|

|

|

|

|||||

|

|

IHS Holding Limited IHS is scheduled to release first-quarter 2025 results on May 20, before market open. The Zacks Consensus Estimate for earnings is currently pegged at 17 cents per share on revenues of $421.3 million.

First-quarter earnings estimates have been revised upward by 21.4% over the past 60 days. The bottom-line projection indicates an increase of 342.9% from the year-ago number. The Zacks Consensus Estimate for quarterly revenues indicates year-over-year growth of 0.8%.

IHS has a dismal earnings surprise history. The company’s earnings outpaced the Zacks Consensus Estimate only once in the trailing four quarters, the average surprise being a negative 46.6%. However, in the last reported quarter, it delivered an earnings surprise of 812.5%. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

IHS Holding Limited price-eps-surprise | IHS Holding Limited Quote

Our proven model does not conclusively predict an earnings beat for the company this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold) increases the odds of an earnings beat, but that’s not the case here.

IHS has an Earnings ESP of 0.00% and a Zacks Rank of 1. You can see the complete list of today’s Zacks #1 Rank stocks here.

You can uncover the best stocks before they’re reported with our Earnings ESP Filter.

IHS has been benefiting from its growing presence across emerging markets in Africa. Solid demand for the company’s critical infrastructure that facilitates mobile communication coverage and connectivity in the backdrop of increasing 5G deployment is expected to have augmented its top-line performance in the first quarter. The results are likely to be driven by growth in revenues from colocation (average number of tenants per tower), lease amendments and new sites.

The company is leveraging its market-leading position and capitalizing on the growing demand for communications infrastructure solutions, particularly in Nigeria. Exiting 2024, its total number of towers in its largest market, Nigeria, was 16,495, reflecting an increase of 0.6% year over year. These are likely to have driven its performance in the quarter.

Strength in the SSA market (comprising South Africa, Cameroon and other countries), supported by the addition of new tenants and higher revenues from colocations and lease amendments, is likely to drive its results. For instance, IHS added approximately 100 towers and more than 800 tenants across the SSA market in 2024. It’s worth noting that the deployment of 5G across sub-Saharan Africa and Latin America has been driving demand for IHS' towers.

The company’s strategic priorities to expand its presence across markets are also anticipated to have been favourable. For instance, in 2024, it successfully renewed and extended all MTN MLAs, which include MTN Nigeria. The company also entered into an extended deal with Airtel Nigeria to add 3,950 new tenancies.

However, IHS’ international presence keeps it exposed to the risk of adverse currency fluctuations. This is because a strengthening U.S. dollar requires the company to either raise prices or contract profit margins in locations outside the United States.

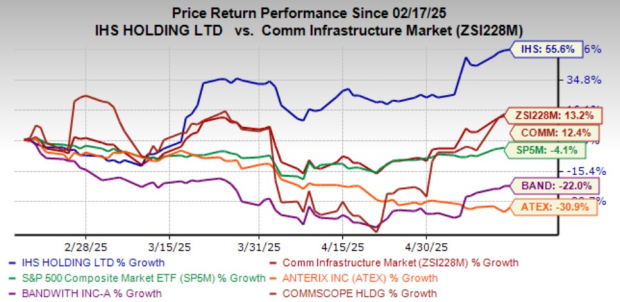

IHS shares have surged 55.6% in the past three months compared with the Zacks Communication - Infrastructure industry’s 13.2% growth. Shares of this shared communications infrastructure owner and operator have also fared better than the S&P 500’s decline of 4.1%. The company’s peers, Anterix Inc. ATEX and Bandwidth Inc. BAND, have lost 30.9% and 22% respectively, while CommScope Holding Company, Inc. COMM gained 12.4% in the same period.

It’s worth noting that Anterix is well-known for providing transformative broadband solutions to utility and critical infrastructure customers. While CommScope offers infrastructure solutions for communications, data center and entertainment networks, Bandwidth operates as a Communications Platform-as-a-Service provider.

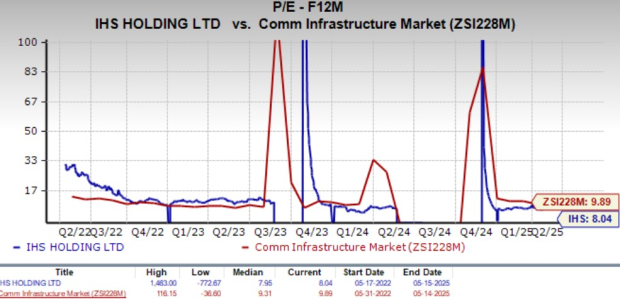

In terms of valuation, IHS’ forward 12-month price-to-earnings (P/E) is 8.04X, which is below the industry average of 9.89X. IHS stock presents an attractive valuation for investors. In comparison with IHS’ valuation, Bandwidth and CommScope are trading at 8.93X and 5.77X, respectively.

Solid momentum in the communication infrastructure market, supported by growing demand for scalable infrastructure for seamless connectivity with the wide proliferation of IoT, transition to cloud and accelerated 5G rollout, positions IHS favorably for strong first-quarter results. Its strategic priorities and growth investments also bode well.

With a favorable valuation compared with the industry and strong earnings projections, the company is well-positioned to deliver sustained growth and shareholder value. We believe that the IHS stock is an ideal candidate for investors' portfolios.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-23 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite