio supports the company’s strategy to improve the operating performance of its local stations and pay down debt. On Aug. 6, Scripps closed on the placement of $750 million in new senior secured second-lien notes at a rate of 9.875%. Proceeds were used to pay off the company’s 2027 senior notes; pay down $205 million of its 2028 term loan B-2; and pay off a portion of its revolving credit facilities. The company has since paid off the remaining balance on its revolving credit facilities. Net leverage at the end of the third quarter was 4.6x, down from 4.9x at the end of the first quarter and in line with the company’s projected year-end leverage. Scripps’ local television stations led an employee- and on-air campaign to raise money for the Scripps Howard Fund’s ninth annual “If You Give a Child a Book …” campaign, and proceeds will allow the Fund to invest a record-breaking $1.8 million during the 2025-2026 academic year to provide more than 300,000 books to children at low-income schools across the United States.

Interestingly, the stock is up 63.7% since reporting and currently trades at $3.36.

Is now the time to buy E.W. Scripps? Access our full analysis of the earnings results here, it’s free.

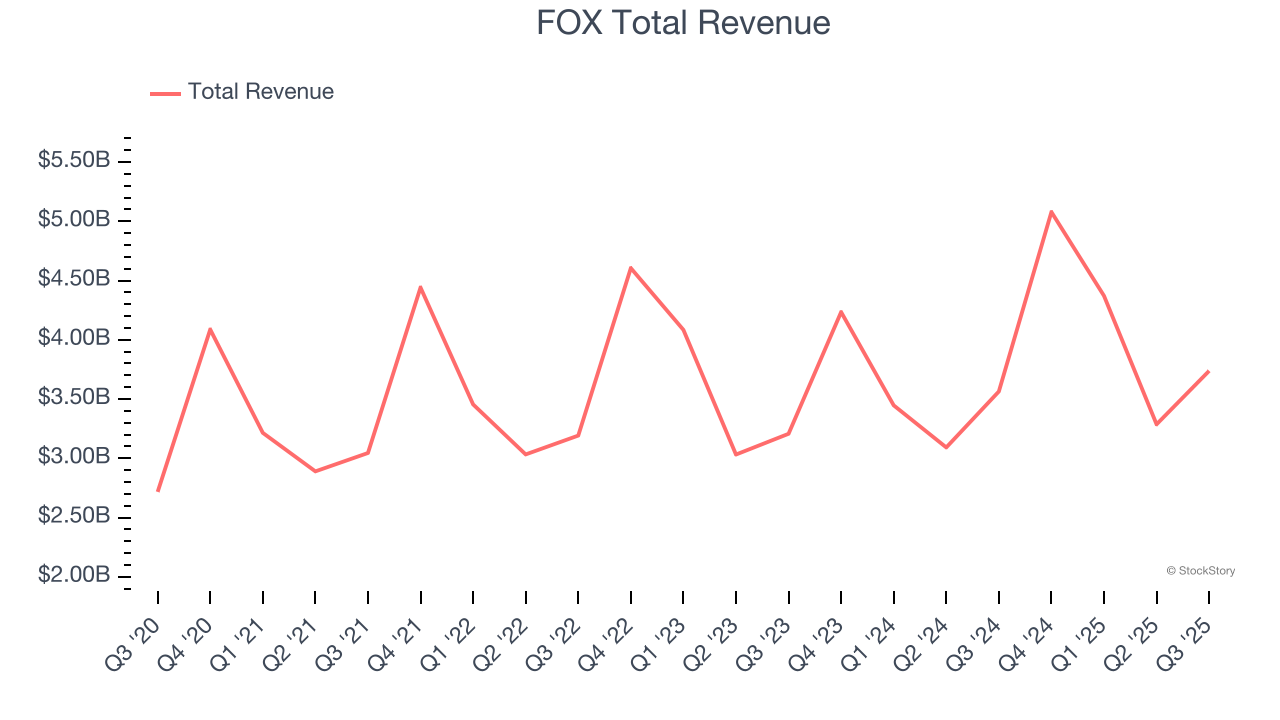

Founded in 1915, Fox (NASDAQ:FOXA) is a diversified media company, operating prominent cable news, television broadcasting, and digital media platforms.

FOX reported revenues of $3.74 billion, up 4.9% year on year, outperforming analysts’ expectations by 4.6%. The business had a stunning quarter with a beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

FOX scored the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 13.5% since reporting. It currently trades at $69.

Is now the time to buy FOX? Access our full analysis of the earnings results here, it’s free.

Owner of Spongebob Squarepants and formerly known as ViacomCBS, Paramount Global (NASDAQ:PARA) is a major media conglomerate offering television, film production, and digital content across various global platforms.

Paramount reported revenues of $6.70 billion, down 3.4% year on year, falling short of analysts’ expectations by 5.6%. It was a softer quarter as it posted a miss of analysts’ Filmed Entertainment revenue estimates and a miss of analysts’ TV Media revenue estimates.

Paramount delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 25.4% since the results and currently trades at $11.38.

Read our full analysis of Paramount’s results here.

Specializing in local media coverage, Gray Television (NYSE:GTN) is a broadcast company supplying digital media to various markets in the United States.

Gray Television reported revenues of $749 million, down 21.2% year on year. This result met analysts’ expectations. Taking a step back, it was a satisfactory quarter as it also logged a beat of analysts’ EPS estimates but revenue guidance for next quarter missing analysts’ expectations.

Gray Television had the slowest revenue growth among its peers. The stock is down 8.6% since reporting and currently trades at $4.21.

Read our full, actionable report on Gray Television here, it’s free.

Occasionally featuring celebrity hosts like Ryan Seacrest on its shows, iHeartMedia (NASDAQ:IHRT) is a leading multimedia company renowned for its extensive network of radio stations, digital platforms, and live events across the globe.

iHeartMedia reported revenues of $997 million, down 1.1% year on year. This print surpassed analysts’ expectations by 1.9%. Taking a step back, it was a softer quarter as it logged a significant miss of analysts’ adjusted operating income estimates and a significant miss of analysts’ EPS estimates.

The stock is down 30.2% since reporting and currently trades at $3.19.

Read our full, actionable report on iHeartMedia here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.

| Feb-18 | |

| Feb-11 | |

| Feb-09 | |

| Feb-09 | |

| Feb-02 | |

| Jan-29 | |

| Jan-29 | |

| Jan-28 | |

| Jan-16 | |

| Jan-13 | |

| Jan-04 | |

| Jan-04 | |

| Jan-01 | |

| Dec-18 | |

| Dec-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite