|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

The shifting interests of students and parents toward online education alternatives, especially for career learning, have altered the perspective of the education market and the firms operating in it. This focal shift is proving beneficial for education providers like Stride, Inc. LRN and Strategic Education, Inc. STRA, whose product offerings sit at the juncture where digital education and the demand for adult learning meet.

Stride’s operations primarily focus on the United States market, offering K-12 virtual schooling and career-learning programs. Conversely, Strategic Education provides a range of post-secondary education and other academic programs, including business administration, information technology and nursing, through physical campuses as well as online platforms.

Besides, the recent formation of the Accreditation, Innovation and Modernization (AIM) committee, which was announced by the U.S. Department of Education on Jan. 26, 2026, advocates long-term growth. The primary purpose of forming the AIM committee is to reform the country’s higher education accreditation system, ensuring students are more exposed to high-quality and data-driven programs and reducing bureaucratic barriers. This strategic move by the government is expected to boost workforce skills, thus increasing the demand for services offered by the companies mentioned above.

Let’s decode and closely compare the fundamentals of the two education stocks to determine which one is the better investment now.

The sustained secular shift toward virtual and alternative education models is fueling Stride’s prospects in the education market. Parents' dissatisfaction with traditional K-12 education remains high, while concerns about safety, mental well-being and the need for flexibility continue to drive enrollment toward online options. This backdrop supports the company’s core value proposition and underpins management’s confidence in long-term growth.

Amid this favorable backdrop, the Career Learning segment has become the primary growth booster for LRN. During the first six months of fiscal 2026, this segment’s enrollments have increased year over year by 18.1% to 111,100 students, with revenues growing 20.5% to $547.6 million. The numbers highlight the company’s success in aligning offerings with workforce-oriented education trends. Importantly, withdrawal rates have stabilized after earlier technical volatility, suggesting that retention initiatives and academic quality investments are beginning to show results.

Besides favorable market trends, LRN’s operating leverage and disciplined cost management are taking the limelight. During the first six months of fiscal 2026, its adjusted operating income and adjusted EBITDA grew year over year by 23.8% and 21.3%, respectively. Despite temporary headwinds from platform implementation challenges, Stride reaffirmed its full-year revenue guidance and raised its adjusted operating income outlook, signaling confidence in execution for the remainder of fiscal 2026. For fiscal 2026, the company now expects adjusted operating income to be in the range of $485-$505 million, up from the $475- $500 million range expected earlier.

Notably, on Nov. 3, 2025, Stride’s board of directors authorized a stock repurchase program for the purchase of up to $500 million of its common stock until Oct. 31, 2026. This underscores the management’s confidence in long-term value creation for its shareholders. During the six months ended Dec. 31, 2025, LRN repurchased 1,272,790 shares of its common stock at an average price of $69.65 per share.

Strategic Education is gaining from robust employer-affiliated enrollment trends. During the third quarter of 2025, employer-affiliated enrollment hit a record of 32.7% of the U.S. Higher Education (USHE) segment’s enrollment, up from 29.8% in the year-ago quarter, attributable to the ongoing focus on employers that are aiding in generating consistent growth in the employer-affiliated enrollment. Besides, an increase in Workforce Edge revenues from new employer partnerships, growth in Sophia Learning subscriptions and higher employer-affiliated enrollment boosted the Education Technology Services (ETS) segment’s revenues in the first nine months of 2025 by 46.8% year over year.

Continuous innovation and course updates expand STRA’s product portfolio, which, in turn, boosts enrollments and drives long-term growth. The company is focusing on providing programs based on a “competency-based learning model and direct assessment capabilities”. One of these innovations is FlexPath. FlexPath allows students to move through coursework at their own pace by demonstrating mastery of specific skills and competencies. Its format aligns well with Strategic Education’s employer-affiliated enrollments, making it easier for companies to support employee upskilling and for employees to advance their education on their own schedules.

Other programs like Workforce Edge and RightSkill are other notable offerings of STRA that contribute handily to its growth prospects. Workforce Edge manages education benefits programs for corporate clients, allowing companies to provide employees with access to educational opportunities. On the other hand, RightSkill is a skills-based training program that trains students for roles in high-demand areas, helping students find immediate work and helping employers get job-ready candidates.

With growing skill-based program demand for enriching the workforce, these diversified product offerings are proving incremental for STRA’s near and long-term growth. With increased revenue generation, the company will be able to create value for its shareholders. During the first nine months of 2025, Strategic Education paid $43.4 million in cash dividends and $94.3 million through the repurchase of shares, creating shareholder value. Notably, STRA had no long-term debt as of the third quarter of 2025, making its financial position healthy in the current risky market scenario.

As witnessed from the chart below, in the past three months, Stride’s share price performance stands well above that of Strategic Education and the Zacks Schools industry.

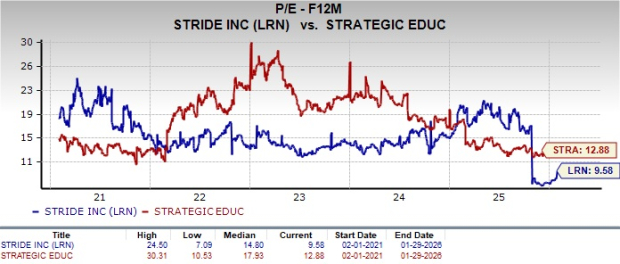

Considering valuation, over the last five years, Stride is trading below Strategic Education on a forward 12-month price-to-earnings (P/E) ratio basis.

Overall, from these technical indicators, it can be deduced that LRN stock offers an incremental growth trend with a discounted valuation, while STRA stock offers a diminishing growth trend with a premium valuation.

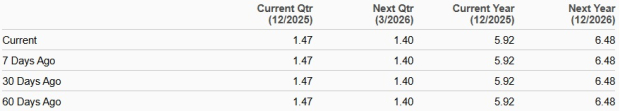

LRN’s earnings estimates for fiscal 2026 and fiscal 2027 have moved north in the past seven days. The revised figures for fiscal 2026 and fiscal 2027 imply year-over-year improvements of 3.7% and 9.2%, respectively.

LRN EPS Trend

The Zacks Consensus Estimate for STRA’s 2026 earnings has remained unchanged over the past 60 days. However, the estimated figure for 2026 reflects 9.5% year-over-year growth.

STRA EPS Trend

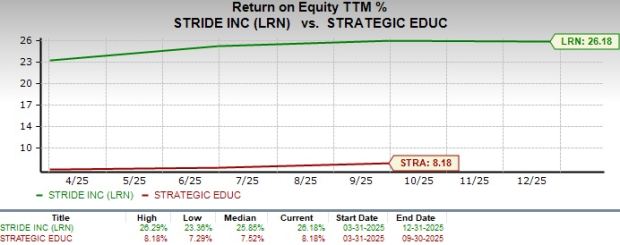

Stride’s trailing 12-month ROE of 26.2% significantly exceeds Strategic Education’s average, underscoring its efficiency in generating shareholder returns.

The education sector continues to benefit from rising demand for flexible, career-oriented learning models, supported by favorable regulatory developments such as the newly formed AIM committee. Within this backdrop, Stride and Strategic Education emanate different growth trajectories.

Stride is gaining momentum from the sustained shift toward virtual K-12 and workforce-focused education. Its Career Learning segment remains the key growth engine, with operating leverage and disciplined cost control driving solid profit expansion. Moreover, Stride’s higher ROE, discounted valuation and earnings estimate uptrend enhance its relative appeal, despite lingering risks tied to technology execution and enrollment volatility.

On the other hand, Strategic Education's diversified post-secondary and adult learning platform with growing employer-affiliated enrollments bodes well. Innovative offerings such as FlexPath, Workforce Edge and Sophia Learning support steady growth and align well with workforce upskilling trends. A debt-free balance sheet and consistent shareholder return provide stability, but earnings momentum appears more moderate and valuation relatively richer.

Thus, it can be deduced that LRN stock offers stronger near-term growth and valuation support, while STRA stock provides steadier, employer-linked demand, even though both carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-10 | |

| Feb-08 | |

| Feb-08 | |

| Feb-05 | |

| Feb-04 | |

| Feb-04 | |

| Feb-04 | |

| Feb-03 | |

| Feb-03 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite