|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Southern Copper Corporation SCCO delivered higher year-over-year sales and earnings in the fourth quarter of 2025. Both beat the respective Zacks Consensus Estimate on higher sales volumes and metal prices. For 2025, SCCO delivered record sales, adjusted EBITDA and net income, mainly driven by higher silver, molybdenum and zinc sales volumes and higher prices for these metals and copper. However, copper production for the year declined 1.8% and sales volume dipped 0.1%. SCCO has also guided a 4.7% decline in copper output this year.

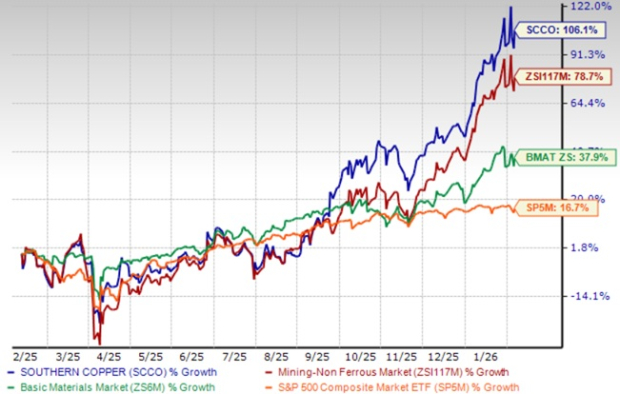

Despite this, the stock’s performance over the past year has been impressive. SCCO shares have surged 106.1%, outperforming the non-ferrous mining industry’s 78.7% growth, the Zacks Basic Materials sector 37.9% rise and the S&P 500’s 16.7% return.

SCCO has also outpaced copper peers like Freeport-McMoRan Inc. FCX, Rio Tinto Group RIO and BHP Group Limited BHP, as shown in the chart below.

Before assessing how investors should position themselves in SCCO stock, let’s take a closer look at the company’s quarterly performance and underlying fundamentals.

The company reported fourth-quarter 2025 earnings of $1.56 per share, marking a solid 59% year-over-year increase. Net sales rose 39% year over year to $3.87 billion on higher sales volumes for copper, silver, zinc and molybdenum, and elevated metal prices.

SCCO posted record net sales of $13.4 billion for 2025. The 17.4% year-over-year increase was mainly attributed to higher sales volumes for molybdenum, zinc, silver and higher prices for copper, molybdenum, zinc and silver. These gains were offset by a 0.1% dip in copper sales volume.

Net of by-product revenue credits were 58 cents in 2025, which were down 33.7% year over year, mainly attributable to a 34-cent increase in by-product revenue credits.

Adjusted EBITDA hit a record high of $7.8 billion (up 22% year over year) and net income was a record $4.3 billion (up 28.4%), driven by higher sales and effective cost-control initiatives. Earnings for the year improved 24% year over year to $5.24 per share.

For 2025, copper production decreased 1.8% to 956,270 tons, which came in 1% lower than the company’s expected 965,000 tons. Lower output at Buenavista and the Peruvian mines, partially offset by a rise in production at IMMSA and La Caridad mines, led to lower output.

Expecting lower ore grades at its Peruvian operations, the company expects copper production at 911,400 tons in 2026, implying a decrease of 4.7% from 2025.

Despite the near-term production headwinds, Southern Copper expects to ramp up its copper production to around 1.6 million tons by 2033. This indicates a 6.6% CAGR over 2025. To support this expansion, the company plans to invest more than $20.5 billion over the next decade, with $10.3 billion earmarked for Peru.

The long-awaited Tia Maria project, located in Arequipa, Peru, with an annual capacity of 120,000 tons of SX- EW copper cathodes, is expected to start in 2027. In Mexico, the El Pilar project (expected to start in 2029) will contribute around 36,000 tons of copper cathodes annually. This project will use highly cost-efficient and environmentally friendly SX-EW technology.

By 2030, El Arco in Mexico is expected to become online and add 190,000 tons of copper. Peru’s Los Chancas project is slated to add 130,000 tons of copper starting in 2031. This will be followed by Michiquillay in 2032, adding an expected 225,000 tons of copper. It is projected to become one of Peru's largest copper mines with an expected mine life of more than 25 years.

SCCO holds the largest copper reserves among listed peers, totaling 51.1 million metric tons, exceeding those of Freeport-McMoRan, BHP and Rio Tinto. Its low-cost, integrated operations and deep pipeline of world-class greenfield projects further strengthen its competitive positioning. The company is well-positioned to capitalize on the expected surge in copper demand in the year to come, backed by the energy transition trend.

Copper futures are up 26% in a year and are at around $5.90 per pound. Copper has gained this year amid expectations of a tightening in global supply amid high demand. The long-term outlook for copper is positive, as copper demand is expected to grow, driven by electric vehicles, and renewable energy and infrastructure investments while supply remains tight.

Silver prices surged 170% in 2025, driven by elevated geopolitical risks, economic uncertainty, resilient demand and tightening inventories. Prices are trending around $80 an ounce. Zinc futures climbed to around $3,330 per ton, up 17% year over year.

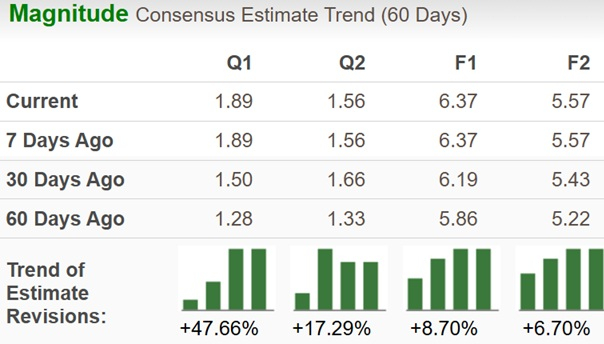

The Zacks Consensus Estimate for Southern Copper’s 2026 earnings is pegged at $6.37 per share, suggesting 21.6% year-over-year growth. The same for 2026, however, indicates a decline of 12.6%.

EPS estimates for both 2025 and 2026 have been revised upward over the past 60 days.

The company’s current dividend yield of 2.00% is higher than the industry’s 1.26% and the S&P 500’s 1.07%.

Southern Copper’s return on equity, a profitability measure of how prudently the company is utilizing its shareholders’ funds, is at 43.05%, higher than the industry average of 12.73%.

Southern Copper is currently trading at a forward price-to-sales multiple of 11.29X, a significant premium to the industry average of 5.13X.

Freeport-McMoRan, Rio Tinto and BHP Group Limited are trading at much lower price-to-sales multiples of 3.16X, 2.01X, and 3.34X, respectively.

Southern Copper’s unmatched reserve base, high-quality assets in investment-grade countries and ambitious capex-driven growth plans make it a compelling long-term play on rising copper demand.

However, the stock’s premium valuation, near-term production declines and expectations of softer earnings beyond 2026 suggest limited upside at current levels. New investors may prefer to wait for a more attractive entry point. Southern Copper currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Anglo American Writes Down De Beers Diamond Unit Value by Another $2.3 Billion

BHP

The Wall Street Journal

|

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite