|

|

|

|

|||||

|

|

GE HealthCare Technologies Inc. GEHC recently announced FDA approval for Optison, its polyethylene glycol (PEG)-free ultrasound enhancing agent, for use in pediatric patients. This milestone expands the application of Optison to children of all ages, enabling clearer and more accurate echocardiogram imaging.

As one of the only ultrasound agents in the United States without PEG, Optison offers a safer alternative for patients with PEG hypersensitivity. With a proven safety profile and decades of clinical use in adults, this FDA approval follows successful studies demonstrating Optison’s efficacy in pediatric heart imaging. GE HealthCare’s expanded pediatric indication reflects its commitment to advancing diagnostic tools that improve accuracy while addressing patient safety and comfort, positioning Optison as a vital solution in pediatric cardiology diagnostics.

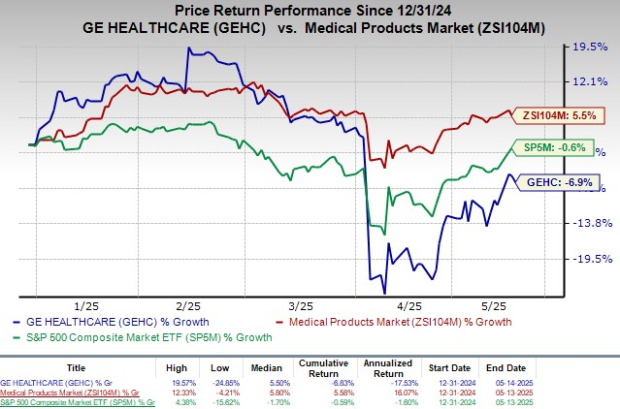

Shares of the company closed flat at $72.84 yesterday following the announcement. In the year-to-date period, GEHC shares have lost 6.9% against the industry’s 5.5% growth. The S&P 500 decreased 0.6% in the same time frame.

The FDA approval of Optison for pediatric use significantly broadens GEHC’s market potential by enabling access to a new and critical patient segment. This expansion not only reinforces GEHC’s leadership in ultrasound imaging agents but also drives incremental revenue growth through increased adoption in pediatric cardiology. The product is positioned to capture greater market share amid rising demand for advanced, non-invasive diagnostic tools. Over the long term, this approval strengthens GEHC’s competitive edge, supports sustained earnings growth, and enhances investor confidence, making the stock poised for upward momentum.

Meanwhile, GEHC currently has a market capitalization of $33.81 billion. In the last reported quarter, GEHC delivered an earnings surprise of 10.9%.

Optison is an advanced ultrasound enhancing agent developed by GEHC, designed to improve the clarity and diagnostic accuracy of echocardiograms. By using gas-filled microbubbles that reflect ultrasound waves more effectively than surrounding tissues or blood, Optison enhances the visibility of the heart chambers and endocardial borders. This improved imaging capability is crucial for cardiologists to assess ventricular function and diagnose heart abnormalities or diseases accurately. Importantly, Optison is the only ultrasound enhancing agent available in the United States that does not contain PEG, a substance known to cause hypersensitivity or anaphylaxis in some patients, making it a safer option for individuals with PEG allergies.

The recent FDA approval for Optison’s pediatric indication marks a significant milestone for GEHC. Previously approved for adult use since 1997, Optison’s pediatric approval follows a comprehensive Phase IV clinical study that demonstrated its efficacy and safety in children aged 9 to 17. This approval allows cardiologists to extend the use of Optison to pediatric patients with suboptimal echocardiograms, addressing the challenge of obtaining clear heart images in younger patients. The clinical study demonstrated that Optison enhanced the delineation of endocardial borders, improved visualization of left ventricular wall segments, and reduced the number of suboptimal echocardiogram images, thereby facilitating more accurate diagnoses and informed treatment decisions for pediatric heart conditions.

Beyond its diagnostic benefits, Optison’s unique safety profile adds considerable value in clinical settings. Unlike many other contrast agents, Optison’s PEG-free formulation reduces the risk of hypersensitivity reactions, which is particularly important for vulnerable pediatric patients. Despite its proven safety over decades and use in over 5 million adult patients in the United States, serious adverse reactions remain rare but are closely monitored, with guidelines emphasizing the importance of patient assessment and the availability of resuscitation equipment during administration.

The FDA approval of Optison for pediatric use is set to significantly strengthen GE HealthCare’s Pharmaceutical Diagnostics (PDx) segment by expanding its addressable market and driving increased adoption of its ultrasound-enhancing agents. By enabling use in pediatric patients, an important and previously underserved group, Optison can capture new revenue streams and deepen GEHC’s footprint in cardiac imaging diagnostics. This approval also enhances the segment’s product portfolio with a PEG-free contrast agent, differentiating it from competitors and meeting growing demand for safer, more effective diagnostic tools. Ultimately, this milestone supports PDx’s growth trajectory by boosting clinical adoption, improving patient outcomes, and reinforcing GE HealthCare’s leadership in innovative diagnostic solutions.

GEHC carries a Zacks Rank #3 (Hold) at present.

Some better-ranked stocks in the broader medical space that have announced quarterly results are CVS Health Corporation CVS, Integer Holdings Corporation ITGR and Boston Scientific Corporation BSX.

CVS Health, carrying a Zacks Rank of 2 (Buy), reported first-quarter 2025 adjusted earnings per share (EPS) of $2.25, beating the Zacks Consensus Estimate by 31.6%. Revenues of $94.59 billion outpaced the consensus mark by 1.8%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

CVS Health has a long-term estimated growth rate of 11.4%. CVS’s earnings surpassed estimates in each of the trailing four quarters, with an average surprise of 18.1%.

Integer Holdings reported first-quarter 2025 adjusted EPS of $1.31, beating the Zacks Consensus Estimate by 3.2%. Revenues of $437.4 million surpassed the Zacks Consensus Estimate by 1.3%. It currently sports a Zacks Rank #1.

Integer Holdings has a long-term estimated growth rate of 18.4%. ITGR’s earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 2.8%.

Boston Scientific reported first-quarter 2025 adjusted EPS of 75 cents, beating the Zacks Consensus Estimate by 11.9%. Revenues of $4.66 billion surpassed the Zacks Consensus Estimate by 2.3%. It currently carries a Zacks Rank #2.

Boston Scientific has a long-term estimated growth rate of 13.3%. BSX’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 8.8%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite