|

|

|

|

|||||

|

|

IREN Limited IREN is set to report its second-quarter fiscal 2026 results on Feb. 5.

The Zacks Consensus Estimate for fiscal second-quarter revenues is currently pegged at $230.12 million, indicating 92.42% year-over-year growth.

The consensus mark for the bottom-line loss is currently pegged at 9 cents, widened by two cents over the past 30 days. This indicates a sharp year-over-year deterioration from earnings of 9 cents.

Over the last four quarters, the company has struggled to surpass expectations, missing the Zacks Consensus Estimate thrice and beating only once, delivering an average negative earnings surprise of 26.52%.

IREN Limited price-eps-surprise | IREN Limited Quote

Our proven model does not conclusively predict an earnings beat for IREN this time around. Per the Zacks model, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. However, this is not the case here, as you can see below.

IREN Limited has an Earnings ESP of -39.29% at present, and it carries a Zacks Rank #3. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

IREN Limited continues to benefit from several supportive operational and financial factors. The company’s ongoing expansion from 23,000 GPUs toward a targeted 140,000 GPUs by the end of 2026 positions it to capture accelerating AI cloud demand in the second quarter of fiscal 2026. Continued ASIC-to-GPU conversions at British Columbia sites and additional deployments at Mackenzie and Canal Flats campuses should improve capacity utilization and support incremental revenue generation. Rising GPU capacity and improving utilization are expected to act as key operational drivers of sequential top-line growth in the quarter under review.

IREN’s strong liquidity position, supported by approximately $1.8 billion in cash balance from recent financing initiatives and customer prepayments, strengthened its ability to sustain Bitcoin mining operations in the second quarter of fiscal 2026 despite volatility in power costs. This liquidity buffer is expected to have reduced funding pressures and operational risk, thereby supporting steadier mining performance and more predictable mining revenues in the to be reported quarter.

However, these positives are tempered by the company’s highly capital-intensive expansion strategy. IREN is expanding its AI cloud platform to support the Microsoft contract and large GPU deployments. The company plans to invest approximately $5.8 billion in GPUs and related infrastructure, with only partial offset from customer prepayments and secured GPU financing. Management aims to cover the remaining costs through a combination of cash reserves, operating cash flow, increased debt, equity issuance and convertible notes, which will raise leverage and dilute shareholders. These high capital requirements and financing uncertainties are likely to have weakened financial flexibility, thereby hindering performance in the fiscal second quarter of 2026.

IREN’s first-quarter fiscal 2026 results were significantly aided by unrealized gains on financial instruments tied to its convertible notes, which artificially lifted net income and EBITDA above core operating levels. These gains were non-operational and largely accounting-driven, obscuring the company’s underlying profitability from its AI cloud and data center businesses. In the absence of comparable unrealized gains in the fiscal second quarter, earnings quality is expected to weaken. Accordingly, reported profitability may come under pressure in the to-be-reported quarter.

IREN Limited’s shares have declined 1.5% over the past three months compared with the broader Finance sector’s return of 4.3%. However, it has outperformed peers such as Cipher Mining CIFR, TeraWulf WULF and CleanSpark CLSK. Over the same time period, Cipher Mining, TeraWulf and CleanSpark have fallen 5.1%, 6.2% and 29.2%, respectively.

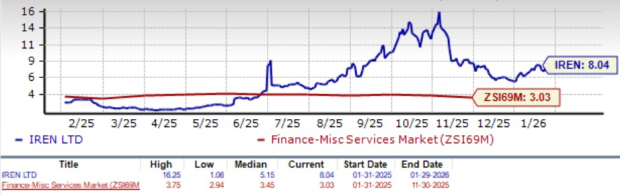

IREN stock is not so cheap, as the Value Score of F suggests a stretched valuation at this moment. In terms of forward 12-month price/sales, IREN is trading at 8.04X, higher than the Zacks Financial - Miscellaneous Services industry’s 3.03X.

Compared with major bitcoin miners, IREN Limited has a lower P/S multiple than Cipher Mining and TeraWulf, but has a higher multiple than CleanSpark. At present, Cipher Mining, TeraWulf and CleanSpark trade at forward 12-month Price/Sales ratios of 25.55, 14.7 and 3.85, respectively.

The company enters second-quarter fiscal 2026 with multiple tailwinds, including the phased ramp of its Microsoft AI cloud contract, continued growth in GPU fleet and data center capacity and strong multi-year customer commitments. A strengthened liquidity position and diversified financing reduce execution risk, and momentum from record first-quarter operations provides a favorable setup for sequential improvement.

However, IREN’s move into AI cloud and HPC exposes it to heightened execution and competitive challenges. The company now faces direct competition from rapidly expanding peers such as Applied Digital and TeraWulf, which are scaling their AI data center platforms through partnerships with CoreWeave and Fluidstack, respectively. While these competitors have already established strong market positions, IREN remains in the early stages of building its AI cloud business, creating uncertainty around its ability to meet growth objectives.

IREN’s premium valuation significantly raises downside risk at this stage. While AI cloud growth, rising GPU capacity and strong liquidity provide support. Although mounting capital requirements and competitive pressures weaken near-term visibility, limiting upside potential ahead of the fiscal second quarter earnings release.

Given these factors, it is advisable to remain on the sidelines until a better risk-reward opportunity emerges. You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 20 hours | |

| 20 hours | |

| Feb-27 |

MARA Surges On Data Center Partnership, AI Plans. Crypto Plays Report.

WULF -9.28%

Investor's Business Daily

|

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Trump-Linked Miner Reports Results, MARA Surges On AI Partnership

WULF -9.28% WULF

Investor's Business Daily

|

| Feb-26 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite