|

|

|

|

|||||

|

|

Sony Group Corporation SONY is scheduled to report third-quarter fiscal 2025 earnings on Feb. 5, 2026.

The Zacks Consensus Estimate for earnings is pegged at 34 cents per share, down 17% from the year-ago figure. The consensus estimate for revenues is $23.9 billion, implying a 17.5% decline from the prior-year actuals.

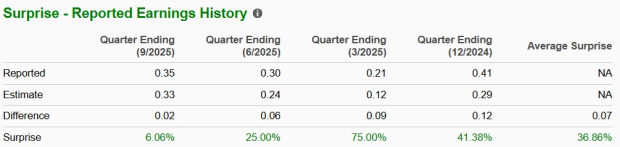

The company’s earnings surpassed the Zacks Consensus Estimate in each of the last four quarters, with the average surprise being 36.9%.

In the past year, the stock has gained 1.1% against the Zacks Audio Video Production industry’s fall of 0.5%.

Strong momentum in Game & Network Services (G&NS), Music and Imaging & Sensing Solutions (I&SS) units amid a slowdown in the Pictures and Entertainment, Technology & Services (ET&S) is likely to have driven Sony’s revenue trajectory in the fiscal third quarter. The G&NS segment is on a steady track, driven by the continued growth of PlayStation 5 in both active users and user spending. PlayStation’s monthly active users rose 3% year over year in September to 119 million.

Game software and network services sales are expected to have increased in the to-be-reported quarter, driven by more users moving to higher service tiers and stronger first-party game releases. Sony plans to build on this momentum to support long-term, profitable growth and invest in shaping the future of play. The company expects steady growth in revenues and profit from network services as the PS5 user base expands. Key goals include increasing revenues from PlayStation Plus and maximizing PlayStation Store earnings through personalization and pricing optimization.

Sony Music continues to benefit from steady streaming growth and a deep content library, while Sony Pictures’ performance will hinge on box office trends and licensing revenue. It plans to expand its Music business in emerging markets like Latin America, India and parts of Europe, where streaming adoption is rising through organic growth and acquisitions. The company is investing in music catalogs, talent discovery and partnerships with local labels, while expanding IP via biopics, documentaries and live events. Sony Music Group also strengthened digital platform ties, signing new licensing deals with Spotify and supporting responsible AI use that protects artists and songwriters.

Furthermore, Sony is strengthening its businesses through accretive acquisitions and joint ventures. In October 2025, it acquired STATSports, adding real-time athlete tracking and performance analytics. Integrated with Hawk-Eye and KinaTrax, the deal enhances Sony’s sports data platform and is expected to drive faster growth across its sports portfolio. The I&SS sales are likely to have been led by higher image sensor sales for mobiles and cameras. Stronger image sensor sales and tighter cost control by cutting low-profit areas and focusing resources on key priorities are driving profitability.

Sony Corporation price-eps-surprise | Sony Corporation Quote

However, for the second half of the fiscal year, an uncertain business environment has persisted, and it expects to operate cautiously, with only modest progress likely. A major North American customer is exploring alternative suppliers (including Korean chipmakers), which could adversely impact Sony’s market position if tariffs alter procurement patterns. While Sony is shifting hardware production for U.S. sales outside China, relocation and supply chain changes may affect costs and require flexible pricing strategies. In the imaging market, demand has weakened sharply in China after subsidies ended on June 30, 2025, and in the United States due to the drag from additional tariffs.

Also, businesses with significant U.S. dollar- and euro-denominated expenses, such as Game & Network Services and Electronics, are likely to be more exposed to forex swings.

In January 2026, Sony introduced the LinkBuds Clip Truly Wireless Open Earbuds, a new category of open-clip earbuds designed to let users enjoy music while staying fully aware of their surroundings. Built for everyday life, the LinkBuds Clip redefines personal audio by blending immersive sound with natural environmental awareness, allowing users to hear traffic, conversations and announcements without removing their earbuds.

In December 2025, Sony partnered with Kakao Entertainment to explore collaborations using Sony’s immersive 360 Reality Audio, including joint content production.

In October 2025, Sony India launched the new FE 100mm F2.8 Macro GM OSS, the first medium telephoto macro lens in its G Master series. Designed for (Alpha) E-mount cameras, it offers 1.4x magnification, advanced stabilization and improved handling for exceptional precision and creative versatility.

Sony has announced its entry into INZONE gaming peripherals. The new lineup includes keyboards, mice, mouse pads, wired earphones and headphones, optimized with insights from Fnatic players for core and pro esports gamers.

Sony partnered with Smart Eye AB, a global pioneer in Interior Sensing AI and Driver Monitoring Systems, to integrate Smart Eye’s advanced sensing and biometric authentication software with Sony’s newly launched IMX775 RGB-IR image sensor. The initiative aims to address key global automotive safety regulations while enabling a new level of secure, personalized in-vehicle experiences.

Our proven model does not predict an earnings beat for Sony this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold) increases the odds of an earnings beat. That is not the case here.

Earnings ESP: SONY has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: SONY currently carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Here are three stocks you may want to consider, as our model shows that these have the right elements to post an earnings beat in this reporting cycle.

Trimble Inc. TRMB, slated to release fourth-quarter 2025 results on Feb. 10, has an Earnings ESP of +1.91% and a Zacks Rank of 2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Trimble’s fourth-quarter 2025 earnings is pegged at 96 cents per share, suggesting a year-over-year rise of 7.9%. TRMB has a trailing four-quarter average surprise of 7.4%.

Under Armour, Inc. UAA has an Earnings ESP of +68.75% and sports a Zacks Rank of 1 at present. UAA is slated to release quarterly figures on Feb. 6. The consensus estimate for Under Armour’s third-quarter fiscal 2025 earnings is pegged at a loss of 2 cents per share, implying a decline of 125% from the year-ago quarter’s actual. UAA has a trailing four-quarter average surprise of 44.5%.

Ralph Lauren RL currently has an Earnings ESP of +0.53% and a Zacks Rank of 2. RL is slated to report third-quarter fiscal 2026 results on Feb. 5. The consensus estimate for Ralph Lauren’s earnings is pegged at $5.78 per share, implying a 19.9% jump from the year-ago quarter. The consensus mark for earnings has moved up 1% in the past 30 days. RL has a trailing four-quarter average surprise of 9.8%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 4 hours | |

| 4 hours | |

| 8 hours | |

| Feb-22 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite