|

|

|

|

|||||

|

|

Crocs, Inc. CROX has reported strong first-quarter 2025 results, wherein the top and bottom lines surpassed the Zacks Consensus Estimate. Revenues and earnings were flat year over year. The company’s first-quarter outperformance was driven by strong execution across the Crocs and HEYDUDE brands, supported by disciplined cost management, resilient consumer demand and strategic pricing.

The above-mentioned factors contributed to better-than-expected gross and operating margins, robust cash flow, and higher adjusted earnings per share despite a challenging macroeconomic environment.

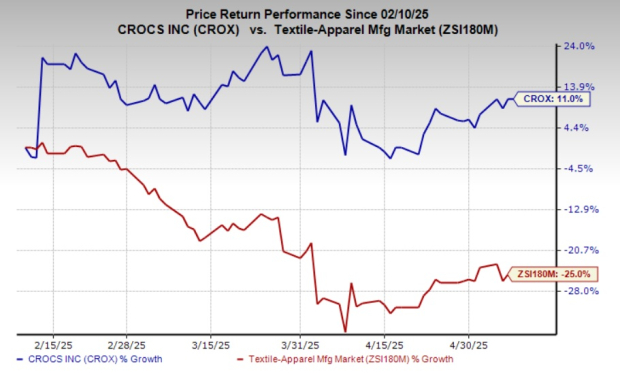

Shares of Crocs rose 1.2% in the pre-market trading session following the strong first-quarter 2025 performance. In the past three months, the Zacks Rank #4 (Sell) company’s shares have gained 11% against the industry’s 25% decline.

Crocs’ adjusted earnings of $3.00 per share beat the Zacks Consensus Estimate of $2.51 and were nearly flat year over year. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

Consolidated revenues were flat year over year at $937 million and beat the Zacks Consensus Estimate of $910 million. On a constant-currency basis, revenues improved 1.4% year over year. DTC revenues increased 2.3%, while wholesale revenues fell 1.6%. On a constant-currency basis, DTC revenues jumped 3.5% while wholesale revenues were flat year over year.

The Crocs brand’s revenues grew 2.4% year over year to $762 million, including a 1.1% increase in DTC revenues and a 3.2% rise in wholesale revenues. On a constant-currency basis, revenues for the Crocs brand improved 4.2%, with a 2.5% rise in the DTC business and a 5.3% increase in wholesale. Revenues for the Crocs brand surpassed the Zacks Consensus Estimate of $744 million.

The HEYDUDE brand’s revenues rose 9.8% year over year to $176 million. The decline was due to a 17.9% decrease in wholesale revenues, offset by an 8.3% increase in DTC revenues. On a constant-currency basis, revenues for the HEYDUDE brand improved 9.5%, with an 8.3% rise in the DTC business and a 17.4% increase in wholesale. Revenues for the HEYDUDE brand beat the Zacks Consensus Estimate of $167 million.

The adjusted gross profit rose 3% year over year to $541.5 million. The adjusted gross margin expanded 180 basis points (bps) to 57.8%. Adjusted selling, general and administrative (SG&A) expenses, as a percentage of revenues, increased 520 bps to 34%. Adjusted operating income fell 12.5% year over year to $255 million. The adjusted operating margin contracted 330 bps to 23.8% from the year-ago quarter.

Crocs, Inc. price-consensus-eps-surprise-chart | Crocs, Inc. Quote

The company ended first-quarter 2025 with cash and cash equivalents of $166.5 million, long-term borrowings of $1.48 billion, and stockholders’ equity of $1.97 billion. The company incurred a capital expenditure of $15 million in the first quarter of 2025.

In the quarter, the company borrowed $130 million of debt. CROX repurchased 0.6 million shares for $61 million. It had $1.3 billion of share repurchase authorization available for future repurchases at the end of the first quarter.

The company anticipates capital expenditure of $80-$100 million for 2025 related to the expansion of its distribution capabilities.

Amid ongoing macroeconomic uncertainty, led by evolving global trade policies, the company has decided to withdraw its 2025 financial guidance issued on Feb. 13, 2025. Given the current volatility, the company will not issue an updated full-year outlook now.

We have highlighted three better-ranked stocks, namely, G-III Apparel Group GIII, Under Armour UAA and Duluth Holdings DLTH.

G-III Apparel is a manufacturer, designer and distributor of apparel and accessories under licensed brands, owned brands, and private label brands. It has a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

GIII has a trailing four-quarter earnings surprise of 117.8%, on average. The Zacks Consensus Estimate for G-III Apparel’s current financial-year sales and EPS indicates declines of 1.2% and 4.5%, respectively, from the year-ago reported figures.

Under Armour is one of the leading designers, marketers and distributors of authentic athletic footwear, apparel and accessories for a wide variety of sports and fitness activities in the United States and internationally. The company carries a Zacks Rank #2 at present.

The consensus estimate for UAA’s current financial-year sales and EPS indicates declines of 9.8% and 44.4%, respectively, from the year-ago reported figures. Under Armour has a trailing four-quarter earnings surprise of 98.6%, on average.

Duluth Holdings, a provider of casual wear, workwear and accessories for men and women, carries a Zacks Rank of 2 at present. DLTH has a trailing four-quarter negative earnings surprise of 37.2%, on average.

The Zacks Consensus Estimate for DLTH’s current financial-year EPS indicates an increase of 5.6% from the year-ago reported level.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite