|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Uber Technologies UBER, based in San Francisco, CA, has followed an assertive global expansion strategy while diversifying its business model. Although ride-sharing remains its primary operation, the company has developed meaningful additional revenue streams through Uber Eats, the food delivery service, and Uber Freight, a logistics marketplace. This multi-pronged strategy indicates that Uber is positioning itself as a broad transportation and delivery ecosystem rather than solely a ride-hailing provider.

Lyft LYFT, also headquartered in San Francisco, has taken a more focused approach. The company operates almost exclusively within the United States and remains largely centered on ride-sharing, with significantly less emphasis on diversification. This streamlined strategy enables Lyft to dedicate resources to enhancing its core offering, though this limits exposure to faster-growing areas such as delivery services and international markets.

Earlier this month, both companies reported their fourth-quarter 2025 results. In light of their differing strategies, it is worth evaluating which stock presents the more compelling opportunity following the latest quarterly earnings.

On Feb. 4, Uber reported lower-than-expected earnings per share for the fourth quarter of 2025, causing its shares to lose value. Moreover, the earnings guidance for the current quarter was tepid.

Uber’s fourth-quarter 2025 earnings per share of 71 cents missed the Zacks Consensus Estimate of 79 cents and declined 77.8% year over year. The increase in more affordable rides and higher insurance costs hurt results. Total revenues of $14.3 billion edged past the Zacks Consensus Estimate of $14.2 billion. The top line jumped 20.1% year over year on a reported basis and 19% on a constant currency basis.

With economic activities normalized in the post-pandemic scenario, people are traveling to work and other places as before. As a result, UBER’s Mobility business has been seeing buoyant demand, with segmental revenues increasing 19% year over year on a reported basis and 18% on a constant currency basis to $8.2 billion.

With customer traffic picking up, gross bookings from the unit were highly impressive, aiding the fourth-quarter results. Gross bookings from the Mobility segment in the December quarter increased 19% year over year on a constant-currency basis to $27.4 billion.

Uber’s Delivery business also performed well in the quarter, with segmental revenues growing 29% year over year on a constant-currency basis. Gross bookings from the Delivery segment in the fourth quarter rose 26% year over year on a constant-currency basis to $25.4 billion. Total gross bookings jumped 22% to $54.1 billion. Uber expects March quarter gross bookings in the $52-$53.5 billion range, representing 17-21% year over year growth on a constant currency basis.

Despite the miss in the December quarter, the company has an impressive earnings surprise record. Uber’s earnings have outpaced the Zacks Consensus Estimate in three of the past four quarters. The average beat exceeds 100%.

Uber Technologies, Inc. price-eps-surprise | Uber Technologies, Inc. Quote

Even though revenues topped expectations, the fourth-quarter earnings miss and the below-par EPS guidance for the March quarter resulted in the stock shedding value after the release. UBER’s increased investments for developing cheaper and more affordable mobility offerings like Moto, a 2-wheeler product, to broaden its customer base, might have contributed to the subdued adjusted earnings per share guidance (65-72 cents) for the March quarter.

Moreover, Uber announced the appointment of a new chief financial officer. Balaji Krishnamurthy took over from Prashanth Mahendra-Rajah as the CFO on Feb. 16. The appointment of Balaji as the CFO may imply that Uber will continue making high investments toward autonomous vehicles or AV-related partnerships rather than immediately focusing on margin expansion. This is because Balaji is actively involved in Uber’s AV push.

The anticipation of Uber continuing to incur high costs, courtesy of its AV-related investments, may have kept investors wary, contributing to the downward stock movement. Shares of Uber have declined 7% since its earnings release.

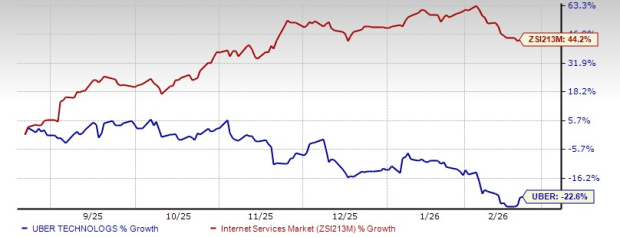

The slip following the fourth-quarter earnings miss marks a continuation of Uber’s disappointing price performance over the past six months. Over the timeframe, Uber’s shares have declined in double digits, underperforming the Zacks Internet-Services industry. Uber’s shares have dropped primarily on concerns regarding competition in the robotaxi and autonomous driving space.

On Feb. 10, Lyft released its fourth-quarter 2025 earnings report. Lyft reported a loss per share of 20 cents in contrast to the Zacks Consensus Estimate of earnings of 32 cents. In the year-ago quarter, Lyft reported earnings per share of 30 cents. Revenues of $1.59 billion missed the Zacks Consensus Estimate of $1.76 billion but increased 2.7% on a year-over-year basis.

The earnings miss by Lyft in December meant that its unimpressive earnings surprise record continued. Lyft has reported a negative earnings surprise in each of the past four quarters. The average miss is 47.1%.

Lyft, Inc. price-eps-surprise | Lyft, Inc. Quote

In the December quarter, gross bookings increased 19% year over year to $5.1 billion. This was the 19th consecutive quarter where Lyft demonstrated double-digit year-on-year growth in the key metric, demonstrating the resilience and momentum of its customer-friendly strategy. For the first quarter of 2026, Lyft anticipates gross bookings to grow almost 17-20% year over year, reaching $4.86-$5.00 billion.

The strong gross bookings scenario apart, Lyft’s board of directors has authorized the repurchase of up to an additional $1 billion in shares. This shareholder-friendly move followed the inaugural share repurchase program in 2025.

The loss, however, reported in the quarter seems to have disappointed investors, resulting in the stock declining sharply since the fourth-quarter earnings release. Despite that, Lyft’s shares have performed better than Uber's over the past six months.

Lyft is trading at a forward sales multiple of 0.76X, comparing favorably to Uber’s 2.55X. LYFT has a Value Score of A compared with UBER’s C.

Agreed that both companies are benefiting from gross bookings growth, on the back of the strength of the ride share market. Lyft’s favorable valuation picture, the recent shareholder-friendly buyback announcement and the better price performance of late place it on a more solid footing than Uber.

Considering these factors, LYFT appears to be the more attractive choice at this time, even though both stocks currently carry a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 3 hours | |

| 4 hours | |

| 7 hours | |

| 8 hours | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 |

Uber, Latest Victim of Disruption Panic, Still Has Role in Robotaxis

LYFT UBER

The Wall Street Journal

|

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite