|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Pfizer PFE and AstraZeneca AZN are two global pharmaceutical leaders with a commanding presence in oncology. For Pfizer, oncology is a key growth driver, accounting for roughly 27% of total company revenues. Beyond cancer therapies, Pfizer maintains a diversified portfolio with strong franchises in inflammation and immunology, rare diseases and vaccines.

AstraZeneca has an even larger exposure to oncology, with the segment contributing about 44% of total revenues. Outside of oncology, AstraZeneca has meaningful positions in immunology, rare diseases, vaccines, as well as cardiovascular, respiratory and metabolic diseases.

Both companies have promising R&D pipelines capable of delivering innovative treatments and supporting future growth. But which stock presents a better investment opportunity right now? Let’s dive into their fundamentals, growth outlook and potential challenges to make a well-informed comparison.

Pfizer is one of the largest and most successful drugmakers in oncology. Its oncology revenues grew 8% in 2025, driven by drugs like Xtandi, Lorbrena, the Braftovi-Mektovi combination and Padcev.

Pfizer’s dependence on its COVID business has now reduced. Pfizer’s non-COVID operational revenues are improving, driven by its key in-line products like Vyndaqel, Padcev and Eliquis, new launches and newly acquired products like Nurtec and those acquired from the Seagen acquisition in 2023.

Revenues from Pfizer’s non-COVID products rose 6% operationally in 2025. Its recently launched and acquired products delivered $10.2 billion in revenues in 2025 while growing approximately 14% operationally year over year. In 2026, Pfizer expects its recently launched and acquired products to continue to record double-digit growth.

Pfizer is also trying to rebuild its pipeline through acquisitions. Seagen, Metsera and Biohaven are the most significant strategic acquisitions in recent years. In 2025, Pfizer invested around $9 billion in M&A deals, including the acquisition of obesity drugmaker, Metsera and the licensing deal with 3SBio.

Its significant cost reduction and efforts to improve R&D productivity measures are also driving profit growth. Pfizer’s dividend yield stands at 6.4%, which is impressive.

However, the company faces several near-term challenges. With the end of the pandemic, sales of Pfizer’s COVID products, Comirnaty and Paxlovid, are declining. Sales of Comirnaty declined in 2025 due to a narrow recommendation for COVID vaccines in the United States, while Paxlovid experienced reduced demand from lower infection rates. In 2026, Pfizer expects its COVID revenues to be around $5 billion, representing a decline from 2025 COVID sales of around $6.7 billion as COVID infection rates are expected to continue to decline.

Pfizer also expects a significant negative impact on revenues from the loss of exclusivity (“LOE”) in the 2026-2030 period as several of its key products, including Eliquis, Vyndaqel, Ibrance, Xeljanz and Xtandi, face patent expirations. The LOE cliff is expected to hurt sales by approximately $1.5 billion in 2026. The company’s lukewarm guidance for 2026 suggests a decline in top- and bottom-line growth. Pfizer expects its recently launched and acquired products and a strong pipeline to help revive top-line growth toward the end of the decade.

AstraZeneca now has 16 blockbuster medicines, including Tagrisso, Fasenra, Farxiga, Imfinzi, Lynparza, Soliris and Ultomiris in its portfolio, with sales (product sales and alliance revenues) exceeding $1 billion. These drugs drove AstraZeneca’s 8% top-line growth and 11% core EPS growth in 2025, backed by increasing demand trends.

Newer drugs like Wainua, Airsupra, Saphnelo, Datroway (partnered with Daiichi Sankyo) and Truqap contributed to top-line growth in 2025, more than offsetting the loss of exclusivity of some mature brands like Brilinta, Pulmicort and Soliris. The rare disease business is also showing some improving trends.

In 2026, AZN expects continued revenue and earnings growth. It expects total revenues to grow by a mid-to-high single-digit percentage at CER in 2026, while core EPS is expected to increase by a low double-digit percentage at CER.

AstraZeneca has set itself some visible targets for the next few years. It expects to generate $80 billion in total revenues by 2030. By the said time frame, AstraZeneca plans to launch 20 new medicines, with around half of these already launched/approved. It believes that many of these new medicines will have the potential to generate more than $5 billion in peak-year revenues. The company is also on track to achieve a mid-30s percentage core operating margin by 2026.

AstraZeneca also boasts a robust pipeline and expects results of more than 20 phase III studies this year.

AstraZeneca faces its share of challenges, like the impact of Part D redesign on U.S. oncology sales and ongoing investigations at its China subsidiary. Generic/biosimilar competition in the United States and Europe is hurting sales of key drugs like Brilinta, Soliris and Farxiga.

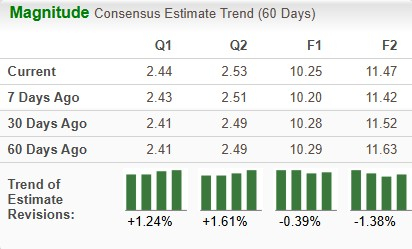

The Zacks Consensus Estimate for AZN’s 2026 sales and EPS implies a year-over-year increase of 6.0% and 123.6%, respectively. EPS estimates for 2026 have declined from $10.28 per share to $10.25 per share over the past 30 days, while those for 2027 have declined from $11.52 to $11.47 per share over the same timeframe.

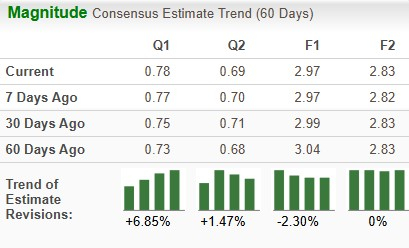

The Zacks Consensus Estimate for Pfizer’s 2026 sales and EPS implies a year-over-year decline of 2.5% and 7.8%, respectively. The Zacks Consensus Estimate for 2026 earnings has declined from $2.99 per share to $2.97, while that for 2027 has been stable at $2.83 per share over the past 30 days.

In the past year, Pfizer’s stock has risen 1.8%, while AstraZeneca’s stock has rallied 40.6% compared with the industry’s increase of 14.7%.

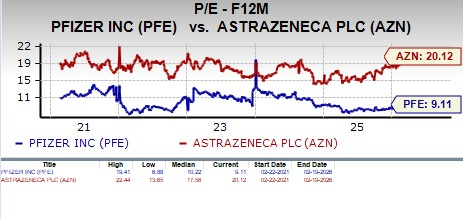

Pfizer looks more attractive than AZN from a valuation standpoint. Going by the price/earnings ratio, AZN’s shares currently trade at 20.12 forward earnings, slightly higher than 18.74 for the industry. However, AZN’s stock is trading below its 5-year mean of 17.58. Pfizer’s shares currently trade at 9.11 forward earnings, significantly lower than the industry and the stock’s 5-year mean of 10.22.

AstraZeneca’s dividend yield is around 1%, while Pfizer's is 6.4%.

With both AstraZeneca and Pfizer having a Zacks Rank #3 (Hold), choosing one stock is a difficult task. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

For AstraZeneca, the top-line growth momentum of 2025 is likely to continue in 2026 despite the generic erosion of some drugs. However, the company has clearer growth targets ($80 billion in revenues by 2030).

On the other hand, for Pfizer, near-term challenges like declining COVID sales, U.S. Medicare Part D headwinds and the LOE cliff in the 2026-2030 period are significant. It remains to be seen if Pfizer’s key drugs like Vyndaqel and Padcev, and its recently launched and acquired products and a growing obesity and oncology pipeline, help the company offset its LOEs over the next several years.

We believe that AstraZeneca is a safer bet than Pfizer despite the latter’s cheaper valuation and better dividend yield. AstraZeneca has demonstrated more efficient profitability, and its upside potential appears to be higher.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 2 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 9 hours | |

| 9 hours | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite