|

|

|

|

|||||

|

|

Earnings estimates for AST SpaceMobile, Inc. ASTS for 2025 and 2026 have moved down 10.3% and 28.6% to a loss of $1.07 and a loss of 90 cents per share, respectively, over the past 90 days. The negative estimate revision depicts bearish sentiments about the stock’s growth potential.

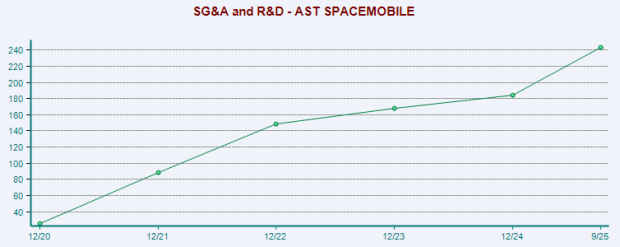

Unfavorable macroeconomic conditions, including rising inflation, higher interest rates, capital market volatility, tariff imposition and geopolitical conflicts, have adversely impacted AST SpaceMobile. These have led to continued fluctuations in satellite material prices, resulting in increased capital costs and pressure on the company’s financial performance. In addition, AST SpaceMobile has to continuously customize its network offerings, enhance the cost-effectiveness of its products and services and boost its satellite data networks to remain ahead of the competition, which results in higher operating costs.

Due to high infrastructure setup costs and research and development expenses for highly sophisticated satellite technology, AST SpaceMobile expects significant expenditures in the coming months for building and launching the next crop of satellites in tune with its expansion plans to serve the full spectrum of U.S. subscribers. This is largely because the company is slated to deploy about 45-60 satellites in orbit by the end of 2026.

The company faces severe competition from existing and new industry leaders like SpaceX’s Starlink and Globalstar. To combat such competitive pressure, ASTS has to continuously upgrade its service offerings, leading to high costs and difficulties for developing, building and launching a satellite network.

In addition, AST SpaceMobile continues to acquire a large number of companies. While this improves revenue opportunities, it adds to integration risks. These include adverse legal, organizational and financial challenges, loss of key customers and distributors, and increased demands on management’s time.

Despite the recent blip, AST SpaceMobile has completed the unfolding of BlueBird 6, the first of its next-generation satellites. Featuring the largest commercial phased array in low Earth orbit (LEO) at nearly 2,400 square feet, the satellite marks a 3.5x increase in size over its predecessors (BlueBird 1-5) with 10x data capacity. The company is slated to launch BlueBird 7 in late February. This is likely to strengthen its position as one of the leading space-based cellular broadband service providers in the market.

Utilizing large phased array antennas, AST SpaceMobile's technology is backed by more than 3,800 patents and patent-pending claims. This design aims to deliver worldwide cellular coverage by eradicating dead zones and providing space-based connectivity to areas that lack broadband service. By connecting directly to standard smartphones at broadband speeds, these advanced phased arrays eliminate the need for special equipment, enhancing current mobile networks while ensuring seamless use of existing mobile phones.

AST SpaceMobile has surged 248.6% over the past year compared with the industry’s growth of 39.3%. It has also outperformed its peers like Aviat Networks, Inc. AVNW and Comtech Telecommunications Corp. CMTL over this period. While Aviat has gained 17.2%, Comtech is up 170.2% over the same period.

One-Year ASTS Stock Price Performance

The successful launch of the Bluebird satellites will likely transform network connectivity and help bridge the digital divide, significantly expanding its global presence and enhancing AST SpaceMobile’s capabilities in providing ubiquitous connectivity.

However, the downtrend in estimate revisions portrays skepticism about the business model. Stiff competitive pressure and an uncertain geopolitical environment are headwinds for the company. High operating expenses remain an overhang as well. Consequently, it might be a prudent investment decision to avoid the stock at the moment.

AST SpaceMobile carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 5 hours | |

| 8 hours | |

| 12 hours | |

| Mar-03 | |

| Mar-03 | |

| Mar-03 |

Stocks to Watch Tuesday Recap: Target, Best Buy, Pinterest, MongoDB

ASTS +14.21% ASTS +6.63%

The Wall Street Journal

|

| Mar-03 | |

| Mar-03 | |

| Mar-03 | |

| Mar-03 | |

| Mar-03 | |

| Mar-03 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite