|

|

|

|

|||||

|

|

DaVita Inc. DVA is scheduled to report fourth-quarter 2025 results on Feb. 2, 2026, after the closing bell.

In the last reported quarter, the company’s earnings per share (EPS) of $2.51 lagged the Zacks Consensus Estimate by 23.7%. Over the trailing four quarters, its earnings outperformed the Zacks Consensus Estimate on three occasions and missed once, delivering an earnings surprise of 0.3%, on average.

Let’s check out the factors that have shaped DVA’s performance prior to this announcement.

DaVita’s fourth-quarter 2025 performance is likely to have reflected a combination of seasonal normalization and the company’s ongoing execution on operational priorities. Treatment volumes could see a sequential improvement, supported by a more favorable treatment-day mix and the absence of certain disruptions that affected earlier quarters. On the third-quarter earnings call in October 2025, management indicated expectations for higher revenue per treatment in the quarter, driven by routine rate adjustments, vaccine-related revenues and the timing of collections tied to the resolution of aged claims. Together, these factors will likely drive the top-line performance and help support earnings momentum in the to-be-reported quarter.

Cost discipline is also expected to remain a key support in aiding fourth-quarter 2025 results. While patient care costs and general and administrative expenses typically rise seasonally in the fourth quarter, DaVita’s continued focus on operational efficiency and labor management is expected to offset part of this pressure. Ongoing investments in technology and revenue cycle infrastructure, although contributing to higher near-term expenses, are designed to enhance productivity and collections, which could aid quarterly results. In addition, the timing of integrated kidney care (IKC) revenue recognition may provide incremental support, given the inherent variability in quarterly phasing for this business.

However, some headwinds are likely to persist. Elevated mortality rates and higher missed treatment frequencies remain near-term challenges and could continue to weigh on volume growth. Pressure from payer mix variability and lingering impacts from higher pharmaceutical usage may also temper margin expansion.

Although the operating environment remains mixed, we expect a combination of seasonal tailwinds, disciplined execution and favorable timing factors to aid DaVita in delivering a steadier performance in the fourth quarter of 2025 despite the ongoing challenges.

For fourth-quarter 2025, the Zacks Consensus Estimate for revenues is pegged at $3.53 billion, implying an improvement of 6.9% from the prior-year quarter’s reported figure.

The consensus estimate for EPS is pegged at $3.24, indicating an uptick of 44.6% from the prior-year period’s reported number.

Per our proven model, a stock with a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold), along with a positive Earnings ESP, has higher chances of beating estimates. This is not the case here, as you can see below.

Earnings ESP: DVA has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita Inc. price-eps-surprise | DaVita Inc. Quote

Over the past three months, DaVita’s shares have lost 9.6%, underperforming Medical - Outpatient and Home Healthcare’s 0.3% loss. DVA’s shares also underperformed the Zacks Medical sector’s increase of 5.3% and the S&P 500’s growth of 2.8%.

DaVita’s peers like Aveanna Healthcare Holdings Inc. AVAH, Option Care Health, Inc. OPCH and Elanco Animal Health Incorporated ELAN have outperformed it. AVAH’s shares have lost 7.6%, while OPCH and ELAN’s shares have gained 31.2% and 9.1%, respectively, in the same time frame.

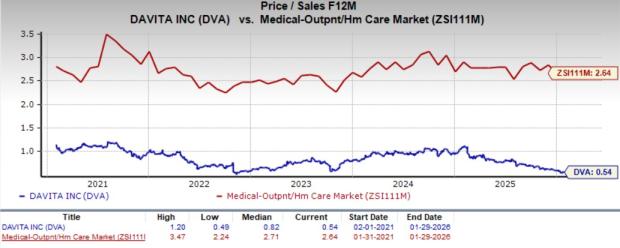

From a valuation standpoint, DVA’s forward 12-month price-to-sales (P/S) is 0.5X, a discount to the industry's average of 2.6X.

The company is trading at a discount to its peers, Aveanna Healthcare, Option Care Health and Elanco Animal Health. Aveanna Healthcare, Option Care Health and Elanco Animal Health’s P/S currently stand at 0.7X, 0.9X and 2.4X, respectively.

This suggests that investors may be paying a lower price relative to the company's expected sales growth.

DaVita’s management has provided a clear long-term strategy focused on advancing clinical care, leveraging technology and maintaining disciplined execution. Leadership continues to emphasize that improving patient outcomes is central to restoring sustainable growth over time. Efforts to enhance clinical protocols, increase time on therapy and adopt newer dialysis technologies — including advanced dialyzers and middle-molecule clearance solutions — are aimed at gradually reducing elevated mortality levels that remain above pre-pandemic norms. While these initiatives are expected to take time to translate into measurable volume benefits, they underpin management’s longer-term growth outlook.

Technology investments represent another key pillar of long-term visibility. DaVita is continuing to enhance its next-generation clinical platform while upgrading scheduling and revenue operations systems. The expanding use of data analytics and AI across clinical and administrative functions is intended to improve care coordination, reduce hospitalizations and support operating efficiency over time, even as these investments weigh on near-term expenses.

In addition, DaVita’s IKC and value-based care initiatives provide structural earnings visibility. Management remains confident in its ability to expand risk-based arrangements and manage medical costs over time, despite variability in quarterly performance. Combined with sustained cost discipline and capital management, these priorities support durable long-term performance visibility.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 9 hours | |

| Mar-04 | |

| Mar-04 | |

| Mar-03 | |

| Mar-02 | |

| Mar-02 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite