|

|

|

|

|||||

|

|

Oil prices have delivered eye-catching gains this month, only to reverse sharply on a day-to-day basis. That combination of strong momentum and sudden pullbacks has made energy investing both tempting and tricky. In such an environment, investors may want to keep an eye on broker-recommended stocks like Expand Energy EXE, Energy Transfer LP ET and Archrock, Inc. AROC, which are often viewed as ways to stay exposed to the sector without constantly reacting to every headline-driven move.

These names stand out as oil volatility highlights the value of discipline and expert-backed signals over emotional trading.

Oil has posted its biggest monthly rise in years, driven largely by geopolitical tensions and supply concerns. Brent crude recently climbed above $70 a barrel for the first time since July, while West Texas Intermediate pushed past the mid-$60s level, marking multi-month highs. On a monthly basis, both benchmarks are on track for double-digit percentage gains, underscoring the strength of the rally.

Yet, the gains have come with sharp daily swings. Prices have repeatedly pulled back by more than 1% in single sessions, even as the broader trend remains positive. Risk-off sentiment in global markets, a strengthening U.S. dollar and shifting expectations around near-term supply disruptions have all contributed to abrupt reversals. For investors, this has created a market that rewards patience but punishes poor timing.

Much of the recent volatility has been tied to escalating rhetoric surrounding U.S.-Iran tensions. Fears of potential military action and possible disruptions to shipping routes such as the Strait of Hormuz have pushed risk premiums higher. Headlines alone have been enough to spark rallies, even before any actual supply impact materializes.

At the same time, analysts have noted that even if military action were to occur, it would likely be targeted and may avoid Iran’s core oil production and export infrastructure. Iran’s output has historically survived multiple crises, and broader expectations point to limited, rather than prolonged, supply disruption. This contrast between market reaction and underlying fundamentals has amplified short-term price swings.

Sharp moves in oil prices often push retail investors to act on emotion rather than strategy. Sudden rallies tied to geopolitical headlines can trigger fear of missing out, drawing investors in near short-term peaks. On the flip side, abrupt sell-offs may prompt rushed exits, even when the underlying outlook has not meaningfully changed.

This behavior is common in commodity markets, where news flow can drive prices faster than fundamentals. Constantly reacting to every upswing or dip usually leads to poor timing, which can hurt returns over time — even when the longer-term trend remains favorable.

The volatility and uncertainty of oil prices make investment decisions difficult for individuals. With the future direction of the commodity’s movement being anybody's guess, it might be a wise decision to go ahead with stocks preferred by analysts, who have deep fundamental knowledge and understanding of the industry and its companies.

The brokers have direct communication with top management, which gives them a deeper insight into what is happening in a particular company. They diligently review companies’ publicly available documents and even attend conference calls.

Moreover, brokers generally have an in-depth understanding of the overall sector and industry. They place company fundamentals against the current economic backdrop to determine the suitability of a particular stock as an investment.

With that context, it is worth taking a closer look at three broker-favored energy names that investors are watching as oil swings continue. With the help of the Zacks Stock Screener, we have selected these stocks that have been given a Strong Buy or Buy rating by 75% or more brokers.

Expand Energy: Expand Energy is a natural gas-focused exploration and production company based in Oklahoma City. It operates mainly in the Haynesville and Appalachian regions, with core positions in the Marcellus and Haynesville/Bossier shales. The Zacks Rank #3 (Hold) company was formed through the merger of Chesapeake Energy and Southwestern Energy. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Expand Energy is now the largest natural gas producer in the United States. Its production mix is heavily weighted to gas, supported by large, unconventional assets and efficient operations. The company is positioned to benefit from rising demand tied to LNG exports, data centers, and broader electrification trends.

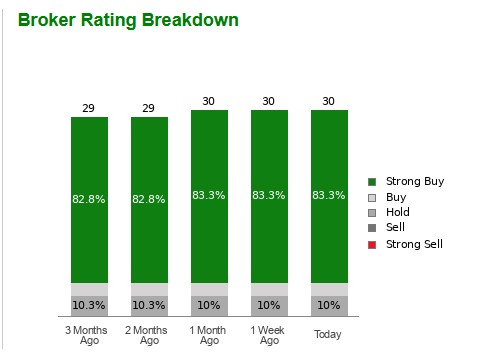

Investors should know that 25 of the 30 brokers providing data to Zacks on Expand Energy’s stock have Strong Buy recommendations. The other five ratings are two Buys and three Holds, giving the company an attractive average brokerage recommendation (“ABR”) of 1.25 on a scale of 1 to 5 (Strong Buy to Strong Sell).

Energy Transfer: It is a Dallas-based energy partnership with one of the largest and most diversified midstream networks in the United States. Founded in 1996, Energy Transfer owns extensive natural gas, NGL, crude oil, and refined products infrastructure, spanning major U.S. production basins and key demand markets.

The Zacks #3 Ranked partnership’s assets include pipelines, storage, processing, fractionation, export terminals and fuel marketing operations. Energy Transfer also controls the general partner and incentive distribution rights of Sunoco and holds a significant stake in USA Compression Partners, adding exposure to fuel distribution and compression services.

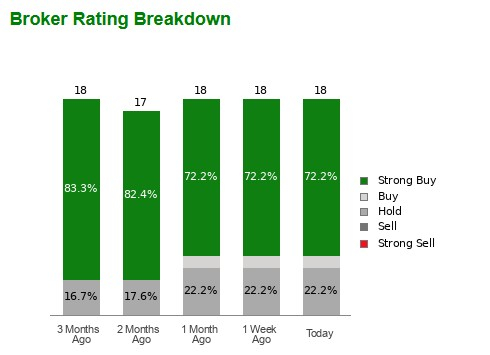

Energy Transfer’s stock has no Strong Sell or Sell broker ratings, with 13 of them strongly recommending the company’s shares. After including one Buy and four Hold ratings, ET’s 1.50 ABR is intriguing.

Archrock: Based in Houston, TX, Archrock is a U.S. energy infrastructure company focused on midstream natural gas compression. It provides contract compression services and equipment across all major U.S. basins, with a strong presence in the Permian, Gulf Coast, South Texas, and Mid-Continent regions. Archrock operates the largest compression fleet in the country, led by high-horsepower units.

The company — currently carrying a Zacks Rank of 3 — also offers a broad range of aftermarket services that support customer-owned equipment. Compression is a must-run service, giving Archrock stable, recurring revenue and a resilient business model tied to natural gas transport and midstream activity.

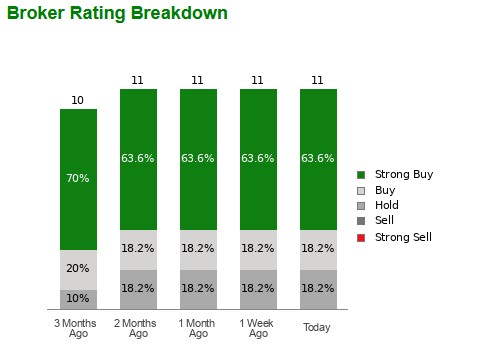

An under-the-radar energy stock, Archrock has a very favorable ABR of 1.55. Currently, out of 11 brokers, seven rate the stock as Strong Buy, two have a Buy rating, and two maintain a Hold rating.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 39 min | |

| 2 hours | |

| 2 hours | |

| 5 hours | |

| 6 hours | |

| 7 hours | |

| 8 hours | |

| 8 hours | |

| 10 hours | |

| 11 hours | |

| 12 hours | |

| 12 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite