|

|

|

|

|||||

|

|

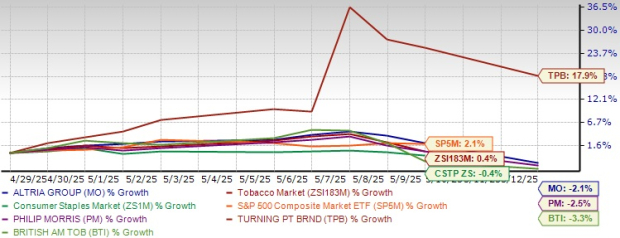

Altria Group Inc. MO saw its shares pull back 2.1% since reporting first-quarter 2025 results on April 30, 2025. This performance marks a notable underperformance compared to the Zacks Tobacco industry, which edged up 0.4%, the Zacks Consumer Staples sector, which slipped 0.4%, and the broader S&P 500, which advanced 2.1% during the same period.

Among its tobacco peers, Turning Point Brands, Inc. TPB significantly outperformed, delivering a 17.9% return during this time. Meanwhile, major global competitors Philip Morris International PM and British American Tobacco BTI saw declines of 2.5% and 3.3%, respectively.

The decline in Altria’s share price came despite reporting first-quarter adjusted earnings per share (EPS) of $1.23, which surpassed the Zacks Consensus Estimate of $1.17 and marked 6% year-over-year growth. However, net revenues declined 5.7% to $5.26 billion primarily due to weaker volumes. (Read: MO Q1 Earnings Beat Estimates, Sales Decline on Low Cigarette Volumes)

While revenues fell short, the underlying business remained resilient. Altria’s robust pricing strategy, high dividend yield, and momentum in smoke-free products such as on! continue to support its long-term outlook. That said, investor sentiment was likely impacted by the regulatory setback that forced the discontinuation of NJOY ACE, a key part of its e-vapor portfolio.

This divergence between solid earnings performance and stock price weakness raises a critical question for investors: Is the pullback a short-term overreaction or a long-term buying opportunity?

Altria demonstrated its pricing resilience in the first quarter, effectively leveraging strong pricing strategies to support profitability amid declining cigarette shipment volumes. Despite ongoing macroeconomic pressure and rising operational costs, Altria’s ability to raise prices across its Smokeable Products and Oral Tobacco categories helped cushion the blow to revenues.

The U.S. cigarette industry continues to face headwinds, and Altria is no exception. In the first quarter of 2025, cigarette shipment volumes fell due to persistent macroeconomic challenges and the rapid expansion of illegal disposable e-vapor products. Inflationary pressures, particularly affecting lower-income consumers, have curtailed disposable income and pushed smokers toward more affordable alternatives. While inflation has shown signs of easing, elevated everyday costs are still weighing on consumer behavior.

As a result, Altria’s Smokeable Products segment saw continued revenue softness, which resulted in the company’s overall top-line pressure. However, the company’s robust pricing initiatives have helped mitigate margin erosion, reflecting its ability to navigate a declining volume environment effectively.

A standout performer in the first quarter was on!, Altria’s oral nicotine pouch brand managed by Helix Innovations. The brand saw shipment volumes rise 18%, surpassing 39 million cans. Notably, on! expanded its retail share of the oral tobacco category to 8.8%, while increasing its market share in the nicotine pouch segment to 17.9%. These gains came even as Altria raised retail prices, underscoring strong consumer demand and brand loyalty.

Altria’s e-vapor business faced significant disruption in the quarter, with NJOY ACE pulled from the market due to a recent regulatory challenge. This led to a non-cash impairment charge of $873 million. Despite the setback, Altria reiterated its long-term commitment to the vapor space. The company continues to call out the growing presence of illicit disposable vapes, which now make up over 60% of the e-vapor market. These unregulated products are taking share from compliant brands like NJOY. However, Altria views this as a strategic opportunity to innovate. By leveraging NJOY’s R&D capabilities and aligning with evolving consumer preferences, the company aims to launch next-generation vapor products that are both compliant and competitive.

The Zacks Consensus Estimate for MO’s 2025 and 2026 EPS increased 0.8% and 1.1%, respectively, in the past 30 days. The upward revisions in earnings estimates indicate a bullish outlook for the stock. (Find the latest earnings estimates and surprises on Zacks Earnings Calendar.)

The Zacks Consensus Estimate for Altria’s second-quarter 2025 EPS has moved up by a penny in the past 30 days, highlighting optimism over the company’s near-term prospects.

Altria is currently trading at a notable discount compared to both its industry peers and the broader market, making it an appealing option for value-focused investors. As of now, Altria trades at a forward 12-month price-to-earnings (P/E) ratio of 10.51x, which is significantly lower than the industry average of 14.55x and the S&P 500’s average of 20.70x. This relative undervaluation is further supported by Altria’s Value Score of B.

The valuation disparity becomes even more striking when compared to key competitors. Philip Morris is trading at a forward P/E of 21.17x, while Turning Point commands a multiple of 19.66x. Meanwhile, British American Tobacco is trading at a lower multiple of 8.80x.

Altria is also trading well above its 100-day and 200-day moving averages — an important bullish technical indicator. This breakout is not just technical but reflects growing market confidence in its growth story.

Altria’s post-earnings pullback may look like a warning sign on the surface, but the fundamentals suggest otherwise. Altria continues to navigate a shifting landscape marked by inflationary pressures, regulatory uncertainty, and category disruption. But it does so while demonstrating pricing power and executing on its long-term strategy to pivot toward smoke-free alternatives. With its defensive business model and attractive valuation, Altria remains a stable and reliable investment. For those looking for a blend of value and relative safety, the recent pullback could be a green light and not a cause for concern.

At present, Altria carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| 5 hours | |

| 6 hours | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite