|

|

|

|

|||||

|

|

Electronic component provider Littelfuse (NASDAQ:LFUS) reported Q1 CY2025 results exceeding the market’s revenue expectations, with sales up 3.5% year on year to $554.3 million. On the other hand, next quarter’s revenue guidance of $580 million was less impressive, coming in 0.9% below analysts’ estimates. Its non-GAAP profit of $2.19 per share was 21.1% above analysts’ consensus estimates.

Is now the time to buy Littelfuse? Find out by accessing our full research report, it’s free.

“In the first quarter, we delivered results that exceeded our expectations, driven by solid Electronics Segment demand recovery and robust growth in our Industrial Segment,” said Greg Henderson, Littelfuse President and Chief Executive Officer.

The developer of the first blade-type automotive fuse, Littelfuse (NASDAQ:LFUS) provides electrical protection and control components for the automotive, industrial, electronics, and telecommunications industries.

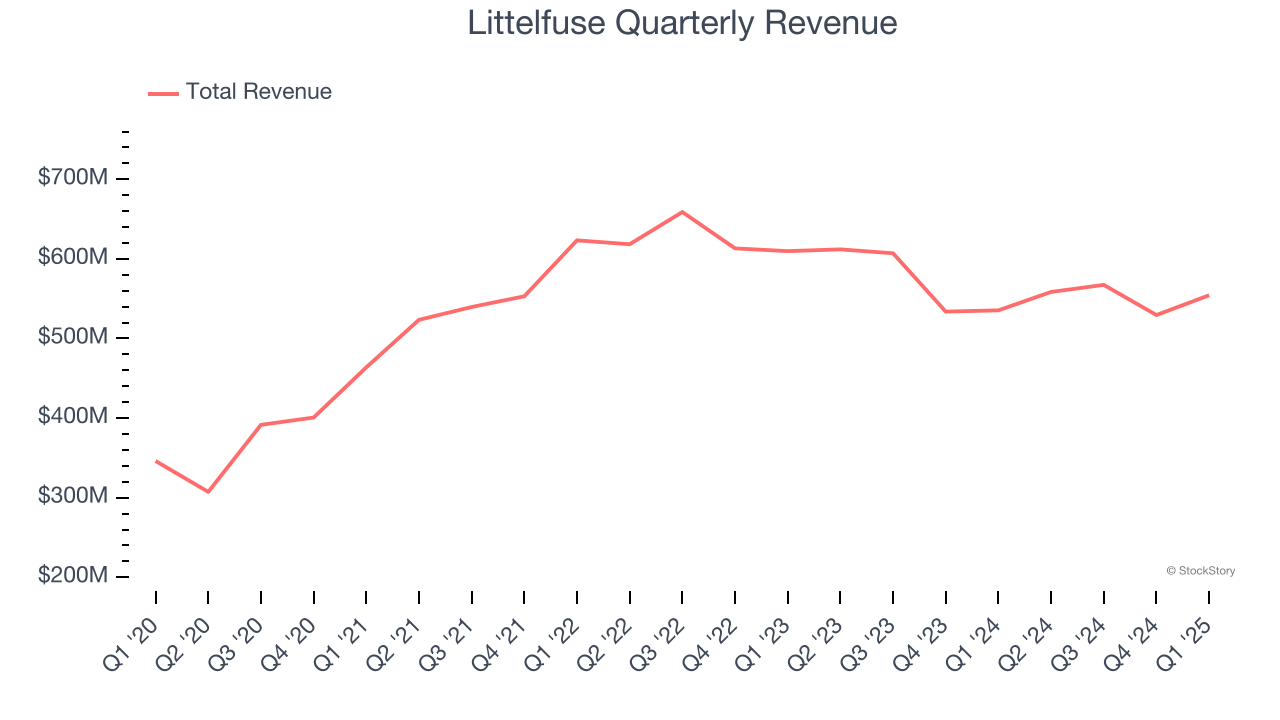

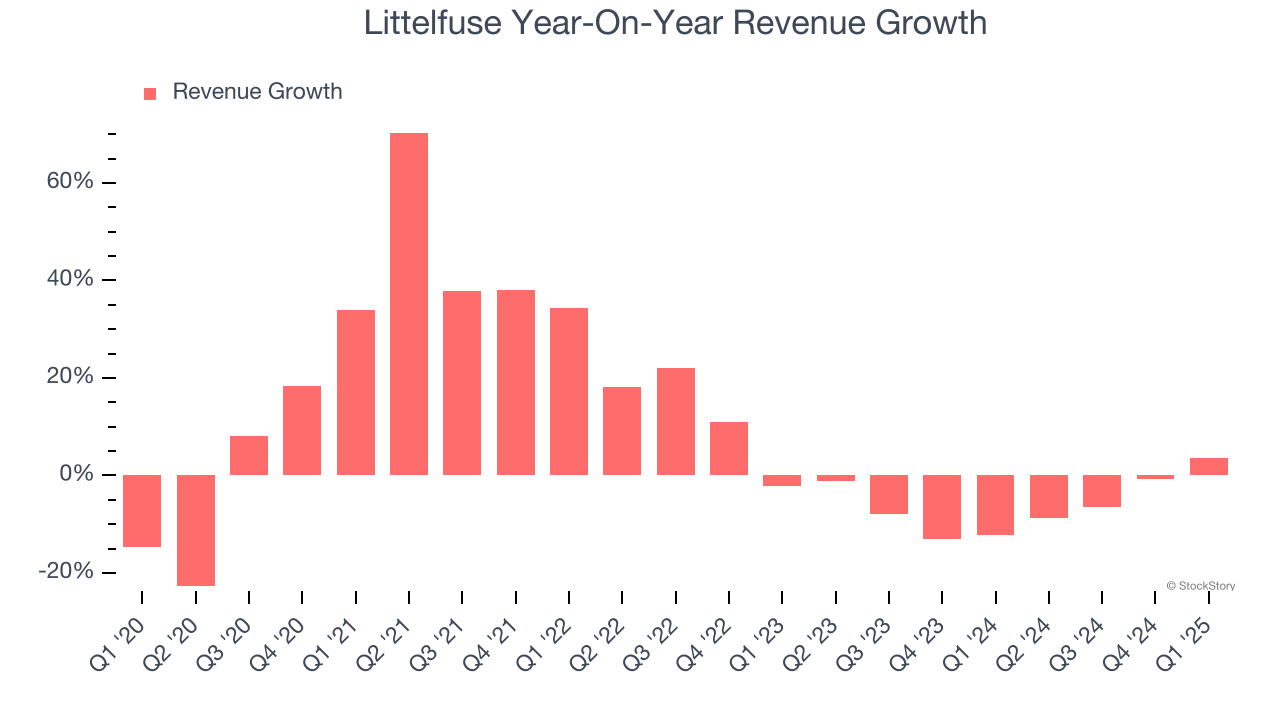

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Littelfuse grew its sales at a decent 8.9% compounded annual growth rate. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Littelfuse’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 6% over the last two years. Littelfuse isn’t alone in its struggles as the Electronic Components industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

This quarter, Littelfuse reported modest year-on-year revenue growth of 3.5% but beat Wall Street’s estimates by 2.2%. Company management is currently guiding for a 3.9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 6.3% over the next 12 months. While this projection implies its newer products and services will catalyze better top-line performance, it is still below the sector average.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

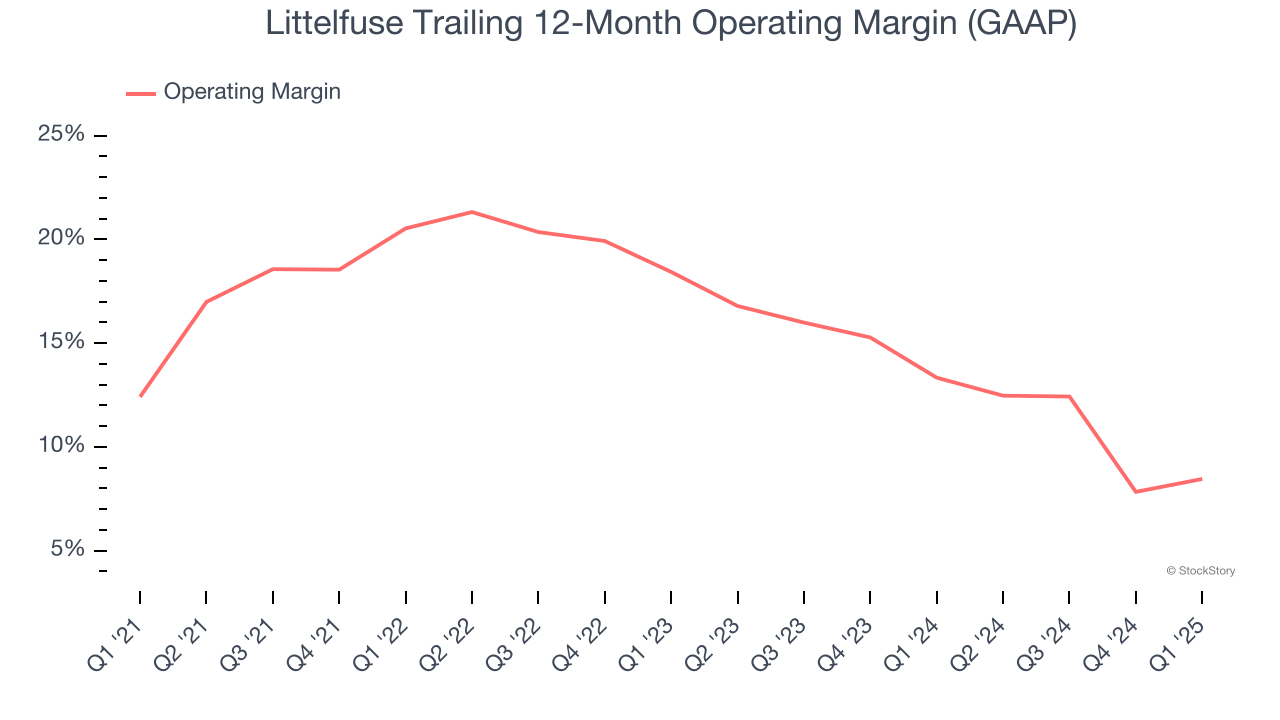

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Littelfuse has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 14.9%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Littelfuse’s operating margin decreased by 4 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Littelfuse generated an operating profit margin of 12.7%, up 2.4 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

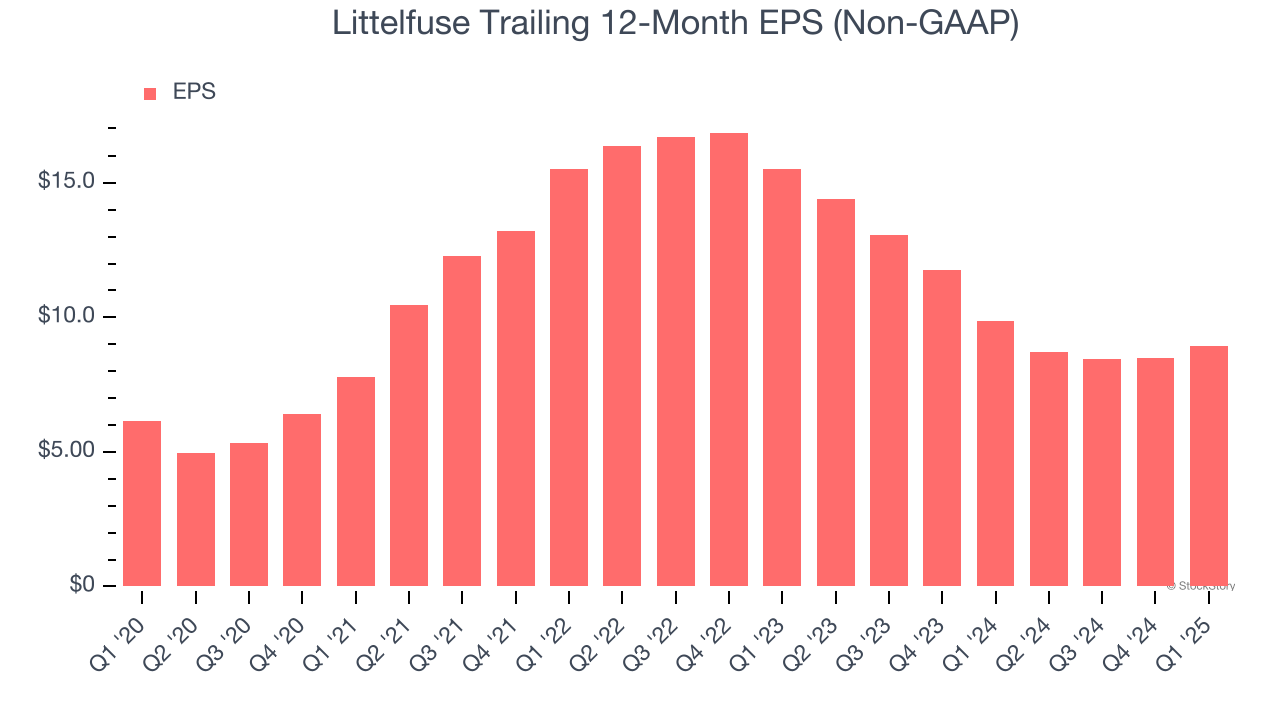

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Littelfuse’s EPS grew at an unimpressive 7.8% compounded annual growth rate over the last five years, lower than its 8.9% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

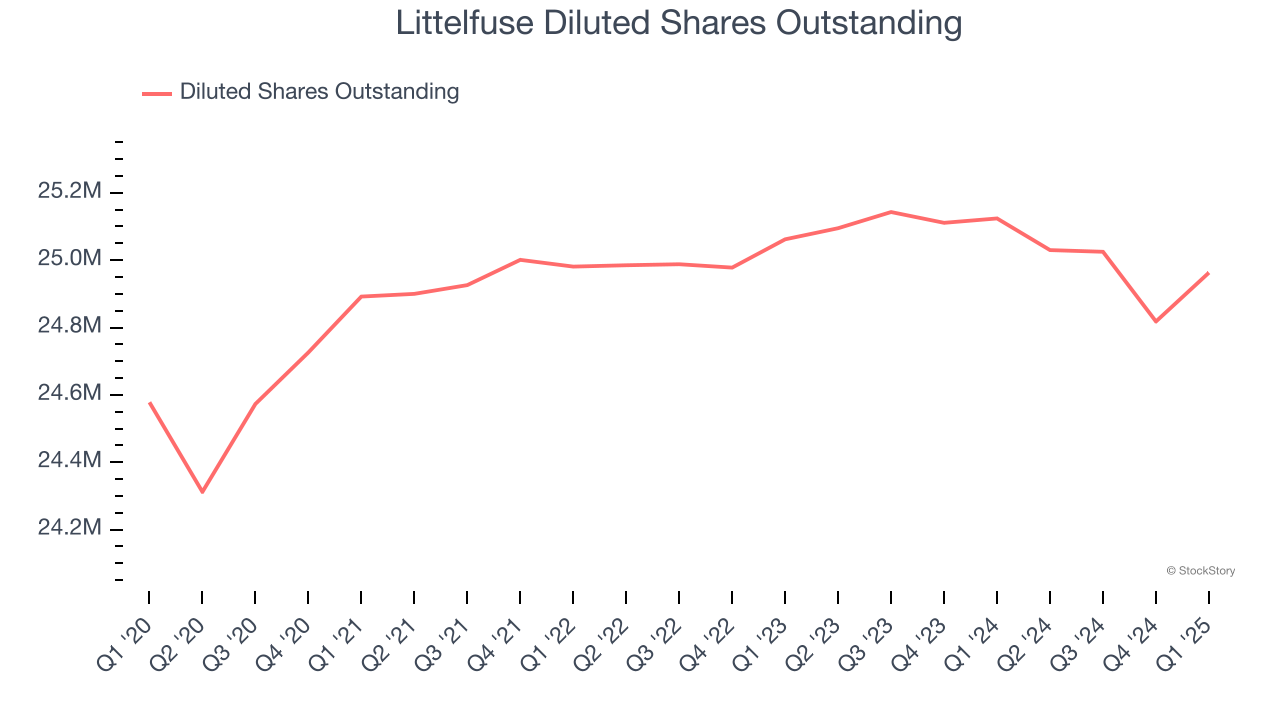

We can take a deeper look into Littelfuse’s earnings to better understand the drivers of its performance. As we mentioned earlier, Littelfuse’s operating margin improved this quarter but declined by 4 percentage points over the last five years. Its share count also grew by 1.6%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Littelfuse, its two-year annual EPS declines of 24.1% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q1, Littelfuse reported EPS at $2.19, up from $1.76 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Littelfuse’s full-year EPS of $8.93 to grow 9.2%.

We were impressed by how significantly Littelfuse blew past analysts’ EBITDA expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next quarter slightly missed. Zooming out, we think this was a solid quarter. The stock traded up 8.7% to $194.90 immediately following the results.

Sure, Littelfuse had a solid quarter, but if we look at the bigger picture, is this stock a buy? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

| Feb-09 | |

| Feb-04 | |

| Feb-04 | |

| Feb-02 | |

| Jan-29 | |

| Jan-29 | |

| Jan-29 | |

| Jan-28 | |

| Jan-28 | |

| Jan-28 | |

| Jan-28 | |

| Jan-28 | |

| Jan-28 | |

| Jan-28 | |

| Jan-28 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite