|

|

|

|

|||||

|

|

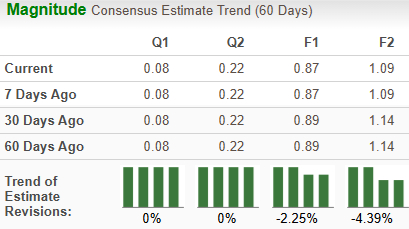

CommScope Holding Company, Inc. COMM is scheduled to report first-quarter 2025 earnings on May 1, 2025. The Zacks Consensus Estimate for revenues and earnings is pegged at $1.11 billion and 8 cents per share, respectively. Over the past 60 days, earnings estimates for COMM for 2025 have decreased from 89 cents per share to 87 cents and for 2026 from $1.14 per share to $1.09.

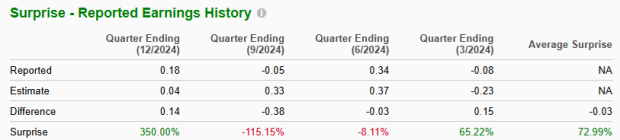

The infrastructure solutions provider delivered a four-quarter earnings surprise of 73%, on average, beating estimates twice. In the last reported quarter, the company pulled off an earnings surprise of 350%. (See the Zacks Earnings Calendar to stay ahead of market-making news.)

Our proven model does not predict an earnings beat for CommScope for the first quarter. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold) increases the chances of an earnings beat. This is not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

CommScope currently has an ESP of 0.00% with a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

During the quarter, CommScope joined forces with the National Content & Technology Cooperative (“NCTC”) to support independent service providers and expand broadband access in remote areas across the United States. Per the agreement, the company will offer its Build America, Buy America compliant portfolio and assist NCTC in securing funding under the BEAD program. Access to such innovative product offerings will significantly support independent service providers’ FTTH network deployment initiatives in rural and underserved areas.

In the first quarter of 2025, CommScope expanded its Propel portfolio with the launch of the Propel XFrame solution. This cutting-edge floor-mounted fiber frame solution is designed to meet the growing demands of data centers and high-performance computing facilities, providing scalable solutions for an evolving infrastructure landscape. With AI deployments and high-density fiber architectures transforming infrastructure needs, the Propel XFrame’s modular design ensures easier and faster reconfigurations, keeping pace with the changing landscape of modern networks. This is likely to have translated into incremental revenues in the quarter to be reported.

CommScope completed the divestiture of the Outdoor Wireless Networks and Distributed Antenna Systems businesses during the quarter. The proceeds of the sale were utilized to fully repay all outstanding amounts under CommScope’s asset-backed revolving credit facility. It also allowed CommScope to fully repay senior secured notes due 2026 and partially repay the senior secured notes due 2029. The divestiture enabled CommScope to increase its focus and further strengthen CommScope NEXT priorities with remaining segments and business units.

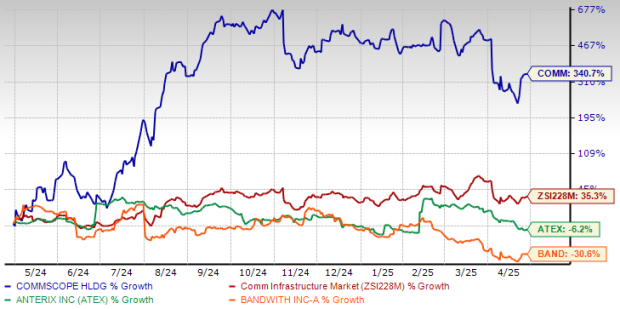

Over the past year, CommScope has surged 340.7% over the past year compared with the industry’s growth of 35.3%. It has also outperformed its peers like Bandwidth Inc. BAND and Anterix Inc. ATEX. Bandwidth has declined 30.6% and Anterix is down 6.2% over this period. Both Bandwidth and Anetrix appear to be hindered by intense competitive pressure from bigger rivals, who enjoy sufficient operating flexibility to respond to evolving technological changes and bundle competing products and services at little or no incremental costs.

One-Year Price Performance of COMM Stock

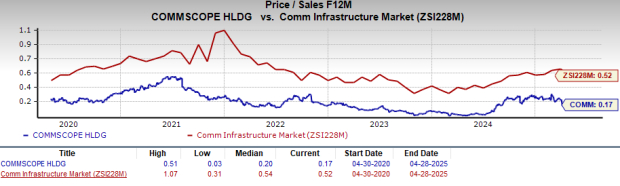

From a valuation standpoint, CommScope appears to be relatively cheaper compared to the industry and below its mean. Going by the price/sales ratio, the company shares currently trade at 0.17 forward earnings, lower than 0.52 for the industry and the stock’s mean of 0.20.

CommScope continues to benefit from stringent cost-cutting measures and focus on core operations. The company is actively pruning its non-core businesses while focusing on inorganic growth to boost its portfolio strength and remain at the forefront of technological innovation by developing solutions to support wireline and wireless network convergence. The enhanced product offerings enable CommScope to provide more comprehensive solutions, catering to the growing demand for high-speed, reliable network connectivity.

With operators moving toward converged or multi-use network structures, combining voice, video and data communications into a single network, CommScope is developing solutions designed to support wireline and wireless network convergence, which will be essential for the success of 5G technology. Its product portfolio has been specifically designed to help global service providers efficiently deploy fiber networks. This augurs well for its long-term growth prospects. The company also continues to be one of the leading suppliers of intelligent antenna platforms for FirstNet deployments.

CommScope is trading at cheap valuation metrics and investors could benefit from its solid long-term fundamentals. However, with decreasing earnings estimates, the stock is witnessing a negative investor perception. CommScope seems to be treading in the middle of the road, and investors could be better off if they trade with caution.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 8 hours | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite