|

|

|

|

|||||

|

|

Federated Hermes, Inc. FHI shares touched a new all-time high of $56.68 during yesterday’s trading session before closing the session slightly lower at $54.88. The rally reflects strong investor confidence driven by continued growth in assets under management (AUM), strength in money market assets and robust strategic positioning.

Over the last six months, FHI stock has risen 5.7% against the industry’s decline of 12.9%. Further, the company has also outperformed its close peers like Ares Management Corporation ARES and T. Rowe Price Group TROW during the same period.

Despite strong rally, investors are now evaluating whether FHI still has upside potential or if patience could provide a better entry point. Let us explore the key growth drivers and risks to answer this.

Strategic Business Expansion: Federated Hermes has been steadily accelerating growth through a series of strategic acquisitions aimed at expanding its capabilities, diversifying revenue streams and strengthening its global footprint. In October 2025, it agreed to acquire an 80% stake in FCP Fund Manager, L.P., a U.S. real estate investment manager. The deal will expand FHI’s private markets and alternatives capabilities in the United States, complementing its U.K. real estate operations and strengthening FCP’s platform for future growth.

Earlier in 2022, the company acquired C.W. Henderson & Associates, Inc., enhancing its separately managed accounts (SMA) business and further supporting product diversification. In 2021, FHI acquired investment management-related assets from Horizon Advisers and purchased the remaining 29.5% stake in Hermes Fund Managers Limited from the BT Pension Scheme, consolidating its international investment operations and reinforcing its AUM growth strategy. Together, these acquisitions position FHI to broaden its investment offerings, deepen client relationships and drive sustainable growth across its global markets.

Strategic Acquisition to Drive AUM Growth: The company has been expanding its assets under management by strengthening its presence in key markets through targeted acquisitions and strategic alliances. The 2022 buyout of C.W. Henderson & Associates, Inc. expanded its SMA business, while the company continues to pursue partnerships and deals to grow globally.

Over the past five years (ended 2025), the company’s AUM has grown at a compound annual growth rate (CAGR) of 7.8%, driven by record money market assets and increased equity holdings. By December 2025, its total AUM reached a record $902.6 billion, reflecting both organic and inorganic growth initiatives. Through these focused expansion efforts, Federated Hermes aims to broaden its client base, deepen product offerings and reinforce its position as a leading global asset manager.

Strength in the Money Market Sector: FHI has maintained a strong position in the money market space. Its money market assets grew at a five-year CAGR of 10.2% through 2025, reflecting sustained expansion. The money market AUM enables the company to offer a broader range of fund options to clients. Looking ahead, management expects favorable market conditions for money market strategies, with fund yields continuing to provide an attractive alternative to direct market instruments and bank deposit rates.

Robust Balance Sheet to Support Stability: The company maintains a strong financial position, with long-term debt of $348.4 million and cash and other investments totaling $724.3 million as of Dec. 31, 2025. With healthy liquidity and manageable debt levels, the company is well-positioned to meet interest and debt obligations, reducing the risk of financial stress even in a challenging economic environment.

Sustainable Capital Distribution Activities: The company continues to reward shareholders while maintaining a strong balance sheet. In July 2025, the company approved its 18th repurchase program for an additional 5 million shares, bringing the total authorization to 15 million shares. As of Dec. 31, 2025, approximately 6.1 million shares remained available under these programs.

Alongside share buybacks, FHI has consistently paid dividends since its 1998 IPO. In April 2025, it raised its quarterly dividend by 9.7% to 34 cents per share. Over the last five years, it increased its dividends four times while having a payout ratio of 27%. The company currently offers a dividend yield of 2.4%. Notably, the dividend yield of its peers, Ares Management and T. Rowe Price are 3.4% and 5.4%, respectively,

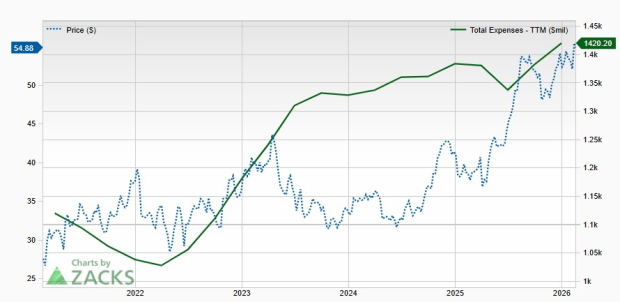

Rising Operating Expenses: Operating expenses remain a concern for Federated Hermes. Although the metric declined in 2021, it recorded a five-year (ended 2025) CAGR of 4.5%, driven primarily by intangible asset-related costs. Any expected increase in distribution expenses and new hires could further elevate the company’s cost base.

Revenue Concentration Risk: The company’s investment advisory fees account for a significant portion of FHI’s total revenues, comprising 65% as of Dec. 31, 2025. The significant fluctuations in the fair value of securities held, or higher redemptions from the funds and products advised by the company, could materially impact managed assets. This concentration may weigh on the company’s revenues and profitability if market conditions become unfavorable.

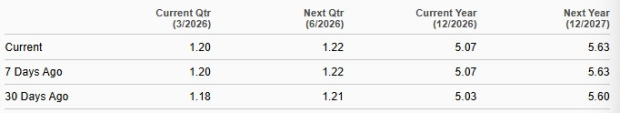

The Zacks Consensus Estimate for FHI’s 2026 and 2027 earnings indicates a 1.8% and 10.9% rise, respectively. Over the past month, the earnings estimates for 2026 and 2027 have been revised upward.

In terms of valuation, FHI stock appears inexpensive relative to the industry. The company is currently trading at a 12-month trailing price-to-earnings P/E ratio of 10.66X, lower than the industry’s 13.96X.

Price-to-Earnings F12M

Meanwhile, Ares Management trades at a P/E ratio of 19.38X, while T. Rowe Price’s P/E ratio stands at 9.29X.

The company’s strong rally highlights investor confidence in the company’s strategic growth initiatives and robust financial position. Its continued expansion through targeted acquisitions, strength in money market assets and record AUM underscore its ability to deepen client relationships and diversify revenue streams. The company’s solid balance sheet and disciplined capital distribution through dividends and share repurchases further enhance shareholder value.

Though Federated Hermes’ rising operating expenses and revenue concentration in investment advisory fees pose risks, the company’s ongoing strategic execution, favorable market positioning and attractive valuation support its long-term growth potential. Hence, investors can consider keeping FHI stock on their radar and wait for a better entry point for long-term portfolio growth.

The company currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 hours | |

| 7 hours | |

| 7 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite