|

|

|

|

|||||

|

|

With significant footprints in credit card issuance and consumer lending, Capital One COF and Synchrony Financial SYF are both key players in the consumer finance space. Both companies are deeply influenced by consumer credit trends and interest rate environments as they generate most of their revenue from interest income, fees and lending activity tied to consumer spending.

While this shared focus on consumer credit creates a natural area of overlap in their business models and puts them in competition with each other, their strategic approaches diverge markedly.

COF functions more like a diversified financial institution offering a wide range of banking services and credit cards, while SYF is more niche-focused, concentrating on private-label and co-branded cards primarily through deep retailer partnerships and point-of-sale financing solutions.

Now, the question arises, which among the two firms is better positioned for long-term growth. Let us dig deep into the fundamentals of the two companies to understand which credit card firm, Capital One or Synchrony, is a better choice for investors now.

COF’s key strength lies in its data-driven, digital-first business model, which enables efficient customer acquisition, disciplined underwriting and scalable growth in its credit card franchise. In a strategic move to enhance its market position, Capital One acquired Discover Financial Services in May 2025 in a $35.3-billion all-stock deal. This deal made COF the largest U.S. credit card issuer by balances and significantly expanded its payment network capabilities.

The deal gave Capital One control of Discover Financial’s payments network — one of only four in the United States — generating greater revenues from interchange fees and offering strategic independence from Visa and Mastercard.

Over the years, COF has pursued an inorganic growth strategy to diversify its offerings and expand its market presence. In January 2026, it announced a deal to acquire Brex for $5.15 billion, which is expected to be closed in the middle of 2026. Some of the other notable buyouts of COF are ING Direct USA, HSBC's U.S. Credit Card Portfolio and TripleTree. These acquisitions have been instrumental in transforming Capital One from a monoline credit card issuer into a diversified financial services firm with a significant presence in retail banking, commercial lending and digital banking platforms.

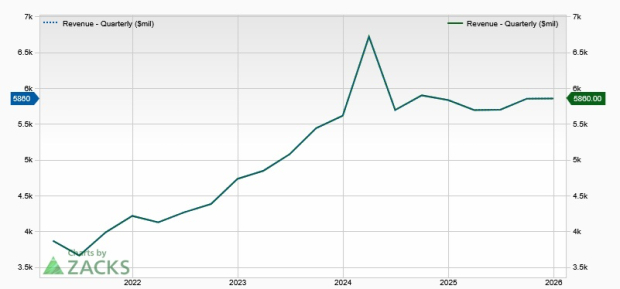

Though the company’s revenues declined marginally in 2020, the metric witnessed a five-year (2020-2025) compound annual growth rate (CAGR) of 13.4%. Revenue prospects look encouraging, given the company’s solid credit card and online banking businesses, Discover Financial's buyout and decent loan demand.

Despite the three interest-rate cuts in 2025, Capital One’s net interest income (NII) and net interest margin (NIM) are expected to keep benefiting from robust demand for credit card loans. The company’s NII witnessed a CAGR of 13.4% over the five years ended 2025. Also, NIM expanded to 7.84% in 2025 from 6.88% in 2024 and 6.63% in 2023. Thus, solid demand for credit card loans and Capital One’s efforts to scale its business are expected to continue to drive NII and NIM.

Further, COF, which primarily serves customers in the United States, Canada and the U.K., boasts a solid balance sheet position. As of Dec. 31, 2025, it had total debt (securitized debt obligations plus other debt) worth $51 billion, and total cash and cash equivalents of $57.4 billion.

Though the company slashed its quarterly dividend 75% in 2020 based on the Federal Reserve’s requirements, it restored it to 40 cents per share in the first quarter of 2021. In July 2021, the company hiked the same by 50% to 60 cents per share and raised its quarterly dividend 33.3% in November 2025 to 80 cents.

Capital One also has a share repurchase plan in place. In October 2025, its board of directors authorized the repurchase of up to $16 billion of shares, which began on Oct. 21. Given its earnings strength and solid liquidity position, the company is expected to keep enhancing shareholder value through efficient capital distributions.

SYF stands out by leveraging its strong distribution channel to offer a broad range of products, including private-label credit cards and dual cards for use on MasterCard and Visa networks. It has the potential to issue dual cards for use on the American Express and Discover networks, contributing to a more profitable and resilient business model.

The company has been driving growth through targeted acquisitions and partnerships that enhance digital capabilities and diversify offerings. In 2024, it acquired Ally Financial’s point-of-sale financing business, Ally Lending.

The Allegro Credit acquisition expanded its presence in audiology and dental financing, while partnerships with PayPal, Venmo, LG Electronics, Mastercard and others modernized payment experiences. Expansions with Ashley, American Eagle Outfitters and an alliance with Adobe Commerce further strengthened its ecosystem and e-commerce reach. It partnered with OnePay to power a credit card program at Walmart, offering a smarter, embedded credit experience for U.S. shoppers.

Driven by its partnerships and strategic organic and inorganic efforts, SYF’s revenues witnessed a five-year (ended 2025) CAGR of 5.1%.

Syncrony Financial has a solid balance sheet. As of Dec. 31, 2025, it had $15 billion in cash and cash equivalents. Total borrowings were $15.2 billion. Given its earnings strength and solid liquidity position, the company’s enhanced capital distribution plans look sustainable.

In the fourth quarter of 2025, the company returned capital worth $952 million through share buybacks and paid out common stock dividends of $106 million. As of Dec. 31, 2025, it had a leftover capacity of $1.2 billion under its share buyback authorization for the period ending June 30, 2026.

The Zacks Consensus Estimate for COF’s 2026 and 2027 revenues implies year-over-year growth of 18.3% and 4.6%, respectively.

The consensus estimate for earnings for 2026 indicates a 3.1% year-over-year rise, while the 2027 estimate suggests a rally of 22.7%. Earnings estimates for both years have been revised upward over the past 30 days.

Analysts seem slightly less bullish on Synchrony Financial’s revenue prospects. The consensus mark for the company’s 2026 and 2027 revenues indicates year-over-year rallies of 4.2% and 4.8%, respectively.

The consensus estimate for 2026 earnings suggests a 1.4% year-over-year decline, while the earnings estimate for 2027 indicates a rise of 9.7%. Estimates for both years have been revised lower over the past 30 days.

In the past year, COF shares have gained 8.7% and the SYF stock has rallied 13.8%, both underperforming the S&P 500 Index’s 15.9% rise.

Valuation-wise, COF is currently trading at a 12-month forward price-to-earnings (P/E) of 10.33X, higher than its five-year median of 9.06X. The SYF stock is currently trading at a 12-month forward P/E of 7.76X, which is slightly higher than its five-year median of 7.45X.

While Capital One is trading at a premium compared with Synchrony Financial, its valuation seems justified, given its superior growth trajectory.

Synchrony Financial has a robust liquidity position and a strong distribution channel, alongside a diverse revenue stream. Its targeted model often yields stronger profitability metrics and operational efficiency, as it operates a leaner structure, and focuses on specialized products and relationships. However, elevated expenses are expected to hurt the company’s profitability to some extent. Also, in the current volatile environment, the company’s allowance for loan losses is expected to remain elevated, impacting the bottom line.

In contrast, Capital One’s strategic partnerships, along with higher credit card demand, are likely to continue to support growth. Its broader diversification and scale can translate into higher absolute revenue but sometimes at the cost of tighter profitability margins and higher operational complexity.

Currently, both Capital One and Synchrony Financial are taking proactive steps to navigate the tough macroeconomic backdrop amid changing interest rates. The push for a temporary cap on credit card interest rates at 10% APR (aimed at addressing high borrowing costs), if implemented, will negatively impact both firms by reducing their interest income.

Thus, while it does not seem a wise idea to immediately invest in the stocks, those who already own COF and SYF stocks in their portfolios should hold on to them for long-term gains.

Capital One is often viewed as the option with broader banking utilities and growth potential, while SYF is viewed as more focused, partnership-driven and potentially more efficient in its niche. Currently, Capital One and Synchrony Financial both carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-10 | |

| Feb-09 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite