|

|

|

|

|||||

|

|

AerSale Corporation ASLE is slated to release first-quarter 2025 results on May 7, after market close.

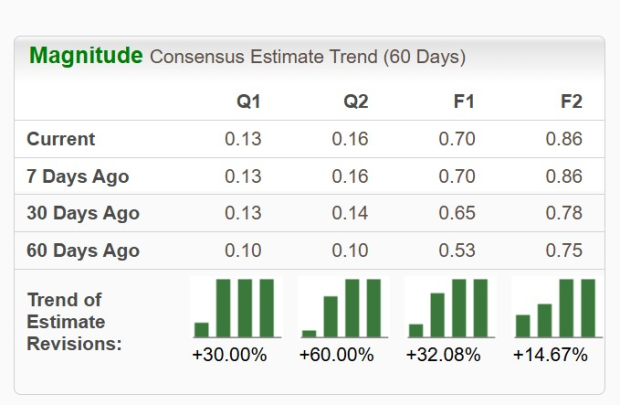

The Zacks Consensus Estimate for revenues is pegged at $88.1 million, implying a 2.7% decline from the year-ago quarter's reported figure. The consensus mark for earnings is pegged at 13 cents per share, suggesting a solid improvement of 18.2% from the prior-year quarter’s reported number. The bottom-line estimate has also moved 30% north in the past 60 days. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

ASLE has an unimpressive earnings surprise history. Its earnings missed the Zacks Consensus Estimate in two of the trailing four quarters and beat in the other two, the average negative surprise being 5.36%.

Our proven model does not conclusively predict an earnings beat for ASLE this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat, which is not the case here. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

ASLE has a Zacks Rank #1 and an Earnings ESP of 0.00% at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Asset Management Solutions Unit: Low Sales Growth

Increase in Engines revenues is due to higher used serviceable material (USM) sales and higher leasing revenues, primarily attributable to greater activity in the PW4000 and CFM56 engine product lines. These are likely to have bolstered this segment’s revenues in the first quarter. However, lower aircraft revenues due to lower Flight Equipment sales, primarily attributable to decreased activity in the B757 product line resulting from softer demand in the freighter market, might have weighed on this segment’s overall top-line performance.

The Zacks Consensus Estimate for the Asset Management Solutions unit’s first-quarter sales is pegged at $56.4 million, indicating an improvement of 0.2% from the year-ago quarter’s reported figure.

TechOps Unit to Hurt Sales

Higher commercial maintenance, repair and overhaul (MRO) product sales and improved service revenues from component repair activities can be expected to have boosted this unit’s top line. However, lower part sales from its MRO units might have hurt overall sales for the TechOps segment.

The Zacks Consensus Estimate for this unit’s first-quarter sales is pegged at $28.7 million, suggesting a decline of 8.3% from the year-ago quarter’s reported figure.

Dismal sales performance from AerSale’s TechOps business and an unimpressive performance expected from the Asset management solutions segment must have dragged down the company’s overall top-line performance in the quarter. Continued construction delays at the company’s Pneumatic and Miami Aerostructures facilities might have also had an adverse impact on the quarterly sales.

Higher margin engine leasing and flight equipment sales, lower payroll-related expenses and ASLE’s cost reduction initiatives are expected to have bolstered its first-quarter earnings.

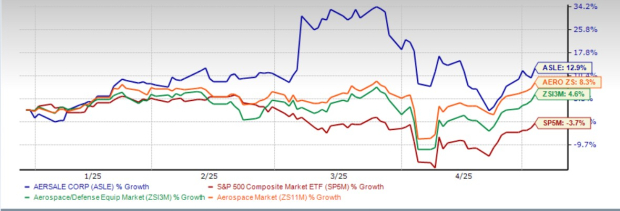

AerSale’s shares have surged a solid 12.9% in the year-to-date period, outperforming the Zacks Aerospace-Defense Equipment industry’s gain of 4.6% as well as the broader Zacks Aerospace sector’s rise of 8.3%. It also came in above the S&P 500’s decline of 3.7% in the same time frame.

Other notable stocks from the same industry have also delivered a similar stellar performance. Shares of Leonardo DRS DRS and TransDigm Group TDG have risen 30% and 14.5%, respectively.

From a valuation perspective, ASLE’s forward 12-month price-to-earnings (P/E) is 9.42X, a discount to its peer group’s average of 50.12X. This suggests that investors will be paying a lower price than the company's expected earnings growth compared to that of its peer group.

ASLE’s Price-to-Earnings (Forward 12 Months)

However, its industry peers are currently trading at a premium compared to ASLE. While the forward 12-month price/earnings multiple for Leonardo DRS is 37.17, the same for TransDigm Group is 35.72.

AerSale company boasts a proven track record of successfully expanding its capabilities through meaningful acquisitions, backed by a solid financial position. In January 2025, AerSale announced the acquisition of a parts portfolio from the Sanad Group. This strategic transaction will help AerSale in serving a diverse and growing global customer base by expanding its inventory breadth with top-quality parts for widely operated aircraft.

The company also brings in innovative products to the market to boost its organic growth. ASLE’s latest product is AerAware, which is a next-generation Enhanced Flight Vision System that enables a pilot to “see” through low visibility conditions.

However, the stock faces a few investment risks. A key concern is its reliance on feedstock availability for Used Serviceable Material (“USM”) sales. Tight supply conditions for end-of-life aircraft and engines could constrain AerSale’s ability to scale its USM business, thereby affecting its revenues and margins. Moreover, while innovations like AerAware offer competitive advantages, commercial adoption rates could be slower than anticipated, limiting expected revenue gains.

Nevertheless, with the global aircraft fleet expanding and maintenance needs intensifying, aerospace services stocks like ASLE have been gaining momentum lately. This is further evident from AerSale’s year-to-date performance at the bourses.

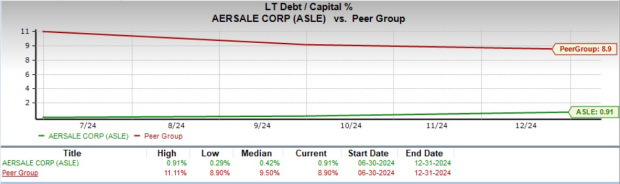

Moreover, the company’s long-term debt-to-capital ratio, as can be seen below, is quite lower than that of its peer group. This indicates that ASLE is less leveraged compared to its Peer Group.

ASLE’s Long-Term Debt-to-Capital

With strong year-to-date price gains, a discounted valuation and solid earnings growth projections, ASLE stock looks attractive ahead of its first-quarter earnings release. Strategic acquisitions, innovative offerings, a favorable Zacks rank and low leverage further strengthen AerSale’s long-term outlook, making it a compelling buy before this Wednesday.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 6 hours | |

| 6 hours | |

| 9 hours | |

| 11 hours | |

| 11 hours | |

| 13 hours | |

| 13 hours | |

| 14 hours | |

| 15 hours | |

| 15 hours | |

| Feb-23 | |

| Feb-22 | |

| Feb-22 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite