|

|

|

|

|||||

|

|

MongoDB MDB and Datadog DDOG are established cloud software providers positioned at the core of modern enterprise technology infrastructure. MongoDB offers a flexible, developer-focused database platform that powers operational and AI-driven applications, while Datadog delivers observability and monitoring solutions that help enterprises manage performance and security across complex cloud environments. Both operate consumption-based models, where revenues expand alongside customer cloud workloads and broader infrastructure spending.

Per Mordor Intelligence, the global cloud infrastructure services market is projected to expand from $254.59 billion in 2026 to $545.03 billion by 2031, at a CAGR of 16.45%. This acceleration is driven by cloud migration, multi-cloud adoption, AI workloads and rising data intensity. As enterprises scale cloud-native applications, demand for scalable databases and real-time observability platforms increases proportionately, positioning both companies to benefit from these structural tailwinds.

Let's delve deep to determine which one is a better investment now.

MongoDB's prospects are being strengthened by continuous platform innovation and expanding adoption among enterprises building modern cloud-native applications. The company's Atlas offering, a fully managed cloud database service, has emerged as the primary growth driver, representing 75% of total revenues in the fiscal third quarter. The shift toward Atlas reflects a broader industry trend where enterprises favor consumption-based models that scale costs with actual workload utilization, creating inherent alignment between infrastructure spending and business outcomes.

The platform's architectural foundation provides distinctive advantages for enterprises managing increasingly complex data requirements. MongoDB's document-oriented model handles unstructured and semi-structured data naturally, addressing limitations inherent in traditional relational databases that require predefined schemas. This flexibility has become particularly valuable as enterprises deploy artificial intelligence applications requiring dynamic data structures and real-time operational context. The integration of vector search capabilities alongside transactional database functionality enables retrieval-augmented generation workloads within a unified platform. The acquisition of Voyage AI in early 2025 has added advanced embedding models that improve search accuracy, further strengthening MongoDB's positioning as the operational data layer for intelligent applications.

MongoDB's enterprise penetration continues to deepen across large enterprises while simultaneously capturing emerging technology companies through efficient self-service channels. The platform serves over 70% of the Fortune 100, with a customer base exceeding 62,500, reflecting strong net additions driven primarily by self-service adoption, demonstrating product-market fit across diverse market segments.

The Zacks Consensus Estimate for MDB's fiscal 2027 EPS is pegged at $5.61, up by 4 cents over the past 30 days, suggesting year-over-year growth of 17.23%.

MongoDB, Inc. price-consensus-chart | MongoDB, Inc. Quote

Datadog's business model focuses on providing observability across enterprise technology stacks by consolidating infrastructure monitoring, application performance management and log analytics into a single platform. The company serves over 32,700 customers with over 1,000 integrations that connect to various cloud services and applications. However, growing market commoditization and limited differentiation in AI workloads present challenges that distinguish it from platforms positioned to benefit from artificial intelligence adoption.

The observability market is becoming increasingly commoditized as major cloud providers bundle monitoring capabilities directly into their infrastructure offerings. This trend reduces the incentive for enterprises to purchase third-party monitoring tools when comparable functionality comes included with existing cloud subscriptions. Datadog faces ongoing pressure to justify its value proposition against free or low-cost alternatives that hyperscalers provide natively, requiring sustained sales and marketing investment to maintain competitive positioning.

The platform's positioning for AI workloads remains limited compared to operational database providers. Datadog's AI features, like Bits AI, enhance existing monitoring processes rather than enabling fundamentally new application types. Unlike MongoDB, which serves as the data foundation for AI applications and benefits directly from AI adoption, Datadog monitors infrastructure that already exists. This creates a more mature market where growth comes from replacing existing tools rather than capturing new AI-driven workloads, limiting exposure to the fastest-growing opportunities in enterprise software.

The Zacks Consensus Estimate for DDOG's 2027 EPS is pegged at $2.74, up by 4 cents over the past 30 days, suggesting year-over-year growth of 20.93%.

Datadog, Inc. price-consensus-chart | Datadog, Inc. Quote

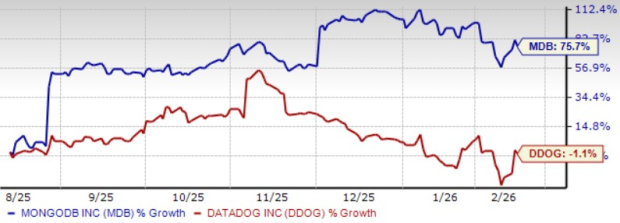

Over the past six months, MongoDB's shares have jumped 75.7%, outperforming Datadog, shares of which have declined 1.1%. MongoDB's stronger performance reflects market recognition of accelerating Atlas growth and expanding AI workload positioning. Datadog's weaker performance has been influenced by concerns around observability market commoditization and competitive pressures from cloud providers offering integrated monitoring capabilities.

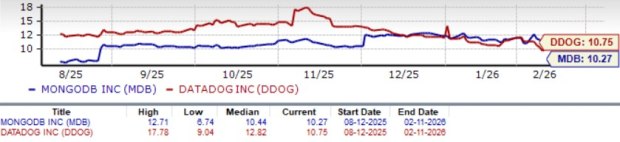

MongoDB trades at 10.27x forward 12-month price-to-sales compared to Datadog's 10.75x, creating an opportunity to acquire the faster-growing platform at a relative discount. MongoDB's lower valuation appears unjustified given its accelerating Atlas growth and expanding role as the operational database layer for AI applications. DDOG's valuation premium is difficult to defend given the observability market commoditization and limited AI differentiation. The pricing suggests that Datadog's mature market growth potential is already reflected.

MongoDB's accelerating Atlas growth and structural positioning as the operational database layer for AI applications position it favorably against Datadog's commoditizing observability market. MDB's document-oriented architecture addresses fundamental requirements of intelligent applications that traditional monitoring tools cannot fulfill. This creates expanding addressable market opportunities as AI adoption intensifies across enterprises. MDB shares have outperformed DDOG shares over the trailing six-month period. MongoDB, carrying a Zacks Rank #1 (Strong Buy), represents the superior investment choice over Datadog, which holds a Zacks Rank #4 (Sell). Investors seeking exposure to high-growth cloud software with meaningful AI upside can consider buying MongoDB at current levels.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite