|

|

|

|

|||||

|

|

Sanofi SNY announced that a late-stage study, evaluating venglustat, an investigational oral glucosylceramide synthase inhibitor (GCSi), in patients aged 12 years and older with type 3 Gaucher disease (GD3), met all primary and most of its secondary endpoints.

The phase III, double-blind LEAP2MONO study evaluated the safety and efficacy of once-daily oral venglustat versus intravenous enzyme replacement therapy (ERT), the current standard of care, given every two weeks, in 43 patients aged 12 years and older with GD3 who were previously stable on ERT. The primary endpoints were to assess the changes in neurological function using the modified Scale for Assessment and Rating of Ataxia (SARA) and the Repeatable Battery for the Assessment of Neuropsychological Status (RBANS) from baseline to week 52.

The study met both primary endpoints. It demonstrated statistically significant and clinically meaningful improvements in neurological symptoms at 52 weeks compared with patients receiving ERT.

Venglustat performed comparably to ERT on non-neurological outcomes such as spleen and liver volume and hemoglobin levels, which were important secondary endpoints of the study. Other key secondary endpoints included percent change in platelet count and change in cerebrospinal fluid and plasma GL1 and lyso-GL1. Venglustat was well-tolerated with no new safety concerns observed. The study observed certain mild side effects, including headache, nausea, spleen enlargement and diarrhea.

Following the successful phase III data, Sanofi is proceeding with global regulatory filings for venglustat to treat GD3.

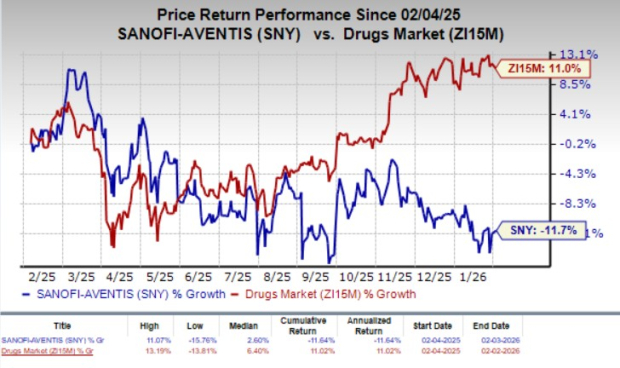

Over the past year, SNY’s shares have declined 11.7% against the industry’s 11% rise.

Gaucher disease is a rare genetic lysosomal disorder caused by a deficiency of the enzyme glucocerebrosidase, which leads to the buildup of glycosphingolipids in cells, especially in macrophages within the spleen, liver, bone marrow, and lungs. At present, there are no approved treatments for GD3.

Sanofi is also evaluating venglustat in two separate late-stage studies (PERIDOT and CARAT) for the treatment of Fabry disease, another rare lysosomal storage disorder. The PERIDOT study showed reductions in neuropathic and abdominal pain, although the primary endpoint was not met, and further analyses are ongoing.

The other phase III study, CARAT, is currently underway to assess the impact of venglustat on left cardiac ventricular mass index in patients with Fabry disease.

Fabry disease is also a rare inherited lysosomal storage disorder caused by a deficiency of alpha-galactosidase A. Sanofi currently markets Fabrazyme, an enzyme replacement therapy for Fabry disease.

SNY’s commercial portfolio for treating Gaucher disease includes two globally marketed drugs, Cerezyme and Cerdelga, which offer enzyme replacement and oral treatment options, respectively.

SNY currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the biotech sector are Assertio Holdings ASRT, Alkermes ALKS and Castle Biosciences CSTL, each currently sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Over the past 60 days, estimates for Assertio’s 2026 loss per share have narrowed from 30 cents to 28 cents. ASRT shares have risen 0.8% over the past year.

Assertio’s earnings beat estimates in one quarter and missed in the remaining three quarters, with the average negative surprise being 35.21%.

Over the past 60 days, estimates for Alkermes’ 2026 earnings per share have increased from $1.54 to $1.91. ALKS shares have risen 13.1% over the past year.

Alkermes’ earnings beat estimates in three of the trailing four quarters and missed in the remaining one, with the average earnings surprise being 4.58%.

Over the past 60 days, estimates for Castle Biosciences’ 2026 loss per share have narrowed from $1.06 to 50 cents. CSTL shares have risen 37.4% over the past year.

Castle Biosciences’ earnings beat estimates in three quarters and missed in the remaining quarter, with the average surprise being 66.11%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 8 hours | |

| 8 hours | |

| 10 hours | |

| 12 hours | |

| 16 hours | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite