|

|

|

|

|||||

|

|

Central Garden & Pet Company CENT reported second-quarter fiscal 2025 results, wherein the top line missed the Zacks Consensus Estimate and declined year over year. Meanwhile, earnings surpassed the Zacks Consensus Estimate and improved from the same period last year.

The company’s fiscal second-quarter results highlight solid execution and continued progress despite softer sales. Margin and earnings per share improved year over year, driven by strong productivity gains and disciplined implementation of the Cost and Simplicity program. While a significant portion of the garden season remains ahead and macroeconomic and geopolitical uncertainties persist, the company is reaffirming its full-year outlook and remains committed to executing its Central to Home strategy with operational excellence.

In the second quarter of fiscal 2025, the company began winding down its operations in the U.K., and is transitioning to a direct-export model to serve customers in the U.K. and select European markets. This shift resulted in $5.3 million of initial non-cash charges to the Pet segment, including $4.4 million in cost of goods sold and $0.9 million in SG&A expenses.

Central Garden & Pet posted quarterly adjusted earnings of $1.04 per share, which surpassed the Zacks Consensus Estimate of 94 cents. Also, the figure increased from 99 cents in the prior-year period. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

Central Garden & Pet Company price-consensus-eps-surprise-chart | Central Garden & Pet Company Quote

The company reported consolidated net sales of $833.5 million, which missed the Zacks Consensus Estimate of $875 million. The metric fell 7% from $900.1 million posted in the year-ago period.

The adjusted gross profit was $277.5 million compared with $281.4 million reported in the year-ago period. The adjusted gross margin expanded 200 basis points (bps) to 33.3%, driven by productivity improvements from Central's Cost and Simplicity program.

SG&A expenses of $179.8 million decreased 3% from $185.4 million year over year, indicating cost management across the organization. As a percentage of net sales, the figure increased 100 bps to 21.6%. We anticipated SG&A expenses, as a percentage of net sales, to increase 20 bps.

The adjusted operating income was $98.7 million, in line with the figure reported in the year-ago period. The adjusted operating margin expanded 80 bps to 11.8%.

Adjusted EBITDA was $123.3 million compared with $124.4 million in the prior-year period.

Net sales for the Pet segment were $454 million, indicating a 6% decrease, which also missed our estimate of $468.5 million. This decline was largely due to the timing of customers' orders and promotional events in the first quarter, along with softer demand and assortment rationalization in durable pet products.

The segment’s adjusted operating income was $65.9 million, up 5% from the prior-year quarter. The adjusted operating margin expanded 150 bps to 14.5%, supported by productivity improvements.

In the Garden segment, net sales of $380 million declined 10% from the year-ago period and missed our estimate of $409.3 million. This decrease was due to pre-season order shifts into the first quarter, unfavorable weather that delayed the spring selling season and the discontinuation of two product lines in Central’s third-party distribution business.

The adjusted segment’s operating income of $58.7 million decreased from $62.3 million reported in the prior-year quarter. The adjusted operating margin improved 70 bps to 15.5%, driven by productivity gains.

Central Garden & Pet ended the quarter with cash and cash equivalents of $516.7 million, long-term debt of $1,190.7 million and shareholders’ equity of $1,541.5 million, excluding the non-controlling interest of $1.9 million.

The company repurchased about 1.2 million shares, or $41 million, in the quarter under review.

Following the end of the quarter, Central repurchased an additional 1.2 million shares for $39 million through April 30, 2025. As of April 30, 2025, $63 million remained available for future stock repurchases. Management expects capital expenditures for fiscal 2025 to be $60 million.

Central Garden & Pet reaffirms its guidance for 2025. The company continues to estimate fiscal 2025 adjusted earnings to be $2.20 per share or more, as mentioned earlier. This forecast takes into account factors such as the shifting consumer behavior amid ongoing macroeconomic and geopolitical uncertainty, challenges in the traditional retail market and unpredictability in weather patterns. The outlook excludes any potential effects from tariff rates, acquisitions, divestitures or restructuring activities, including initiatives related to the Cost and Simplicity program.

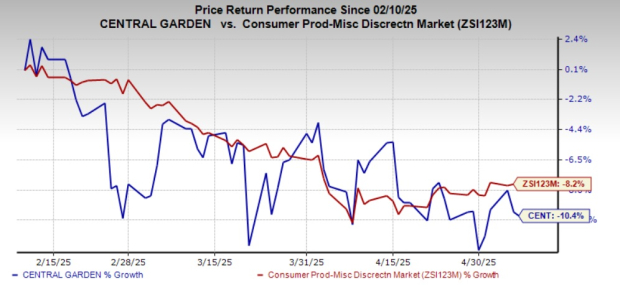

Shares of this Zacks Rank #3 (Hold) company have lost 10.4% in the past three months compared with the industry’s decline of 8.2%.

Sprouts Farmers SFM, which is engaged in the retailing of fresh, natural and organic food products, currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

SFM has a trailing four-quarter earnings surprise of 16.5%, on average. The Zacks Consensus Estimate for Sprouts Farmers’ current financial-year sales and earnings implies growth of around 13.7% and 32%, respectively, from the year-ago reported numbers.

United Natural Foods, Inc. UNFI distributes natural, organic, specialty, produce and conventional grocery and non-food products in the United States and Canada. At present, United Natural carries a Zacks Rank of 2 (Buy).

The consensus estimate for United Natural’s current fiscal-year sales and earnings implies growth of 1.9% and 485.7%, respectively, from the year-ago figures. UNFI delivered a trailing four-quarter earnings surprise of 408.7%, on average.

BRF Brasil Foods SA BRFS, formerly Perdigao S.A., is a Brazil-based food company. It carries a Zacks Rank #2 at present. BRFS delivered a trailing four-quarter average earnings surprise of 9.6%.

The consensus estimate for BRF’s current financial-year sales indicates growth of 0.3% from the prior-year reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite