|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Palo Alto Networks PANW and Cisco Systems CSCO are well-known players in the cybersecurity domain. While PANW focuses broadly on next-generation firewalls, cloud security and AI-driven threat detection, Cisco Systems is growing its presence based on Threat Intelligence, Detection, and Response offerings, which include the offerings from Splunk, as well as growth in Secure Access Service Edge (SASE) and Network Security offerings.

Palo Alto Networks and Cisco Systems are capitalizing on the rapid improvement of the cybersecurity space, fueled by the rise of complex attacks, including credential theft and abuse, remote desktop protocol attacks and social engineering-based initial access. Per a Mordor Intelligence report, the cybersecurity market is projected to witness a CAGR of 12.28% from 2026 to 2031.

With this strong industry growth forecast, the question remains: Which stock has more upside potential? Let’s break down their fundamentals, growth prospects, market challenges and valuation to determine which offers a more compelling investment case.

Palo Alto Networks remains a cybersecurity leader, offering solutions for network security, cloud security and endpoint solutions for customers who need full enterprise security support. Its next-generation firewalls and advanced threat detection technologies are widely recognized and adopted globally.

Palo Alto Networks’ wide range of innovative products, strong customer base and growing opportunities in areas like Zero Trust, Secure Access Service Edge (SASE) and private 5G security continue to support its long-term growth potential. For example, in the second quarter of fiscal 2026, SASE was Palo Alto Networks’ fastest-growing segment, with SASE Annual recurring revenues (ARR) increasing 40% year over year. Growth is mainly coming from customers who want to reduce the number of security tools they use.

Many organizations are moving away from older SASE products that do not provide a full view of their networks, cloud workloads and remote users. A notable example during the second quarter includes a global automotive leader selecting PANW for a major security transformation. The deal was worth over $50 million, including about $30 million for SASE and $20 million for XSIAM to run the company’s global security operations center.

PANW's near-term prospects are expected to be weighed down due to integration and acquisition-related costs. PANW recently completed two major acquisitions, which include its $25 billion CyberArk deal and $3.35 billion Chronosphere acquisition. As a result, PANW is incurring significant integration-related costs, including onboarding employees, aligning go-to-market teams, and integrating systems and operations. Acquisition related cost in the second quarter amounted to $24 million, a whopping increase from $5 million incurred in the prior quarter. These costs are expected to hurt the company's profitability before the benefits of synergies from acquisitions are fully realized.

Equity dilution effect is expected to significantly hurt PANW’s bottom line. In the second quarter of fiscal 2026, PANW issued 112 million shares as part of the CyberArk deal. This is expected to result in significant equity dilution effect, hurting the company’s bottom-line results. Management expects fiscal 2026 earnings per share (EPS) to be in the range of $3.65-$3.70, down from its prior guidance of $3.80-$3.90 per share.

Cisco Systems is making steady progress in its security business. The company has added several new security products, such as Secure Access, XDR, Hypershield, AI Defense and refreshed firewalls. These newer products are seeing good customer adoption, which now represents about one-third of its security portfolio. Excluding firewalls, more than 1,000 new customers adopted these products in the second quarter of fiscal 2026, marking more than 100% sequential growth in new customer additions.

Cisco booked more than 2.5 million Secure Access users in the second quarter, where new customer logos contributed to more than half of the new bookings. Management noted that Secure Access is benefiting from rising use of cloud applications, AI tools and agentic workflows at the network edge, which are increasing demand for secure, identity-based access across distributed environments.

On the firewall side, Cisco reported three consecutive quarters of double-digit unit growth, supported by the recent launch of Cisco's new high-end firewall platforms. Here, the management expects the demand to remain strong as customers continue to modernize security infrastructure. Cisco is also embedding AI deeper into its security stack. Enhancements to AI Defense allow customers to scan AI models and repositories for vulnerabilities and create an AI bill of materials for governance. Within SASE, Cisco introduced a semantic inspection engine that evaluates the intent of agentic interactions to help block more advanced threats.

Overall, Cisco Systems is expanding its security capabilities with new products, stronger Splunk performance and more focus on AI-driven security needs. The above-mentioned factors demonstrate the company’s efforts to support stronger security performance as customer adoption continues to scale and strengthen its position in the security market.

The earnings estimate revision trend for the two companies reflects that analysts are turning more bullish toward Cisco Systems.

The Zacks Consensus Estimate for PANW’s fiscal 2026 and 2027 EPS is pegged at $3.84 and $4.32, respectively. The estimates for fiscal 2026 and 2027 have both remained unchanged over the past 60 days.

The Zacks Consensus Estimate for Cisco Systems’ fiscal 2026 and 2027 EPS is pinned at $4.13 and $4.46, respectively. The estimates for fiscal 2026 and 2027 have both been revised upward by 2 cents and 5 cents, respectively, over the past seven days.

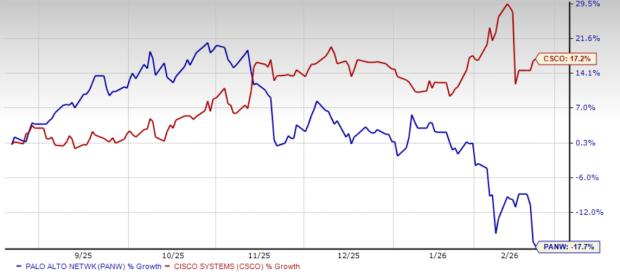

In the past six months, Cisco Systems shares have risen 17.2%, while shares of Palo Alto Networks have lost 17.7%.

Currently, Cisco Systems is trading at a forward sales multiple of 4.95X, lower than Palo Alto Networks’ forward sales multiple of 9.31X. Cisco Systems’ reasonable valuation makes it more attractive for investors looking for value and stability.

Both Palo Alto Networks and Cisco Systems are key players in the cybersecurity space, but their near-term outlooks are quite different. Palo Alto Networks faces near-term risks from rising integration costs due to large acquisitions, share dilution is meaningful, and downward revision of EPS guidance for fiscal 2026. These could hurt PANW’s prospects in the near term.

Cisco Systems shows steadier execution, where the company is witnessing strong adoption of its security product and its earnings estimates are being revised upward. Cisco Systems’ reasonable valuation offers some downside protection as well, making the stock an attractive buy, particularly for investors seeking exposure to cybersecurity growth at a fair price.

Currently, Cisco Systems carries a Zacks Rank #2 (Buy), making the stock a better pick over Palo Alto Networks, which carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 4 hours | |

| 5 hours | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite