|

|

|

|

|||||

|

|

DexCom, Inc. DXCM reported fourth-quarter 2025 adjusted earnings per share (EPS) of 68 cents, which beat the Zacks Consensus Estimate of 65 cents by 4.6%. The company reported adjusted earnings of 45 cents per share in the prior-year quarter.

Full-year adjusted EPS was $2.09, up 27.4% from the comparable 2024 period.

DXCM registered GAAP net income per share of 68 cents, up from the year-ago quarter’s figure of 38 cents.

Full-year GAAP net income per share was $2.09, up 47.2% from the comparable 2024 period.

Total revenues grew 13% (12% on an organic basis) year over year to $1.26 billion. Revenues beat the Zacks Consensus Estimate by 0.6%. The year-over-year revenue growth was driven by strong new customer demand and improving sell-through trends. Robust international momentum in Germany, the United Kingdom and France on the back of expanded type 2 access accelerated adoption and market share gains, and also boosted sales growth.

Full-year 2025 revenues grew 16% (15% on an organic basis) to $4.66 billion.

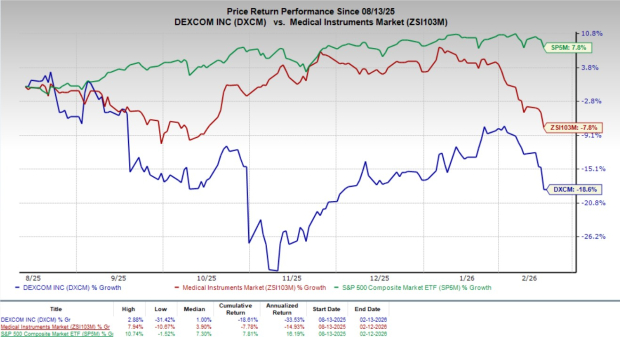

Following the earnings release, shares of DXCM lost almost 1.1% during after-hours trading yesterday. The stock has lost 18.6% in the past six months compared with a 7.8% decline in the industry. The broader S&P 500 Index increased 7.8% in the same period.

U.S. revenues (70.8% of total revenues) increased 11% on a year-over-year basis to $891.5 million. International revenues (29.2%) improved 18% (15% on an organic basis) year over year to $368.1 million.

Adjusted gross profit totaled $799.8 million, up 20.9% from the prior-year quarter’s level. DexCom reported an adjusted gross margin (as a percentage of revenues) of 63.5%, up 410 basis points year over year.

Research and development expenses totaled $148.2 million, up 6.2% year over year. Selling, general, and administrative expenses totaled $321.5 million, down 1.8% year over year.

The company reported total adjusted operating income of $331.5 million, up 58.2% from the prior-year period’s recorded number. Adjusted operating margin (as a percentage of revenues) was 26.3%, up 750 basis points year over year.

DexCom, Inc. price-consensus-eps-surprise-chart | DexCom, Inc. Quote

DXCM exited the fourth quarter with cash, cash equivalents and marketable securities worth $2 billion compared with $3.32 billion in the third quarter of 2025.

Total assets amounted to $6.34 billion, up sequentially from $7.5 billion.

DexCom reiterates its outlook for 2026 revenues. The company expects revenues to be in the range of $5.16-$5.25 billion, implying 11-13% year-over-year growth. The Zacks Consensus Estimate is pegged at $5.22 billion.

DXCM expects adjusted gross margin to be approximately 63-64%. Adjusted operating margin is projected to be approximately 22-23%.

DexCom delivered a solid fourth-quarter performance, marking a strong operational reset and reinforcing management’s view of the company as the premier glucose sensing solution globally. The broad launch of the G7 15 Day system and expansion in international market share are key highlights.

Growth in U.S. revenues was supported by a growing installed base and expanding access among type 2 non-insulin users through commercial PBM channels. 12 million Medicare beneficiaries could gain access to CGM if the CMS finalizes coverage for type 2 non-insulin patients. International revenues rose, benefiting from a recent type 2 basal reimbursement win in France, positioning international markets as a long-term growth engine beyond the United States.

The nationwide rollout of the G7 15-Day system is gaining traction through improvements in accuracy, reliability and wear duration. The extended-wear platform serves as the core technology across the company’s portfolio, including the Stelo and future product generations.

Exiting 2025, the core patient base grew over 20%, supporting potential mid-teens growth in underlying volume. Retention and utilization trends remain stable, with AID users demonstrating utilization rates above 90% and basal and non-intensive type 2 users in the 80-85% range.

Meanwhile, Smart Basal is expected to accelerate patient onboarding as it simplifies basal insulin titration and enhances digital tools, delivering a high-quality experience. Direct EHR integrations are now live or are being implemented across more than 160 health systems. Stelo’s smart food logging feature with macronutrient tracking aims to engage type 2 non-insulin users in the OTC channel and transition them to reimbursed G7 systems. A newly approved adhesive patch technology is expected to improve sensor longevity across G7 15 Day, DexCom ONE+ and Stelo.

For 2026, the company expects gross margin to expand by 200-300 bps, supported by lower logistics costs, manufacturing efficiencies and increasing adoption of the G7 15-day platform. Operating margins are anticipated to expand despite incremental investments in hiring, innovations and the late-year launch of its Ireland manufacturing facility.

The company is preparing for potential Medicare coverage of type 2 non-insulin users and plans to provide longer-term strategic detail at its May 2026 Investor Day.

DXCM currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Intuitive Surgical ISRG, AngioDynamics ANGO and Masimo MASI.

Intuitive Surgical, sporting a Zacks Rank #1 (Strong Buy) at present, has an estimated long-term growth rate of 15.7%. ISRG’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 13.2%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Intuitive Surgical’s shares have remained flat against the industry’s 3.6% decline in the past six months.

AngioDynamics, sporting a Zacks Rank #1 at present, has an estimated earnings growth rate of 59.3% for 2026. ANGO’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 82.1%.

AngioDynamics’s shares have gained 24.8% against the industry’s 3.5% decline in the past six months.

Masimo, carrying a Zacks Rank of 2 (Buy) at present, has an estimated long-term growth rate of 17.1%. MASI’s earnings surpassed estimates in three of the trailing four quarters and missed once, with the average surprise being 12.4%.

Masimo’s shares have lost 11.4% compared with the industry’s 3.5% decline in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 54 min | |

| 1 hour | |

| 1 hour | |

| 4 hours | |

| 9 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Stock Market Today: Dow, Nasdaq Eke Out Gains; Gold, Silver Names Slide (Live Coverage)

MASI +34.22%

Investor's Business Daily

|

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Stock Market Today: Nasdaq, Dow Climb; Airline Name Flies Higher (Live Coverage)

MASI +34.22%

Investor's Business Daily

|

| Feb-17 | |

| Feb-17 |

Stock Market Today: Dow Weakens As Nasdaq Lags; Biotech Name Hits Record (Live Coverage)

MASI +34.22%

Investor's Business Daily

|

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite