|

|

|

|

|||||

|

|

Coty Inc. COTY partnered with OpenAI to explore and implement responsible artificial intelligence solutions across certain areas of its global operations.

Through the introduction of ChatGPT Enterprise, Coty’s workers will gain access to secure, enterprise-grade AI capabilities designed to support productivity, creativity and collaboration while meeting rigorous privacy and data protection standards.

The collaboration is structured to ensure AI is deployed with strong governance and clearly defined guardrails. The technology is intended to augment decision-making, improve efficiency and reinforce Coty’s commitment to quality and performance. The initial rollout will focus on targeted teams, with the flexibility to expand as business needs evolve.

This initiative complements Coty’s broader AI roadmap, which emphasizes workforce enablement alongside technology adoption. A global upskilling program is equipping employees with practical AI skills through structured training, hands-on learning and leadership engagement, enabling responsible and effective use of AI in everyday workflows.

Alongside AI adoption, Coty continues to strengthen its data-driven foundation to support its next phase of growth. The company’s e-commerce business has surpassed $1 billion in net revenues, underlining the scale of its digitally enabled operations. In first-quarter fiscal 2026, e-commerce sell-out grew 5-6%, supported by advanced analytics, disciplined pricing and improved inventory management across regions and channels.

Digital intelligence is also shaping Coty’s go-to-market execution across platforms such as Amazon, TikTok Shop and direct-to-consumer channels. Technology-led inventory controls and data-driven test-and-learn models are improving sell-in and sell-out alignment while guiding marketing investments and innovation launches.

Internally, ongoing investments in modern systems and enterprise tools are enhancing cross-functional collaboration and organizational agility. Technology-enabled performance assessments and operational reviews are supporting long-term scalability, reinforcing Coty’s shift toward more connected, intelligent ways of working.

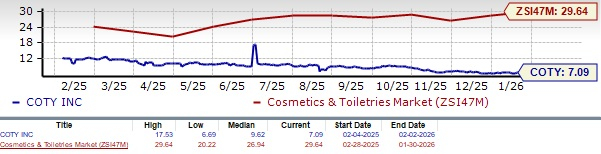

Shares of Coty have decreased 15.4% in the past three months against the industry’s growth of 12%.

From a valuation standpoint, COTY trades at a forward price-to-earnings ratio of 7.09X, down from the industry’s average of 29.64X.

The Zacks Consensus Estimate for Coty’s fiscal 2026 earnings per share implies a year-over-year surge of 90.9%, whereas the same for fiscal 2027 indicates an uptick of 16.5%. Earnings estimates for fiscal 2026 and 2027 have been revised downward by 1 cent and 2 cents, respectively, in the past 30 days.

COTY currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks are Ulta Beauty Inc. ULTA, The Estee Lauder Companies Inc. EL and European Wax Center Inc. EWCZ.

Ulta Beauty offers a wide range of products, including cosmetics, fragrance, skincare, hair care, bath and body products, and salon styling tools in stores. It flaunts a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Ulta Beauty’s current financial-year earnings and sales suggests growth of 0.9% and 9.5%, respectively, from the year-ago actuals. ULTA delivered a trailing four-quarter average earnings surprise of 15.7%.

Estee Lauder is one of the leading manufacturers and marketers of skin care, makeup, fragrance and hair care products. It has a Zacks Rank of 2 (Buy) at present.

The Zacks Consensus Estimate for Estee Lauder's current fiscal-year earnings and sales suggests growth of 43.7% and 4.6%, respectively, from the year-ago actuals. EL delivered a trailing four-quarter average earnings surprise of 82.6%.

European Wax Center is a personal care franchise brand. It currently carries a Zacks Rank of 2.

The Zacks Consensus Estimate for European Wax Center’s current financial year’s earnings and sales implies growth of 46.7% and a decline of 4.3%, respectively, from the year-ago actuals. EWCZ delivered a trailing four-quarter average earnings surprise of 170.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 6 hours | |

| 12 hours | |

| Feb-22 | |

| Feb-22 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite