|

|

|

|

|||||

|

|

GE HealthCare Technologies Inc. GEHC recently announced the launch of CleaRecon DL, an innovative AI-based deep learning technology designed to enhance 3D cone-beam computed tomography (CBCT) imaging in the interventional suite. This cutting-edge solution aims to significantly reduce streak artifacts caused by pulsatile blood flow and contrast distribution, resulting in clearer, more accurate images for improved patient diagnosis and treatment outcomes. CleaRecon DL recently received FDA 510(k) clearance and CE mark.

As part of GE HealthCare’s commitment to advancing medical imaging, CleaRecon DL integrates seamlessly with its Allia Image-Guided Solutions (IGS) systems, providing clinicians with enhanced visualization while minimizing the introduction of additional artifacts. This launch marks a significant step forward in the application of AI to optimize interventional imaging, enabling healthcare providers to deliver safer, more effective care with greater confidence.

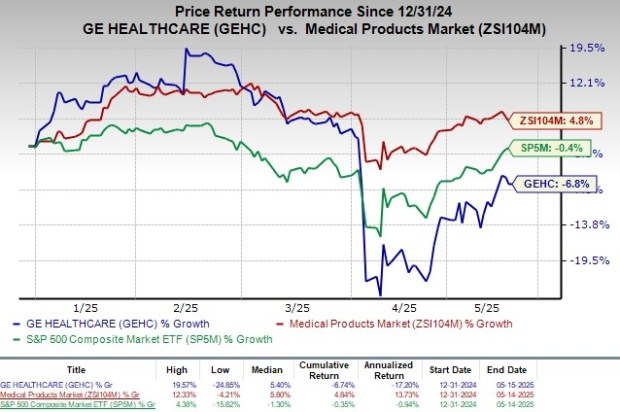

Shares of the company closed flat at $72.91 yesterday following the announcement. In the year-to-date period, GEHC shares have lost 6.8% against the industry’s 4.8% growth. The S&P 500 decreased 0.4% in the same time frame.

The launch of CleaRecon DL positions GE HealthCare at the forefront of AI-driven medical imaging innovation, strengthening its competitive edge in the growing interventional imaging market. By offering a technology that significantly improves image clarity and diagnostic accuracy, GEHC can attract more healthcare providers to adopt its Allia Image-Guided Solutions, driving increased sales and recurring revenues. Additionally, as demand for advanced, AI-enabled healthcare tools continues to rise, this cutting-edge product enhances GEHC’s growth prospects and investor confidence, potentially boosting its stock price over the long term.

Meanwhile, GEHC currently has a market capitalization of $33.35 billion. In the last reported quarter, GEHC delivered an earnings surprise of 10.9%.

GE HealthCare’s newly launched CleaRecon DL leverages deep learning, a state-of-the-art artificial intelligence technique known for its superior performance in image processing. Trained on population-representative data and developed in collaboration with clinical domain experts, CleaRecon DL is engineered to perform specific tasks such as eliminating imaging artifacts and enhancing the clarity of CBCT. This innovative solution outputs significantly clearer and more accurate 3D images, allowing clinicians to better visualize anatomical structures during interventional procedures. In clinical validation studies, 98% of cases demonstrated that CBCT images reconstructed with CleaRecon DL were clearer than conventional CBCT images, and 94% reported an improvement in interpretation confidence, marking a significant leap in diagnostic support.

CleaRecon DL has been developed to work in tandem with GE HealthCare’s Allia IGS systems, a suite of advanced technologies used in interventional radiology and cardiology. The integration is designed to be seamless, allowing clinicians to access enhanced image quality without disrupting existing workflows or requiring additional hardware. With this upgrade, Allia users benefit from improved visualization of vascular structures and tissue details, which is especially valuable during complex procedures such as embolizations, tumor ablations, and vascular interventions. This compatibility reinforces GEHC's ecosystem approach, encouraging healthcare providers already using Allia systems to adopt the new CleaRecon DL feature.

In recent months, GEHC has made strategic moves to expand its imaging services and AI capabilities. Recently, GEHC introduced SIGNA Sprint, a next-generation ultra-premium 1.5T MRI system at the International Society for Magnetic Resonance in Medicine 2025, engineered to push the boundaries of traditional MRI performance. In March, GEHC unveiled Freelium, a next-generation sealed magnet platform at ECR 2025, designed to revolutionize Magnetic Resonance imaging. The platform uses less than 1% of helium compared to traditional systems, promoting sustainability and expanding access to quality imaging in helium-scarce regions. In January, GEHC partnered with Sutter Health to form a seven-year Care Alliance, enhancing access to innovative imaging services and improving the patient and clinician experience across the Sutter Health network. This collaboration aims to create a more seamless and coordinated healthcare system.

GEHC carries a Zacks Rank #4 (Sell) at present.

Some better-ranked stocks in the broader medical space that have announced quarterly results are CVS Health Corporation CVS, Integer Holdings Corporation ITGR and AngioDynamics ANGO.

CVS Health, carrying a Zacks Rank of 2 (Buy), reported first-quarter 2025 adjusted earnings per share (EPS) of $2.25, beating the Zacks Consensus Estimate by 31.6%. Revenues of $94.59 billion outpaced the consensus mark by 1.8%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

CVS Health has a long-term estimated growth rate of 11.4%. CVS’s earnings surpassed estimates in each of the trailing four quarters, with an average surprise of 18.1%.

Integer Holdings reported first-quarter 2025 adjusted EPS of $1.31, beating the Zacks Consensus Estimate by 3.2%. Revenues of $437.4 million surpassed the Zacks Consensus Estimate by 1.3%. It currently sports a Zacks Rank #1.

Integer Holdings has a long-term estimated growth rate of 18.4%. ITGR’s earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 2.8%.

AngioDynamics, currently sporting a Zacks Rank #1 (Strong Buy), reported a third-quarter fiscal 2025 adjusted EPS of 3 cents against the Zacks Consensus Estimate of a 13-cent loss. Revenues of $72 million beat the Zacks Consensus Estimate by 2%.

ANGO has an estimated fiscal 2026 earnings growth rate of 27.8% compared with the S&P 500 Composite’s 10.5% growth. The company surpassed earnings estimates in each of the trailing four quarters, with the average surprise being 70.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 6 hours | |

| 10 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite