|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Integer Holdings Corporation ITGR delivered adjusted earnings per share (EPS) of $1.76 in the fourth quarter of 2025, which improved 23.1% year over year. The figure surpassed the Zacks Consensus Estimate by 3.5%.

The adjustments include expenses related to the amortization of intangible assets and restructuring and restructuring-related charges, among others.

GAAP EPS for the quarter was $1.38, up 51.6% from the prior-year quarter.

Integer Holdings registered revenues of $472.1 million in the fourth quarter, up 5% year over year. The figure topped the Zacks Consensus Estimate by 2%.

Organically, revenues increased 2%.

Robust sales from the majority of the product lines drove the company’s top line in the reported period.

For the full year 2025, ITGR reported revenues of $1.85 billion, up 8% compared with 2024. The company delivered full-year 2025 EPS of $6.4, up 21% year over year.

Integer Holdings operates through three product lines — Cardio and Vascular (C&V); Cardiac Rhythm Management & Neuromodulation (CRM&N) and Other Markets.

During the third quarter of 2025, management began referring to ITGR’s Advanced Surgical, Orthopedics & Portable Medical product line as the Other Markets product line. This was aimed at better capturing the evolving nature of the company’s products and ongoing strategic focus. Per management, the name change has no impact on the financial information previously reported.

Revenues of the C&V business totaled $284.2 million, up 11.3% from the prior-year quarter on a reported basis and up 4.4% organically. Strong growth in the segment was driven by new product ramps in electrophysiology, Precision Coating and VSi Parylene acquisitions and strong customer demand in neurovascular. This compares to our fourth-quarter projection of $261.9 million.

Revenues of the CRM&N business were $167.3 million, down 1.9% year over year on a reported as well as on an organic basis. The decline was due to Cardiac Rhythm Management growth, which was offset by a decline in Neuromodulation, primarily caused by lower demand from select emerging customers with premarket approval.

Integer Holdings’ Other Markets revenues amounted to $20.5 million, down 13.2% year over year on a reported basis, but up 5.9% on an organic basis. Per management, this resulted from the execution of the planned multi-year Portable Medical exit announced in 2022. This compares to our fourth-quarter projection of $26.7 million for Other Markets revenues.

Integer Holdings Corporation price-consensus-eps-surprise-chart | Integer Holdings Corporation Quote

Integer Holdings generated a gross profit of $124.8 million in the fourth quarter, up 6.8% year over year. The gross margin in the reported quarter expanded 50 basis points (bps) to 26.4%. We had projected 28.4% of gross margin for the fourth quarter.

Selling, general and administrative expenses were $57.2 million, up 20.5% year over year. Research, development and engineering costs were $10.1 million in the quarter, down 4.8% year over year. Total operating expenses of $68.8 million increased 15.2% year over year.

Adjusted operating profit totaled $83.3 million, reflecting a 9.6% uptick from the prior-year quarter. Adjusted operating margin in the fourth quarter expanded 70 bps to 17.6%.

Integer Holdings exited the fourth quarter of 2025 with cash and cash equivalents of $17.2 million compared with $58.9 million at the third-quarter end. Total debt (including the current portion) at the end of the fourth quarter 2025 was $1.19 billion, flat compared with the third-quarter end figure.

Cumulative net cash flow from operating activities at the end of the fourth quarter 2025 was $196.1 million compared with $205.2 million a year ago.

Integer Holdings has provided its financial outlook for 2026.

For 2026, the company expects revenues between $1,826 million and $1,876 million (implying a change of negative 1% to 1% from the 2025 reported figure). The Zacks Consensus Estimate is pegged at $1.84 billion.

The company expects full-year adjusted EPS in the band of $6.29-$6.78 (implying a change of negative 2% to 6% from the 2025 reported figure). The Zacks Consensus Estimate is pegged at $6.32.

Integer Holdings exited the fourth quarter of 2025 with strong results. The strong year-over-year top-line and bottom-line performances were impressive. Fourth-quarter revenues rose 5% year over year, while adjusted EPS climbed 23%, reflecting solid operating leverage and continued margin expansion. Cardio & Vascular delivered double-digit growth, supported by acquisitions and healthy neurovascular demand, and full-year adjusted operating income increased 13%, underscoring disciplined execution. The company also generated steady free cash flow and reinforced its capital allocation strategy with share repurchases, highlighting confidence in its long-term outlook.

Despite the strong finish to 2025, ITGR shares slipped about 4% yesterday as investors focused more on the 2026 guidance than the quarter itself. Management projected reported sales to range from down 1% to up 1%, citing slower-than-expected adoption of three newer products that will create a near-term headwind. While the underlying core business is still expected to grow in line with its markets, the tempered outlook suggests 2026 will be more of a reset year before a potential reacceleration in 2027.

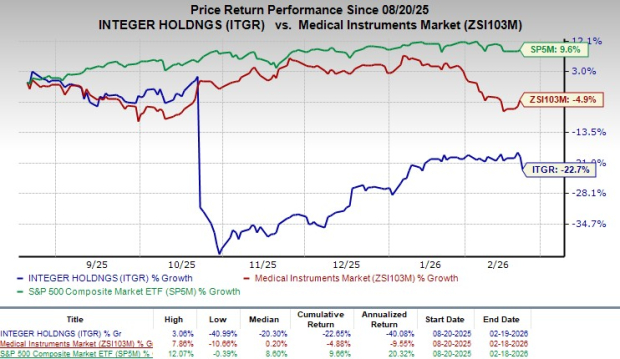

Shares of ITGR have lost 22.7% in the last six-month period compared with the industry’s 4.9% decline. However, the S&P 500 Index has increased 9.6% during the same time frame.

Integer Holdings currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader medical space are Intuitive Surgical ISRG, Veracyte VCYT and GE HealthCare Technologies Inc. GEHC.

Intuitive Surgical, sporting a Zacks Rank #1 (Strong Buy) at present, has an estimated long-term growth rate of 15.7%. ISRG’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 13.2%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Intuitive Surgical’s shares have gained 2.7% against the industry’s 7% decline in the past six months.

Veracyte, sporting a Zacks Rank #1 at present, has an estimated earnings recession rate of 3%. VCYT’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 45.1%.

Veracyte’s shares have climbed 19.8% against the industry’s 7.1% decline in the past six months.

GE HealthCare Technologies, carrying a Zacks Rank of 2 (Buy) at present, has an estimated long-term growth rate of 9.1%. GEHC’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 7.5%.

GE HealthCare Technologies’ shares have risen 11.6% against the industry’s 12.9% decline in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 6 hours | |

| 7 hours | |

| 7 hours | |

| 7 hours | |

| 7 hours | |

| 10 hours | |

| 10 hours | |

| 12 hours | |

| 19 hours | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite