|

|

|

|

|||||

|

|

Astronics Corporation ATRO is slated to release first-quarter 2025 results on May 6, after market close.

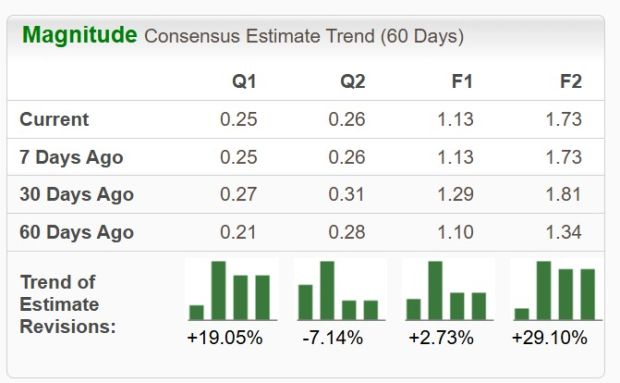

The Zacks Consensus Estimate for revenues is pegged at $190 million, implying 2.7% growth from the year-ago quarter's reported figure. The consensus mark for earnings is pegged at 25 cents per share, suggesting a solid improvement from the prior-year quarter’s reported loss of 9 cents. The bottom-line estimate has also moved 19.1% north in the past 60 days. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

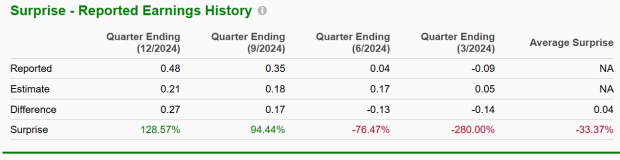

ATRO has an unimpressive earnings surprise history. Its earnings missed the Zacks Consensus Estimate in two of the trailing four quarters and beat in the other two, the average negative surprise being 33.37%

Our proven model does not conclusively predict an earnings beat for ATRO this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat, which is not the case here. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

ATRO carries a Zacks Rank #1 and an Earnings ESP of 0.00% at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Aerospace Unit to Drive Sales Growth

Higher commercial transport sales, primarily related to increased demand by the airlines for cabin power and in-flight entertainment as well as connectivity products, backed by growing global commercial air traffic, are likely to have bolstered ATRO’s Aerospace business segment’s sales. Higher sales from military aircraft markets, backed by enhanced geopolitical tensions worldwide, might also have bolstered this unit’s sales growth in the to-be-reported quarter.

The Zacks Consensus Estimate for the Aerospace unit’s first-quarter sales is pegged at $171.8 million, indicating an improvement of 5% from the year-ago quarter’s reported figure.

Test Systems Likely to Post Dismal Sales

The anticipated delay in the U.S. Army's radio test program entering volume production is expected to have hurt revenue generation from ATRO’s Test Systems unit in the first quarter.

The Zacks Consensus Estimate for the Test Systems segment’s sales is pegged at $18.2 million, indicating a decline of 15% from the year-ago quarter’s reported figure.

Other Factors to Consider

Strong sales performance from ATRO’s Aerospace businesses, which constitute approximately 90% of its total revenues, must have boosted the company’s overall top-line performance in the quarter.

Factors like solid sales expectations, improved operating profit margin from the Aerospace unit and cost savings anticipated in relation to the restructuring within the Test Systems segment are expected to have bolstered ATRO’s first-quarter earnings.

Astronics Corporation’s shares have surged a solid 44.3% in the year-to-date period, outperforming the Zacks Aerospace-Defense Equipment industry’s gain of 1.7% as well as the broader Zacks Aerospace sector’s rise of 5.7%. It also came in above the S&P 500’s decline of 5.7% in the same time frame.

Other notable stocks from the same industry have also performed well year to date but lagged ATRO’s performance. Shares of Leonardo DRS DRS and TransDigm Group TDG have surged 24.5% and 13.2%, respectively.

From a valuation perspective, ATRO’s forward 12-month price-to-earnings (P/E) is 17.31X, a discount to its peer group’s average of 23.41X. This suggests that investors will be paying a lower price than the company's expected earnings growth compared to that of its peer group.

ATRO’s Price-to-Earnings (Forward 12 Months)

However, its industry peers are currently trading at a premium compared to ATRO. While the forward 12-month price/earnings multiple for Leonardo DRS is 35.62, the same for TransDigm Group is 35.37.

While growth opportunities in the global aerospace and defense space remain immense, some challenges persist, which investors should consider before investing in Astronics. Notably, the primary challenges that ATRO continues to face include varying levels of supply-chain pressures from the residual impacts of the COVID-19 pandemic, material availability and cost increases, and a rise in the cost of labor and labor availability, particularly skilled labor.

Nevertheless, expanding commercial air traffic worldwide remains a major growth catalyst for ATRO. We may expect the company’s first-quarter results to duly reflect these growth trends in terms of notable revenue and earnings growth.

The company also enjoys a solid presence in the defense industry, which provides its portfolio with a diversified cushion against any crisis. Evidently, ATRO made good progress last year in its contract for the U.S. Army Future Long Range Assault Aircraft (“FLRAA”) program. With prototypes for this program expected to fly in 2026, the development stage of FLRAA is projected to generate $60-$65 million over the next couple of years for ATRO, which might have partially aided its first-quarter 2025 performance.

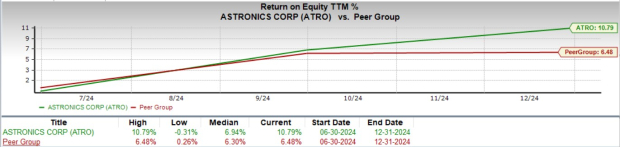

Moreover, the company’s return on equity (ROE) is higher than that of its peer group. This indicates that ATRO is effectively using its shareholders' equity to generate profits compared to its Peer Group.

ATRO’s ROE

ATRO is less likely to disappoint with its first-quarter results, considering the year-over-year growth reflected in its sales and earnings estimates, a favorable Zacks Rank, and the solid year-to-date performance of its shares at the bourses. Moreover, taking into account its discounted valuation and high ROE, investors interested in ATRO may consider buying this stock before next Tuesday.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite