|

|

|

|

|||||

|

|

Fortinet FTNT and Cisco Sytems CSCO are well-established players in the network security market. Both offer enterprise-grade cybersecurity solutions and network infrastructure, with Fortinet focused purely on security and Cisco blending security with broader networking products.

Per the Mordor Intelligence report, the network security market size is estimated at $24.95 billion in 2025. It is expected to witness a CAGR of 11.47% over the forecast period 2025-2030, reaching $42.93 billion by 2030. Both FTNT and CSCO are well-positioned to take advantage of this strong growth in the network security market.

Let’s take a closer look at the fundamentals of the two stocks to determine which one has the greater upside potential.

Fortinet continued to demonstrate strong momentum in network security during the first quarter of 2025, underscored by its leadership in firewall deployments and secure networking. The company maintained its position as the most deployed firewall vendor globally and recorded double-digit growth in FortiGate hardware revenues, driven by early adoption from large enterprise customers upgrading their infrastructure.

A key driver of Fortinet’s performance has been the expansion of its unified Secure Access Service Edge (SASE) platform. In the first quarter, the company reported 18% year-over-year growth in unified SASE billings, with large enterprise SD-WAN penetration reaching 73% and FortiSASE adoption rising nearly 10 percentage points quarter over quarter. Fortinet remains the only vendor to organically develop all core SASE capabilities within a single operating system, FortiOS, improving user experience while reducing complexity and costs.

The launch of the FortiGate 700G series has been strengthening Fortinet’s competitive edge, delivering 5x to 10x performance over rivals through its proprietary FortiASIC technology. Notable customer wins so far include eight-figure SASE deployments with government and education sectors, and seven-figure SD-WAN deals with multinational enterprises.

Fortinet has also been showcasing growing traction with its sovereign SASE solution, tailored for highly regulated sectors, such as finance and healthcare. This offering ensures full on-premise or in-country data control, addressing compliance needs without compromising performance. As a result, Fortinet’s secure networking business is continuing to gain market share, supported by high performance and a unified approach to security.

Cisco’s network security business delivered strong results in the third quarter of fiscal 2025, supported by product innovation and growing customer demand. Security orders rose in the high double digits year over year, with notable contributions from Splunk, SASE, and new offerings like Secure Access, XDR, and Hypershield. The company added more than 370 new customers across these platforms. Most Hypershield customers bundled the product with Cisco’s N9300 Smart Switch, taking advantage of Cisco’s ability to embed security directly into the network fabric.

Cisco has also been benefitting from continued strength in its enterprise networking portfolio. Strong partnerships, such as those with Nvidia, has been enabling Cisco to expand AI-ready secure infrastructure across public and private sector clients globally, reinforcing its position as a trusted partner in sovereign and enterprise cloud builds.

Despite this momentum, Cisco’s networking growth has been facing tough comparisons and remains below historical peaks. While AI infrastructure orders exceeded $600 million in the fiscal third quarter, most revenues have yet to flow through. Additionally, Cisco acknowledged some uncertainty tied to tariffs and macroeconomic conditions. The company noted that future tariff changes could impact margins and that current demand trends remain subject to variability, particularly in global public sector and enterprise deployment timing.

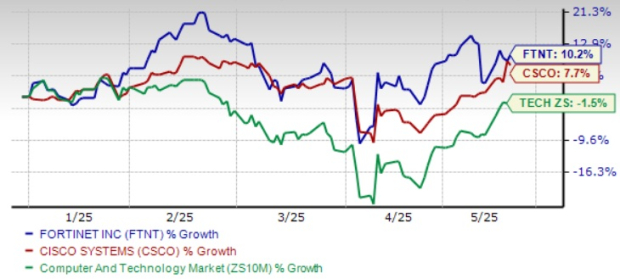

In the year-to-date period, shares of FTNT have returned 10.2%, outperforming CSCO’s gain of 7.7%, and the Zacks Computer and Technology sector’s decline of 1.5%. Fortinet’s outperformance can be attributed to its robust SASE and firewall demand.

In terms of valuation, FTNT’s current forward 12-month P/S ratio of 11.16X is ahead of CSCO’s 4.38X. Although FTNT is trading at a significant premium compared to CSCO, the premium valuation reflects investor confidence in the company's growth potential for the rest of 2025. In contrast, CSCO’s current forward 12-month P/S ratio indicates more cautious market sentiment around its near-term performance.

The Zacks Consensus Estimate for FTNT’s 2025 earnings is pegged at $2.47 per share, which has been revised upward by 3 cents over the past 60 days, indicating a 4.22% increase year over year. The consensus estimate for 2025 revenues is pinned at $6.75 billion, suggesting year-over-year growth of 13.36%.

Fortinet, Inc. price-consensus-chart | Fortinet, Inc. Quote

The Zacks Consensus Estimate for CSCO’s fiscal 2025 earnings is pegged at $3.73 per share, which has been revised upward by a penny over the past 60 days, indicating no change year over year. The consensus estimate for 2025 revenues is pinned at $56.43 billion, suggesting a year-over-year increase of 4.89%.

Cisco Systems, Inc. price-consensus-chart | Cisco Systems, Inc. Quote

Fortinet offers a stronger investment case in 2025 with consistent double-digit revenue growth, expanding SASE adoption, and leadership in firewall deployments. Its integrated platform, ASIC-driven performance, and growing traction in regulated sectors like government and finance have strengthened investor confidence.

Cisco, while showing promise through AI infrastructure deals and the Splunk integration, still faces delayed revenue realization and macro uncertainties. Legacy exposure and slower momentum in core security products make its near-term outlook less compelling compared to Fortinet’s focused and high-growth network security strategy.

FTNT and CSCO currently carry a Zacks Rank #3 (Hold) each. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 8 hours | |

| 8 hours | |

| 9 hours | |

| 9 hours |

Stock Market Today: Dow, Tech Futures Slide; Nvidia, Palantir, Tesla Extend Losses (Live Coverage)

CSCO

Investor's Business Daily

|

| 10 hours | |

| 11 hours | |

| 11 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-15 | |

| Feb-14 | |

| Feb-14 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite