|

|

|

|

|||||

|

|

DexCom, Inc. DXCM is well-poised for growth in the coming quarters, backed by its strong product portfolio. A strong first-quarter 2025 performance and a series of favorable coverage decisions are expected to contribute further. However, risks related to stiff competition persist.

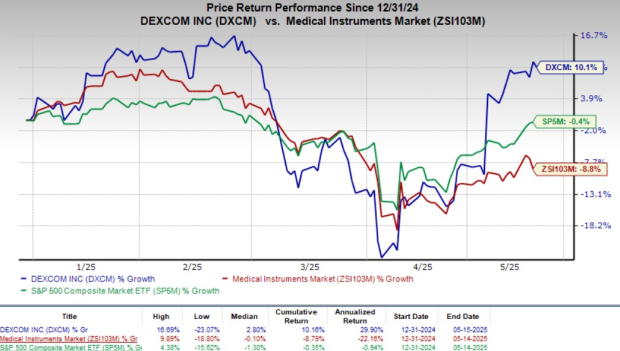

This Zacks Rank #2 (Buy) company’s shares have gained 10.1% year to date compared to the industry’s 8.8% decline. The S&P 500 Index has declined 0.4% in the same time frame.

DXCM, a renowned medical device company and provider of continuous glucose monitoring (CGM) systems, has a market capitalization of $33.93 billion. It projects a 23.1% growth rate over the next five years and anticipates maintaining a strong performance going forward.

DexCom’s earnings surpassed the Zacks Consensus Estimate in two of the trailing four quarters and missed twice, the average surprise being 0.47%.

Let’s delve deeper.

Strong Product Demand: We are upbeat about DexCom's continued strength in CGM products.

In the first quarter, Dexcom’s G7 system continued its robust momentum. Accelerated conversion of the installed base for G7 manufacturing is driving strong revenue performance and improving gross margins. Both the U.S. and international markets benefited from enhanced reimbursement and access wins, underscoring the system’s clinical value.

In Europe, Dexcom’s One+ system performed strongly. The company finalized the basal coverage for One+ in France during the fourth quarter. These trends underscore DexCom’s growing market presence and the effectiveness of its innovative solutions in diabetes management and metabolic health. Internationally, Dexcom has seen pockets of strength in key markets, such as Japan and France, where recent type 2 diabetes coverage expansions have driven growth.

New Product Launch: Dexcom plans to launch a 15-day G7 sensor in the second half of 2025, which is expected to bolster margins and enhance user experience. Additionally, efforts are underway to integrate AI-driven analytics, which deliver personalized insights and support improved patient care. DXCM is actively developing its next-generation sensor, G8, as its new hardware platform across its product portfolio. Building on the insights gained from G7, G8 will be a smaller, more advanced wearable that incorporates multi-analytic capabilities, enhancing its diagnostic potential.

Key product innovations included the launch of Stelo, the first over-the-counter continuous glucose monitor (CGM), which is now available through Amazon's storefront. Dexcom also implemented several software and connectivity updates, including a 180-day data look-back feature, which enhances customer experience and supports wider user engagement. Stelo adoption is growing steadily, particularly among type 2, prediabetes and health-conscious consumers.

In December, DXCM announced the launch of a proprietary Generative AI (GenAI) platform, making it the first CGM manufacturer to integrate GenAI into glucose biosensing technology.

In November, DexCom inked a partnership with OURA with plans to expand its services into smart ring technology, a trending health tracker device. The collaboration is aimed at revolutionizing metabolic health management by integrating DexCom's glucose biosensor data with the biometric insights provided by the Oura Ring. The companies will also co-market and cross-sell each other’s products. The first app integration resulting from the partnership is expected to be launched in 2025.

Positive Coverages: Reimbursement expansion is also playing a crucial role in DexCom’s growth, with insurance coverage extending beyond insulin users. As of January 2025, Dexcom secured coverage with two of the three largest pharmacy benefit managers (PBMs) for all people with diabetes, regardless of insulin use. This contributed to a significant uptick in new starts from the type 2 non-insulin population — the highest in the company’s history. The third major PBM is set to add Dexcom G7 coverage in select formularies by mid-year, marking a transformational shift in CGM access across the United States.

Strong Q1 Results: Dexcom delivered strong operational performance in the first quarter of 2025, driven by robust category demand, significant access wins and focused execution across its teams. The company reported record acceleration in demand from new customers, attributed to its expanded commercial reach following a broad prescriber base expansion in 2024.

U.S. revenues (72% of total revenues) increased 15% on a year-over-year basis to $750.5 million. International revenues (28%) improved 7% (12% on an organic basis) year over year to $285.5 million. Adjusted gross profit totaled $596.2 million, up 4.8% from the prior-year quarter’s level. The company reported total adjusted operating income of $143.1 million, up 2.1% from the prior-year period’s recorded number.

DexCom’s strong revenue growth projection for 2025, driven by continued market expansion, broader access wins and advancements in its CGM technology, looks promising. The company expects revenues to be $4.6 billion, implying 14% year-over-year growth.

Rebate Pressure: Dexcom is encountering notable rebate pressure in the U.S. market, which negatively impacted its revenue growth despite strong demand and improved sales force productivity. The rebate eligibility challenges resulted in a lower growth rate as reported revenue figures reflected these headwinds. Management anticipates that this pressure will become minimal throughout 2025 as efforts to stabilize the rebate channel take effect and support a more robust performance.

Stiff Competition: Rising competition in the Type 1 diabetes market, particularly from pump-integrated CGM systems, adds pressure. Additionally, the leadership transition in the U.S. commercial team introduces potential risks to execution as DexCom navigates these dynamics. While challenges persist, the company’s strategic initiatives and innovation-driven approach position it well for sustained growth.

DexCom, Inc. price | DexCom, Inc. Quote

DexCom has witnessed a stable estimate revision trend for 2025. In the past 30 days, the Zacks Consensus Estimate for 2025 earnings per share has moved down 1 cent to $2.02.

The consensus mark for the company’s second-quarter revenues is pegged at $1.12 billion, indicating an 11.8% improvement from the year-ago quarter’s reported number. The consensus estimate for earnings is pinned at 45 cents per share, implying an improvement of 4.7% year over year.

Some other top-ranked stocks from the same medical industry are GENEDX HOLDINGS WGS, CVS Health CVS and Cencora COR.

GENEDX, sporting a Zacks Rank #1 (Strong Buy) at present, has an estimated growth rate of 336% for 2025. You can see the complete list of today’s Zacks #1 Rank stocks here.

WGS’ earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 145.82%. WGS’ shares have declined 17.3% so far this year.

CVS Health, carrying a Zacks Rank #2 (Buy) at present, has an estimated growth rate of 12.2% for 2025.

CVS’ earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 18.08%. CVS’ shares have risen 34.7% year to date.

Cencora, carrying a Zacks Rank of 2 at present, has an estimated earnings growth rate of 16.7% for 2025.

COR’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 6.00%. Its shares have gained 27.3% so far this year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 13 hours | |

| 14 hours | |

| 15 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite