|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Women’s health device maker, Hologic HOLX, slashed its earnings forecast for the full fiscal 2025, even as the latest second-quarter results topped expectations. The revenue target of $4.05-$4.10 billion remained the same as stated during the February earnings call, reflecting the $100 million cut from the initial guidance. The company cited pressures from U.S. tariffs and geopolitical uncertainties as key factors behind the revised guidance, with select divisional challenges also playing a part. Following the earnings announcement, the after-hours market response was mostly negative. Read more: (Hologic Q2 Earnings & Revenues Top, '25 EPS View Lowered, Stock Down)

Two of Hologic’s close competitors also reported their quarterly results in the early hours on May 1. Becton, Dickinson and Company BDX estimates a $90 million tariff expense for fiscal 2025 related to the export of U.S.-manufactured goods to China. In its Q2 earnings call, Becton, Dickinson stated that it is already taking extra measures to further mitigate the impact of tariffs moving forward. Meanwhile, Exact Sciences EXAS delivered a solid Q1 report while navigating a challenging flu season, and also raised its 2025 sales and EBITDA guidance.

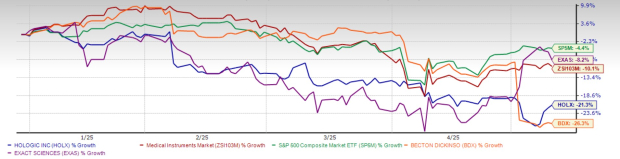

Year to date, HOLX shares have been down 21.3%, steeper than the industry, S&P 500 Composite and Exact Sciences’ plunge. BDX has experienced a further decline.

Let’s look at how the current macro dynamics are shaping Hologic’s outlook for the year.

The company expects to deliver adjusted EPS between $4.15 and $4.25 for fiscal 2025, down from the previous range of $4.25-$4.35. Hologic lowered its sales expectations for China to only $50 million, due to the region’s increasingly challenging geopolitical landscape. Still, a weakening U.S. dollar is expected to compensate for this reduction, allowing the company to keep its annual revenue projection unchanged. Hologic’s second-quarter adjusted earnings came at $1.03 per share, flat year over year but 0.9% above the Zacks Consensus Estimate. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

Core Diagnostics witnessed lesser HIV test sales volume in Africa due to the federal funding cuts, but managed to deliver 1.5% year-over-year growth. Additionally, U.S. growth in Cytology and Perinatal businesses was offset by low-single digit decline internationally, due to the ongoing physician strike in South Korea and reduced hospital spending in China. Hologic expects these challenges to weigh on the full year fiscal 2025 Diagnostics sales as well, capping growth at mid-single digits.

The Breast Health unit had a rocky start to fiscal 2025, with a 2.1% decline in the first quarter and a 6.9% decline in the second. Hologic expects a slowdown in gantry placements this year after an extended period of elevated growth following the chip shortage, creating tougher year-over-year comparisons. Furthermore, interventional breast products and Surgical offerings are mainly manufactured in Costa Rica, where a 10% baseline tariff on U.S. imports is currently in effect.

This, along with significantly higher tariffs on China-sourced raw materials and components, will add an additional $20 million to $25 million in inventory acquisition costs per quarter this year. Hologic still assumes a low-single-digit decline in Breast Health for the full year. Meanwhile, all Skeletal products are produced by a third-party manufacturer in Mexico, which is expected to be mostly exempt from tariffs under the United States-Mexico-Canada Agreement.

As you can see below, analysts are starting to lower Hologic’s EPS estimates for both fiscal 2025 and 2026. For the third quarter, the company expects total revenues between $1 billion and $1.01 billion, with non-GAAP EPS ranging between 1.04 and $1.07. Meanwhile, the Zacks Consensus Estimate for the company’s third-quarter revenues lies at $1.01 billion, indicating a 0.4% year-over-year drop. The consensus mark for EPS is flat year over year at $1.06.

The company’s Diagnostics business remains one of the top-performing diversified assets in its space, with growth consistently led by the core Molecular business. In the fiscal 2025 second quarter, Molecular Diagnostics grew 7.8% year over year (excluding COVID-19-related sales), driven by the high-throughput BV/CV/TV assay, increased sales of respiratory tests and strong growth in the Biotheranostics oncology business. With BV/CV/TV, Hologic is addressing the wide unmet need in the vaginitis market, where older manual testing methods still dominate. Meanwhile, Biotheranostics benefits from the growing adoption of the breast cancer index (BCI) test.

Breast Health service revenues, tied to Hologic’s global gantry installed base, made up more than 45% of the segment’s revenues in the second quarter. The 2024 acquisition of Endomagnetics bolstered the Interventional Breast business, with Hologic now selling its products directly through its own sales force in North America. The move, part of the initiatives carried on by the company’s new leadership team, positions it to tap into the significant market opportunity for wireless localization. Additionally, the Affirm Contrast Biopsy Software received CE mark approval, building on its 2020 FDA approval.

International Surgical sales jumped 16.2% in the second quarter, and the momentum is set to continue. The Fluent Pro system, launched in late 2024, is gaining traction by improving the performance and user experience of the MyoSure platform. Hologic continues to project full-year Surgical growth at high-single digits, driven by the latest Gynesonics acquisition. Meanwhile, the Skeletal Health franchise contributed in the second quarter, growing 22.9% from the accelerated production ramp of the DXA system. Moreover, with a strong operating cash flow of $169.5 million and $1.43 billion in cash and investments as of the fiscal second quarter-end, the company is well-positioned to fund key in-house initiatives and deploy cash toward both M&A and share repurchases.

From a valuation standpoint, Hologic is trading at a forward five-year price-to-sales (P/S) of 3.01X, lower than the industry average of 4.07X. The stock’s Score of B further adds to the appeal.

Meanwhile, EXAS and Becton, Dickinson carry a higher forward five-year P/S of 3.00X and 2.13X, respectively, compared to their industry average.

Hologic has taken a cautious approach with its updated fiscal 2025 projections, given the uncertainties in the economic and policy landscape. The stock has underperformed compared to both the industry and the benchmark, while estimates are likely to continue to trend downward in the near term. Despite the cheaper valuation, it may be wise for potential HOLX investors to wait for a more favorable entry point. However, the company’s recent Q2 performance once again highlights the strength of its divisional drivers, which are poised to support growth in the coming years as well. Robust international performance and financial stability are also encouraging. Hence, the current HOLX shareholders may find it prudent to stay invested.

Hologic carries a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 4 hours | |

| 8 hours | |

| 10 hours | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite