|

|

|

|

|||||

|

|

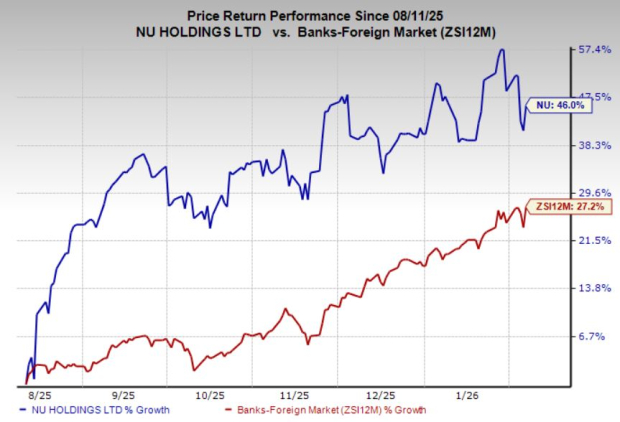

Nu Holdings Ltd. NU has witnessed a 46% rise in its stock price over the six months, outpacing the broader industry’s 27% growth.

This piece examines NU’s recent performance and growth trajectory to determine whether the stock is still attractive after the sharp rise.

Nu Holdings continues to demonstrate why it remains one of the most compelling digital banking platforms globally. The company’s performance in Brazil stands out as a major strength, with a customer base of 110 million and coverage of over 60% of the adult population. Maintaining an activity rate above 85% at this scale is no small achievement; it highlights deep customer engagement rather than superficial user growth. This combination of scale and engagement creates a powerful moat, allowing NU to expand product adoption continuously. The ability to grow while improving efficiency, as reflected in its declining efficiency ratio, reinforces the strength of its core business model.

Beyond Brazil, NU’s accelerating traction in Mexico and Colombia adds an important second growth engine. Mexico has already crossed 13 million customers, while Colombia is approaching 4 million, showing that Nu’s digital-first banking model travels well across geographies. These markets are still in relatively early stages, offering a long runway for customer acquisition and product cross-selling. The consistency in engagement metrics across regions suggests that Nu Holdings is not simply exporting a product but is successfully replicating a scalable platform. This geographic diversification reduces overreliance on a single market and strengthens the company’s long-term growth profile.

Financially, NU’s record revenues and expanding credit portfolio underline the quality of its growth. Rising ARPAC indicates that customers are not only joining the platform but also using it more actively across products. The credit portfolio’s expansion across cards, secured and unsecured lending, shows increasing maturity and diversification, which supports sustainable earnings growth. Importantly, this expansion has been accompanied by healthy asset quality metrics and disciplined risk management. Strong profitability, reflected in rising net income and a record return on equity, demonstrates NU’s ability to balance growth with financial discipline. Looking ahead, management’s vision of becoming an AI-first bank further strengthens the investment case, positioning Nu Holdings to enhance efficiency, personalize customer experiences, and reinforce its competitive edge in digital banking.

Block XYZ remains an important comparison because its ecosystem shows what Nu Holdings could become at scale. Block, through Cash App and Square, maintains a multi-product financial platform that grows wallet share as users adopt more services. The pattern mirrors how Block expanded beyond payments into credit and deposits, reinforcing the link between user engagement and durable revenue.

SoFi Technologies SOFI provides another relevant benchmark as a digital-first institution that strengthened its results by broadening its financial suite. SoFi demonstrated that cross-selling loans, deposits and investment tools can turn a fast-growing user base into a stable revenue engine. SoFi shows how diversified, low-friction product expansion can convert scale into consistent, defensible revenue momentum.

NU also excels in capital efficiency, showcasing strong profitability metrics. Its trailing 12-month return on equity stands at 30.1%, nearly triple the industry average of 11.5%. Likewise, Nu Holdings’ return on invested capital of 14.3% significantly surpasses the sector average of 3.4%, underscoring management’s effectiveness in deploying capital to generate robust shareholder returns.

The Zacks Consensus Estimate for NU’s 2025 earnings is pegged at 60 cents, indicating 33.3% growth from the year-ago level. Earnings for 2026 are expected to increase 44.6% from the prior-year actuals. The company’s sales are expected to rise 35.8% and 30.8% year over year, respectively, in fiscal 2025 and 2026.

Despite the sharp rally over the past six months, Nu Holdings continues to offer an attractive buying opportunity. The company’s ability to scale profitably, deepen customer engagement and replicate its digital banking model across geographies supports confidence in the durability of its growth story. Strong execution in its core market, accelerating international momentum, and disciplined expansion across lending and financial products position NU well for sustained value creation. While near-term volatility cannot be ruled out after a strong run-up, the company’s structural advantages, improving efficiency, and strategic focus on innovation suggest that pullbacks could be used as accumulation opportunities for investors with a long-term horizon.

NU currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 10 hours | |

| 10 hours | |

| 13 hours | |

| 21 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-15 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite