|

|

|

|

|||||

|

|

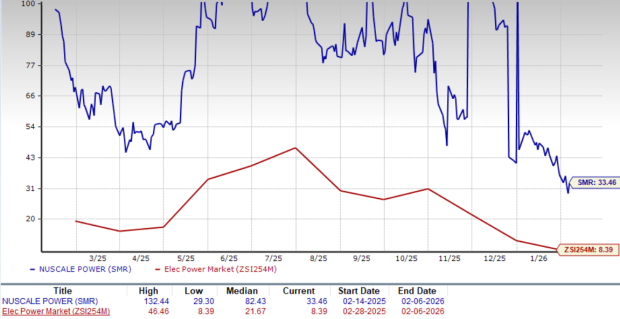

NuScale Power SMR is currently trading at a high price-to-sales (P/S) multiple compared with the Zacks Electronics- Power Generation industry. NuScale Power’s forward 12-month P/S ratio sits at 33.46X, significantly higher than the industry’s forward 12-month P/S ratio of 8.39X. The Zacks Value Score of F also suggests that SMR stock is overvalued.

NuScale Power stock trades at a higher P/S multiple compared with its peers, including BWX Technologies BWXT, Constellation Energy CEG and GE Vernova GEV. At present, BWX Technologies, Constellation Energy and GE Vernova have P/S multiples of 4.89X, 3.48X and 4.66X, respectively.

NuScale Power’s elevated valuation raises concerns about whether the stock can justify such lofty multiples. Considering the premium valuation, investors must be wondering whether they should buy, hold or sell the stock, especially amid near-term challenges.

NuScale Power is moving ahead with its plan to support up to 6 gigawatts (GW) of new nuclear capacity through its partnership with ENTRA1 and the Tennessee Valley Authority (TVA). The program includes about 72 small modular reactor modules across multiple sites, making it the largest planned small modular reactor deployment in the United States. The first plant, which will use 12 modules, is targeted to begin delivering power around 2030.

NuScale Power is entering a critical stage as it works with ENTRA1 and TVA. While the opportunity is large, the company faces several risks that could affect its path to deployment. TVA and ENTRA1 must finalize site selection, complete engineering work and convert the current term sheet into a binding power purchase agreement (PPA). NuScale Power says these discussions are progressing, but no firm contract has been signed yet. The company continues to focus on the combined operating license application process, which is needed before construction can begin.

The company paid $128.5 million to ENTRA1 during the third quarter as part of its milestone agreement. The management stated that total payments across all six TVA projects could reach several billion dollars before NuScale Power receives any equipment orders. This could hurt NuScale Power’s prospects as its revenues are still very small, with $8.2 million reported for the third quarter of 2025. Another key risk is that the TVA agreement is not a binding PPA yet, and delays in signing PPAs could push out orders and revenues. Timelines of projects are long, with the first plant expected around 2030, which shows that meaningful revenues are still years away.

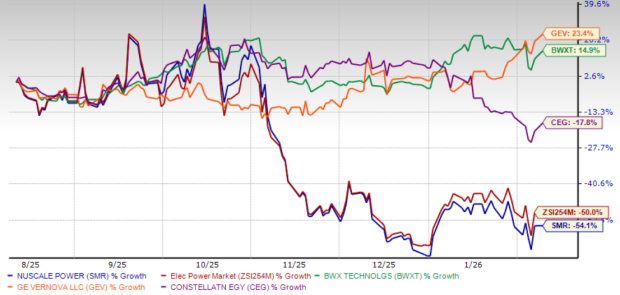

The above-mentioned factors seem to have weighed on investors’ sentiments as reflected in a decline in NuScale Power’s share price over the past six months. NuScale Power stock has plunged 54.1% over the past six months, underperforming the industry’s decline of 50%.

The stock has underperformed its industry peers, including BWX Technologies, Constellation Energy and GE Vernova. Shares of BWX Technologies and GE Vernova have returned 14.9% and 23.4%, respectively, while shares of Constellation Energy have lost 17.8%.

Despite NuScale Power’s advancements in small modular reactor technology, the company faces stiff competition in the nuclear energy industry from companies such as Constellation Energy, BWX Technologies and GE Vernova.

In February 2026, GE Vernova and Xcel Energy signed a long-term strategic partnership to support Xcel’s power generation and grid projects. Under the agreement, GE Vernova will supply gas turbines, wind turbines and grid equipment, helping Xcel secure reliable equipment supply, manage costs, and deliver stable electricity to customers.

In January 2026, Constellation Energy announced that The U.S. Nuclear Regulatory Commission has approved the company’s request to upgrade the control systems at the Limerick Clean Energy Center. The project will cost $167 million and is part of the company’s larger $5.1 billion investment in Pennsylvania. This will help Constellation Energy to keep about 5,100 MW of existing power capacity running and add 1,200 MW more to help keep energy prices stable.

In December 2025, BWX Technologies was selected as part of a consortium to act as Owner’s Engineer for Kozloduy Nuclear Power Plant Units 7 and 8. Here, BWX Technology will oversee design, construction, and safety for the Bulgarian government’s planned Westinghouse AP1000 nuclear reactors to support safe and timely project delivery.

NuScale Power shares have dipped below their 50-day & 200-day moving averages, a bearish technical signal that indicates the potential for continued downward pressure in the short term.

NuScale Power has important technology advantages and major long-term project announcements. Projects’ timeliness and massive upfront investments before receiving equipment orders put a question mark on their growth prospects.

The company faces challenges in the highly competitive energy market, which includes the growing presence of renewable energy sources and regulatory hurdles. NuScale Power’s stretched valuation warrants a cautious approach to the stock.

NuScale Power currently has a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 10 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite