|

|

|

|

|||||

|

|

Sarepta Therapeutics, Inc. SRPT reported first-quarter 2025 adjusted loss of $3.42 per share against the Zacks Consensus Estimate for earnings per share (EPS) of 35 cents. This miss was largely due to a one-time charge incurred by the company to close the recently signed multi-billion-dollar deal with Arrowhead Pharmaceuticals ARWR. In the year-ago period, the company posted an adjusted EPS of 72 cents.

The adjusted figures exclude depreciation and amortization costs and stock-based compensation expenses. Including these items, the loss per share in the quarter was $4.60 against an EPS of 37 cents in the year-ago period.

Sarepta recorded total revenues of $744.9 million, up 80% year over year. The upside was driven by sales of Elevidys, its one-shot gene therapy for Duchenne muscular dystrophy (DMD). The reported figure beat the Zacks Consensus Estimate of $698.2 million. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar)

Sarepta’s commercial portfolio includes three approved RNA-based PMO therapies — Exondys 51, Vyondys 53 and Amondys 45 — and Elevidys, all targeting DMD indications.

Product revenues rose 70% year over year to $611.5 million, driven by increased sales across the company’s marketed products. The figure missed the Zacks Consensus Estimate of $664 million and our model estimate of $637 million.

The company generated $236.5 million from the product sales of its three PMO therapies, up 5% year over year. The figure beat the Zacks Consensus Estimate of $233 million and our model estimate of $212 million.

Sarepta generated $375 million from Elevidys sales compared with $384.2 million in the previous quarter. The figure missed both the Zacks Consensus Estimate and our model estimate of $425 million each, likely due to the headwinds arising from safety concerns and site-related constraints.

SRPT recorded approximately $133.3 million in collaboration and other revenues associated with the commercial Elevidys supply to Roche RHHBY. This figure also included $4 million in royalty revenues from Elevidys sales by RHHBY in non-U.S. territories. In the year-ago period, the company recorded $54 million under this head, most of which was also received from Roche.

Sarepta and Roche entered into a licensing agreement in 2019 to develop Elevidys. Per the agreement, RHHBY has exclusive rights to launch and market Elevidys in ex-U.S. markets.

Adjusted research and development (R&D) expenses totaled $749.2 million compared with $178.1 million in the year-ago period. This significant upside reflects an increase in upfront and milestone expenses associated with the Arrowhead deal.

Adjusted selling, general & administrative (SG&A) expenses totaled $107.1 million, up 7% year over year. This was primarily caused by an increase in professional service expenses incurred by the company as part of its continuing efforts to market Elevidys.

Sarepta revised its financial guidance for the full year. It now expects to record net product revenues between $2.3 billion and $2.6 billion — a significant decline from the previous forecast of $2.9-$3.1 billion. While the primary reason behind this cut stems from the safety concerns around Elevidys, the company also cited administrative complexities related to gene therapy and capacity limitations at treatment sites. Based on these challenges, Sarepta expects Elevidys' revenues in the second quarter of 2025 to be ‘as much as 20% lower’ than the first quarter.

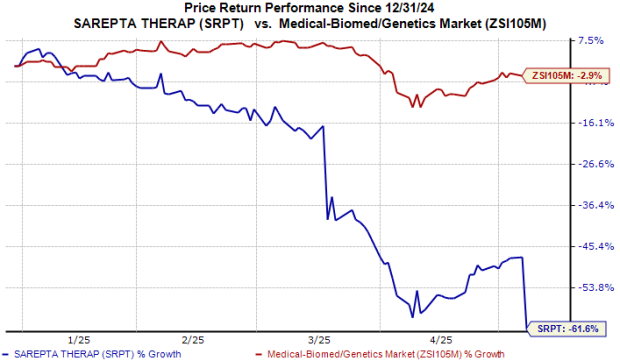

Shares of Sarepta were down 21% in after-hours trading yesterday, likely due to the curtailed sales guidance. Year to date, the stock has plunged 62% compared with the industry’s 3% decline.

The company also revised its guidance on annual expenses. It now expects the combined adjusted R&D and SG&A expenses to be in the $1.78-$2.18 billion range (previously $1.2-$1.3 billion), which includes the impact of upfront and milestone payments associated with the Arrowhead deal.

In March, Sarepta reported the death of a patient following treatment with Elevidys. Per the company, this death was due to acute liver failure, a known but rare risk associated with the use of the gene therapy. Based on this event, the EMA placed a clinical hold on all Elevidys-related studies. While an investigation into the patient’s death is currently ongoing, such developments have adversely impacted Sarepta’s growth trajectory and stock performance.

In February, Sarepta closed its licensing and collaboration deal with Arrowhead. With the completion of the deal, the company now holds exclusive rights to ARWR’s seven pipeline programs, which include four in active clinical development, being evaluated in separate phase I/II studies.

The first is SRP-1001 (formerly ARO-DUX4), which is being developed as a potential treatment for patients with facioscapulohumeral muscular dystrophy (FSHD), while SRP-1003 (formerly ARO-DM1) is being developed to treat myotonic dystrophy type 1 (DM1). The remaining candidates, SRP-1002 (formerly ARO-MMP7) and SRP-1004 (formerly ARO-ATXN2), are being developed to treat idiopathic pulmonary fibrosis (IPF) and spinocerebellar ataxia 2 (SCA2) indications, respectively.

Sarepta is currently evaluating SRP-9003, an investigational gene therapy, in the late-stage EMERGENE study for treating Limb-girdle muscular dystrophy (LGMD) type 2E/R4 (LGMD2E/R4). Data from this study is expected in the first half of 2025. If the data is positive, Sarepta intends to submit a regulatory filing seeking accelerated approval for SRP-9003 in the given indication before 2025-end.

The company is also studying another investigational gene therapy candidate, SRP-6004, in the phase I NAVIGENE study for treating ambulatory patients with LGMD type 2B/R2. In December, Sarepta announced that it has started a clinical study on gene therapy candidate SRP-9004 in LGMD type 2D/R3. It is also on track to start a clinical study on another gene therapy, SRP-9005, for LGMD type 2C, in 2025. Both studies are designed to support potential FDA approval under the accelerated pathway.

Sarepta Therapeutics, Inc. price | Sarepta Therapeutics, Inc. Quote

Sarepta currently has a Zacks Rank #4 (Sell). You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 3 hours | |

| 4 hours | |

| 7 hours | |

| 9 hours | |

| 9 hours | |

| 12 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite