|

|

|

|

|||||

|

|

Celestica Inc. CLS — one of the largest AI-powered EMS (electronics manufacturing services) companies in the world — reported excellent fourth-quarter 2025 earnings results. Adjusted earnings per share (EPS) of $1.89 surpassed the Zacks Consensus Estimate of $1.74 and year-ago EPS of $1.11. Quarterly revenues of $3.65 billion outpaced the Zacks Consensus Estimate of $3.46 billion and the year-ago revenues by 44%.

Total revenues in the Connectivity & Cloud Solutions (CCS) segment improved 64% year over year, primarily driven by strong demand in the communications end market. The segment accounted for 78.3% of CLS’ total revenues in the fourth quarter. Total revenues in the Advanced Technology Solutions segment declined 1% year over year.

CLS’ focus on product diversification and expanding presence in high-value markets is positive. Its strong research and development foundations allow it to produce high-volume electronic products and highly complex technology infrastructure products for a wide range of industries.

CLS is benefiting from healthy demand trends in the Connectivity & Cloud Solutions segment. The growth is primarily backed by CLS’ strength in Hyperscaler Portfolio Solutions networking business and optical programs, especially increasing demand for 800G and 400G network switches.

The growing proliferation of AI-based applications and generative AI tools is fueling solid AI investments across the technology ecosystem. This, in turn, is driving demand for CLS’ enterprise-level data communications and information processing infrastructure products, such as routers, switches, data center interconnects, edge solutions and servers and storage-related products. To further capitalize on this trend, Celestica is steadily expanding its offering through innovation and strategic collaboration.

In the last quarter, Celestica introduced a leading-edge storage platform, the SD6300 ultra-dense storage expansion system, to cater to the exponential AI data growth across traditional enterprise and hyperscale data centers. With a compact footprint of only 1125 mm (including cable management assembly), the SD6300 maximizes utilization of existing data center floor space as it can be accommodated within standard 1200 mm racks.

Celestica has gained solid market traction in the fast-growing AI data center market. Strong demand for its 800G switches among hyperscalers is expected to drive growth in the communications end market. Despite some weakness in the Enterprise end market, healthy traction in the AI/ML compute business will likely drive growth.

Four “Magnificent 7” stocks — Alphabet Inc. GOOGL, Meta Platforms Inc. META, Amazon.com Inc. AMZN and Microsoft Corp. MSFT — are major revenue generators for Celestica.

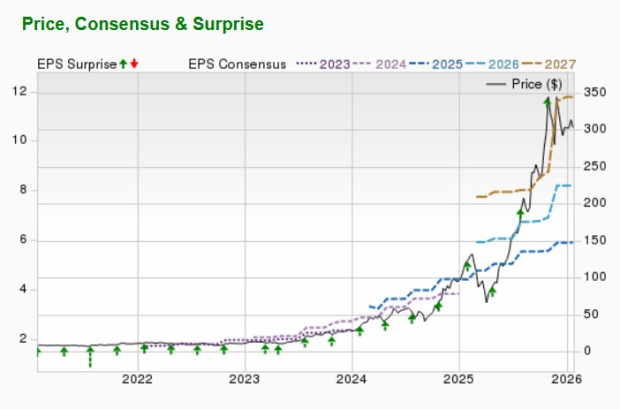

Backed by robust demand for networking products and growing AI-driven data center investments across industries, CLS presented a bullish outlook for 2026. For the first quarter of 2026, Celestica expects revenues in the range of $3.85 billion to $4.15 billion. Non-GAAP EPS are expected to be in the band of $1.95-$2.15. Management expects the non-GAAP operating margin to be about 7.8%.

With strong quarterly results, CLS currently anticipates 2026 revenues to be approximately $17 billion, up from the previous projection of $16 billion. Non-GAAP operating margin is expected to be 7.8%. Non-GAAP EPS is expected to be $8.75, up from the previous view of $8.2 per share. Non-GAAP free cash flow is estimated to be $500 million.

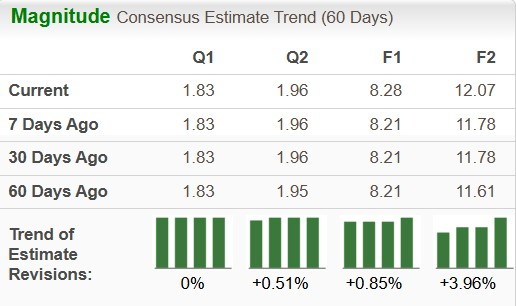

CLS has an expected revenue and earnings growth rate of 29.2% and 36.9%, respectively, for the current year. The Zacks Consensus Estimate for the current year’s earnings has improved 0.9% in the last seven days.

It has an expected revenue and earnings growth rate of 38.1% and 45.7%, respectively, for next year. The Zacks Consensus Estimate for next year’s earnings has improved 2.5% in the last seven days.

The short-term average price target of brokerage firms for the stock represents an increase of 26.4% from the last closing price of $355.24. The brokerage target price is currently in the range of $410-$230. This indicates a maximum upside of 45.9% and a downside of 18.1%. Thus, the risk/reward ratio is currently highly beneficial to the stock.

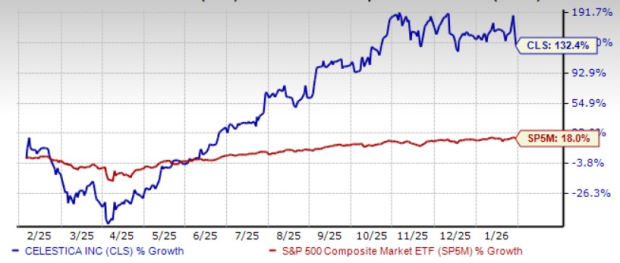

Celestica currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here. The stock soared more than 132% in the past year. However, it declined nearly 20% in the past three months. Even after the declaration of the last earnings results, the stock fell nearly 23%.

The Zacks-defined Electronics - Manufacturing Services industry is currently in the top 7% of the Zacks Industry Rank. In the past year, the industry has provided an astonishing 101% return, while its year-to-date return is an impressive 78.6%. Since it is ranked in the top half of the Zacks Ranked Industries, we expect the EMS industry to outperform the market over the next three to six months.

Along with a strong industry position, Celestica’s innovative product portfolio and its solid market traction in the fast-growing AI data center market have positioned it as a lucrative buy on the dip and a hold for long-term.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 49 min | |

| 2 hours | |

| 2 hours |

Tech Firms Arent Just Encouraging Their Workers to Use AI. Theyre Enforcing It.

AMZN META GOOGL

The Wall Street Journal

|

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite