|

|

|

|

|||||

|

|

Deere & Company DE reported second-quarter fiscal 2025 (ended April 27) earnings of $6.64 per share, beating the Zacks Consensus Estimate of $5.68. The bottom line decreased 22% from the prior-year quarter on lower shipment volumes.

Net sales of equipment operations (comprising Agriculture, and Turf, Construction and Forestry) were $11.17 billion, down 17.9% year over year. However, net sales topped the Zacks Consensus Estimate of $10.65 billion. Total net sales (including financial services and others) were $12.76 billion, down 16% year over year.

Deere & Company price-consensus-eps-surprise-chart | Deere & Company Quote

The cost of sales in the reported quarter was down 16.9% year over year to $7.61 billion. Total gross profit decreased 20.1% year over year to $3.55 billion. Selling, administrative and general expenses fell 5.4% to $1.19 billion from the prior-year period.

Total operating profit (including financial services) was down 26% year over year to $2.31 billion in the fiscal second quarter.

The Production & Precision Agriculture segment’s sales fell 21% year over year to $5.23 billion due to lower shipment volumes, partially offset by price realization. The figure beat our model’s estimated revenues of $4.61 billion for the quarter. Operating profit decreased 30% year over year to $1.15 billion. Our estimate for the segment’s operating profit was $619 million.

Small Agriculture & Turf sales fell 6% to $2.99 billion from the year-earlier quarter. Our projection for the segment’s sales was $2.78 billion. Segmental sales were impacted by lower shipment volume, partially negated by price realization. Operating profit rose 1% year over year to $574 million. The figure beat our estimate for operating profit of $485 million for the segment.

Construction & Forestry sales were $2.95 million, down 23% year over year. The figure missed our projection of $3.29 billion. Operating profit decreased 43% year over year to $379 million. The downside was driven by lower shipment volumes and unfavorable price realization. Our estimate for the segment’s operating profit was $588 million.

Revenues in Deere’s Financial Services division were $1.38 billion in the reported quarter, down 1% year over year. The figure missed our estimate of $1.48 billion. Net income of the company’s Financial Services division was $161 million in the reported quarter compared with $162 million in the prior-year quarter.

DE reported cash and cash equivalents of $7.99 billion at the end of second-quarter fiscal 2025 compared with $7.32 billion at the end of fiscal 2024. The cash flow from operating activities was $568 million in the first half of fiscal 2025 compared with $944 million in the prior-year period. At the end of the quarter, the long-term borrowing was nearly $43 billion compared with $41 billion at the year-ago quarter’s end.

Deere expects net income for fiscal 2025 between $4.75 billion and $5.50 billion.

Net sales for Production & Precision Agriculture are expected to decrease 15-20% year over year in fiscal 2025.

Sales of Small Agriculture & Turf are expected to decline 10-15%. Sales of Construction & Forestry are projected to be down 10-15%. The Financial Services segment’s net income is expected to be $750 million.

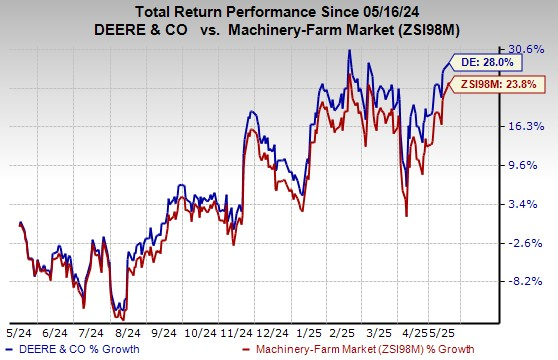

The company’s shares have gained 28% in the past year compared with the industry’s 23.8% growth.

Deere currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AGCO Corp. AGCO delivered adjusted earnings per share of 41 cents in first-quarter 2025 compared with the prior-year quarter’s $2.32. The reported figure topped the Zacks Consensus Estimate of 3 cents.

AGCO’s net sales decreased 30% year over year to $2.05 billion in the March-end quarter. The top line beat the Zacks Consensus Estimate of $2.02 billion. Excluding the unfavorable currency-translation impacts of 2.4%, net sales fell 27.6% year over year.

Lindsay Corporation LNN posted earnings per share of $2.44 in second-quarter fiscal 2025 (ended Feb. 28, 2025), beating the Zacks Consensus Estimate of $1.89. The bottom line rose 49% year over year.

Lindsay generated sales of $187 million, up from $152 million in the year-ago quarter. The top line beat the Zacks Consensus Estimate of $180 million.

CNH Industrial N.V. CNH reported first-quarter 2025 adjusted earnings per share of 10 cents, which declined from 33 cents in the prior-year quarter. The figure, however, surpassed the Zacks Consensus Estimate of 9 cents.

In the first quarter, CNH Industrial’s net sales declined nearly 21% from the year-ago level to $3.82 billion but topped the Zacks Consensus Estimate of $3.79 billion. The company’s net sales from industrial activities came in at $3.17 billion, down 23% due to lower shipment volumes.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 51 min | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite