|

|

|

|

|||||

|

|

AeroVironment, Inc. AVAV stock has lost 16.4% in the past three months, underperforming both the Zacks Aerospace-Defense Equipment industry’s growth of 11.1% and the broader Zacks Aerospace sector’s gain of 7%. It also came below the Zacks S&P 500 Composite’s return of 1.7% in the same time frame.

Other industry players, such as Rocket Lab USA, Inc. RKLB and Astronics Corporation ATRO, have delivered a stellar performance in the past three months. Shares of RKLB and ATRO have risen 48% and 62.1%, respectively, in the said period.

With AVAV’s shares declining over the past three months, investors may have mixed views. Some may remain cautious, while others may see the decline as an opportunity. Before deciding whether to buy, hold or sell, it is important to review whether the company’s fundamentals support long-term growth or if near-term challenges are likely to persist. Evaluating AVAV’s growth prospects and risks can help in making a well-informed investment decision.

AeroVironment continues to operate in an environment marked by several industry-specific challenges that could influence execution and financial performance. Persistent labor shortages may limit workforce availability across manufacturing and engineering functions, potentially slowing production rates. This can create bottlenecks in fulfilling defense contracts, increase overtime and training costs, and raise the risk of delivery delays, especially as demand for unmanned systems remains strong.

Supply-chain disruptions remain another meaningful headwind. Difficulty in sourcing specialized components and electronics may lead to longer lead times and higher procurement costs, which can pressure margins and complicate production planning. These constraints can also affect the company’s ability to scale output efficiently. Similar challenges are being faced by industry peers such as Rocket Lab and Astronics, highlighting that labor and supply limitations are broader sector-wide issues rather than company-specific concerns.

AeroVironment is expanding its defense business through new contracts and technology initiatives. In January 2026, the U.S. Air Force awarded UES, an AeroVironment unit, a $75 million task order under the FRESH program. The work focuses on biotechnology and materials science to support defense modernization at Wright-Patterson Air Force Base in Ohio.

The company also increased its presence in advanced airspace operations. Partnering with CAL Analytics, AeroVironment completed the setup and initial operations of a Beyond Visual Line of Sight airspace management facility at the National Advanced Air Mobility Center of Excellence in Ohio. This project reflects AVAV’s progress in autonomous and advanced air mobility, supporting its long-term growth potential.

The Zacks Consensus Estimate for AVAV’s fiscal 2026 sales implies year-over-year growth of 143.4%, while estimates for fiscal 2027 sales indicate an improvement of 17.5%.

The consensus estimate for its fiscal 2026 and 2027 earnings calls for a year-over-year improvement of 5.5% and 34.4%, respectively.

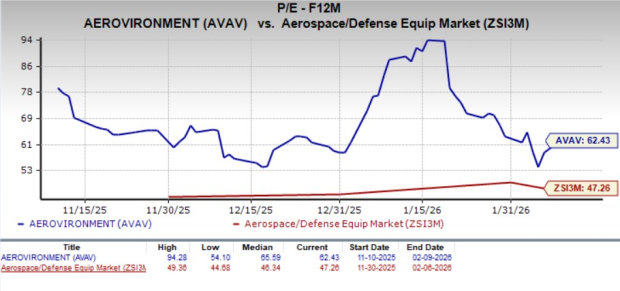

In terms of valuation, AVAV’s forward 12-month price-to-earnings (P/E) is 62.43X, a premium to the industry average of 47.26X. This suggests that investors will be paying a higher price than the company's expected earnings growth compared with its industry average.

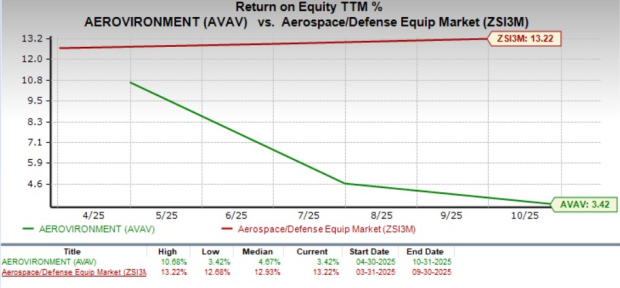

AeroVironment’s return on equity stands at 3.42% compared with the sub industry average of 13.22%. This comparison shows how efficiently the company converts shareholders’ equity into profits relative to its peers. This shows that AVAV is less efficient at converting its equity financing into profits compared with its industry peers.

AVAV has a current ratio of 5.08. The ratio, being more than one, indicates that AVAV possesses sufficient capital to pay off its short-term debt obligations.

Its industry peers, Rocket Lab and Astronics, also maintain current ratios above one. RKLB has a current ratio of 3.18, while ATRO holds 2.87.

Despite AeroVironment’s long-term growth initiatives and strong liquidity position, its near-term fundamentals remain less compelling. The stock has underperformed the broader industry in recent months, while peers have delivered strong gains. At the same time, AVAV trades at a premium valuation compared with the industry, even though its return on equity remains well below the sub industry average. With key operational risks persisting, investors should avoid AeroVironment stock at current levels.

AVAV currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite