|

|

|

|

|||||

|

|

Crown Holdings, Inc. CCK reported first-quarter 2025 adjusted earnings per share (EPS) of $1.67, beating the Zacks Consensus Estimate of $1.22 by a solid margin of 37%. The bottom line marked a 64% improvement year over year.

The earnings growth was driven by higher beverage can shipments across the Americas and Europe, enhanced manufacturing efficiencies and cost savings from the company’s restructuring initiatives.

Including one-time items, the company reported earnings from continuing operations of $1.65 per share compared with 56 cents in the prior-year quarter.

(Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

Crown Holdings, Inc. price-consensus-eps-surprise-chart | Crown Holdings, Inc. Quote

Net sales in the quarter totaled $2.89 billion, surpassing the Zacks Consensus Estimate of $2.87 billion. The figure also marked an improvement of 3.7% from the year-ago quarter’s $2.78 billion. The upside was driven by increased beverage can shipments in Americas and European Beverage and the pass-through of higher material costs. These gains were, however, partially offset by unfavorable foreign currency impact.

The cost of products sold inched up 0.7% year over year to $2.26 billion. On a year-over-year basis, gross profit increased 16% to $620 million. The gross margin was 21.6%, a 230-basis point expansion year over year.

Selling and administrative expenses dipped 1.3% year over year to $152 million. The total segmental operating income was $398 million compared with the prior-year quarter’s $308 million. The total segment operating margin was 13.8% compared with 11.1% in the prior-year quarter. The improvement was attributed to higher beverage can shipments, improved manufacturing performance and savings from Crown Holdings’ previous restructuring actions.

Net sales in the Americas Beverage segment totaled $1.32 billion, up 8% year over year. The segment’s operating profit increased 25% year over year to $236 million.

The European Beverage segment’s sales rose 6% year over year to $512 million. Operating income was $67 million, marking a 31% jump from the year-ago quarter’s $51 million.

The Asia-Pacific segment’s sales totaled $279 million, flat year over year. Operating profit was $47 million, 12% higher than the prior-year quarter’s $42 million.

Sales in the Transit Packaging segment totaled $294 million compared with the year-ago quarter’s $281 million. Operating profit fell 12% year over year to $60 million.

CCK had cash and cash equivalents of $0.78 at the end of the first quarter of 2025, down from $1.12 billion at the end of 2024. The company generated $14 million in cash from operating activities in the first quarter of 2025 against an outflow of $102 million in the prior-year quarter.

Crown Holdings’ long-term debt fell to $4.74 billion at the end of the first quarter from $6.62 billion at the end of 2024.

Crown Holding expects adjusted earnings per share to be between $1.80 and $1.90 in the second quarter of 2025. Adjusted earnings per share (EPS) in the second quarter of 2024 were $1.81.

Backed by the solid performance in the first quarter and upbeat demand, the company now projects full-year adjusted EPS to be $6.70-$7.10 compared with its prior expectation of $6.60-$7.00. The midpoint of the revised guidance implies year-over-year growth of 8%.

It expects 2025 adjusted free cash flow of $800 million.

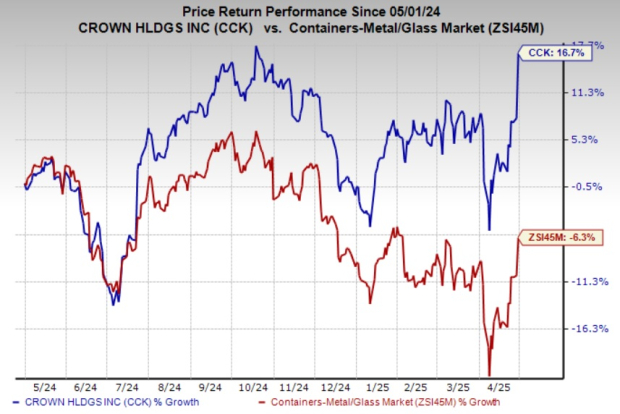

The company’s shares have gained 16.7% in the past year against the industry’s 6.3% decline.

CCK currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Packaging Corporation of America PKG reported adjusted EPS of $2.31 in the first quarter of 2025, beating the Zacks Consensus Estimate of $2.21. The bottom line increased 34% year over year. The figure was above the company’s guidance of $2.21.

The upside primarily resulted from higher prices and mix in the Packaging and Paper segments and volumes in the Packaging segment. Including one-time items, earnings in the reported quarter were $2.26 per share compared with the prior-year quarter’s $1.63.

PKG’s sales in the first quarter rose 8.2% year over year to $2.141 billion. The top line surpassed the Zacks Consensus Estimate of $2.140 billion.

Silgan Holdings SLGN reported a record first-quarter 2025 adjusted EPS of 82 cents per share, which beat the Zacks Consensus Estimate of 78 cents. This marked a 19% increase from EPS of 69 cents in the year-ago quarter. This was attributed to volume growth and outstanding operating performance across all segments, contribution from the Weener acquisition and savings from its cost reduction program.

Silgan’s first-quarter 2025 sales rose 11% year over year to $1.467 billion, missing the Zacks Consensus of $1.471 billion.

Ball Corporation BALL is scheduled to report first-quarter 2025 results on May 6. The Zacks Consensus Estimate for the quarter’s adjusted earnings is 69 cents per share, indicating 1.5% year-over-year growth.

The estimate for Ball Corp.’s sales for the quarter is $2.95 billion, indicating 2.7% growth from the year-ago quarter. BALL has an average earnings surprise history of 7.8% over the trailing four quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-20 | |

| Feb-20 | |

| Feb-18 | |

| Feb-17 | |

| Feb-15 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-10 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite