|

|

|

|

|||||

|

|

Carpenter Technology Corporation CRS reported solid second-quarter fiscal 2026 results, delivering year-over-year increases in its top and bottom lines.

CRS’ shares have surged 92.4% over the past year compared with the industry’s growth of 96.1%. In comparison, the Zacks Basic Materials sector and the S&P 500 have returned 42.8% and 18.2%, respectively.

Let us take a closer look at Carpenter Technology’s fiscal second-quarter results to assess if this is the right time to buy CRS shares.

The company reported revenues of $728 million for the second quarter of fiscal 2026, marking an increase of 7.5% year over year. It posted adjusted earnings of $2.33 per share, higher than $1.66 in the year-ago quarter. The upside was driven by ongoing improvements in the product mix and expanding operating efficiencies. Carpenter Technology posted a record adjusted operating income of $155 million compared with $119 million a year ago.

CRS expects operating income of $680-$700 million for fiscal 2026 compared with the previously guided $660-$700 million. This indicates 31% year-over-year growth at mid-point.

The company is on track to achieve $765-$800 million in operating income by 2027. This indicates a nearly 25% compound annual growth rate compared with the fiscal 2025 figure. The upside can be attributed to higher prices, improved product mix and increased volumes. The company expects expansion beyond fiscal 2027, supported by strengthening market

Dynamics and additional capacity.

The increase in operating income will provide significant cash flow over the next several years, adding value to the company’s stockholders. CRS expects adjusted free cash flow of at least $280 million in fiscal 2026.

The Specialty Alloys Operations segment revenues increased year over year, driven by Aerospace and Defense and Energy end-use markets. The segment reported record operating income in the fiscal second quarter with its operating margin expanding for the 16th consecutive quarter. Carpenter Technology anticipates strong demand and productivity efforts to increase shipment volumes of the Specialty Alloys Operations segment in the third quarter of fiscal 2026.

However, Performance Engineered Products revenues in the quarter were affected by headwinds from Medical and Distribution end-use markets. The metric for the Medical end-use markets moved down 22.3% while revenues in the Distribution markets decreased 14.1%.

Carpenter Technology ended second-quarter fiscal 2026 with cash and cash equivalents of $232 million compared with $315.5 million at the end of fiscal 2025. The long-term debt was $690 million compared with $695 million at the end of fiscal 2025. The company’s net debt/EBITDA ratio is currently 0.6x, which is a historic low.

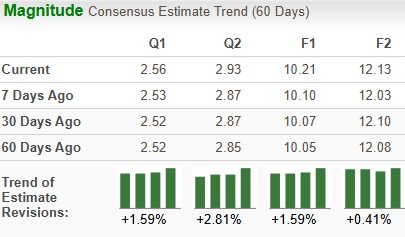

The Zacks Consensus Estimate for fiscal 2026 sales is pegged at $3.07 billion, indicating a 6.6% year-over-year jump. The consensus mark for the year’s earnings is pegged at $10.21 per share, indicating a year-over-year rise of 36.5%.

The Zacks Consensus Estimate for fiscal 2027 sales implies 9.9% year-over-year growth, and the same for earnings suggests a rise of 18.8%.

The Zacks Consensus Estimate for Worthington Steel’s fiscal 2026 earnings is pegged at $2.47 per share, indicating year-over-year growth of 14.3%. The consensus estimate for Metellus’ 2025 earnings is pegged at 58 cents, indicating year-over-year growth of 1.7%.

EPS estimates for CRS' fiscal 2026 have moved 1.6% north over the past 60 days, and the same for fiscal 2027 has moved up 0.4% during the said time frame.

Carpenter Technology is investing in a $400 million brownfield expansion project based in Athens. The project is aimed at adding high-purity primary and secondary melt capacity to the company’s existing downstream finishing assets.

The brownfield capacity expansion project was on schedule and budget as of the second quarter of fiscal 2026. The company is set to ramp up capital expenditures during the second half of fiscal 2026.

Carpenter Technology has been experiencing strong booking growth for the past few quarters. The company expects continued growth across its end-use markets, especially in Aerospace and Defense, which is expected to boost its results. Backed by solid backlog levels, the company's near and long-term outlooks for each end-use market remained positive.

CRS has been witnessing broad-based demand recovery in Aerospace and Defense. Aerospace is gaining from the pickup in global travel. Demand continues to accelerate across all the aerospace submarkets as the supply chain ramps up to meet steadily increasing travel demand.

CRS has a strong liquidity, financial position and focus on reducing debt through a capital allocation approach, which will likely fuel growth.

Carpenter Technology is currently trading at a forward price/sales ratio of 5.59 compared with the industry's 1.99.

Worthington Steel and Metellus are cheaper options, trading at a forward price/sales ratio of 0.65 and 0.68, respectively.

Carpenter Technology has posted strong stock performance, along with improved fiscal second-quarter results, driven by solid demand. It remains well-positioned to gain from the recent brownfield expansion project.

It has a premium valuation, which seems justified, given its strong performance and earnings potential. Considering its upward earnings estimate revisions, now appears to be a favorable time to consider adding the stock to your portfolio. The company’s Zacks Rank #2 (Buy) supports our thesis. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-12 | |

| Feb-11 | |

| Feb-10 | |

| Feb-09 | |

| Feb-09 | |

| Feb-08 | |

| Feb-06 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-04 | |

| Feb-04 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite