|

|

|

|

|||||

|

|

Reddit RDDT and Bumble BMBL operate social networking platforms that facilitate user-generated content and community engagement, offering investors exposure to the social networking sector. RDDT serves as a vast network of communities where users can discuss a wide range of topics, while BMBL offers dating, friendship, and professional networking services, emphasizing user interaction and connection.

Per Mordor Intelligence report, the global social networking market size is projected to be valued at $95.33 billion in 2025, and is expected to reach $209.82 billion by 2030, witnessing a CAGR of 17.09% during the forecast period from 2025 to 2030. RDDT and BMBL are likely to benefit from the significant growth opportunity highlighted by the rapid pace of growth.

RDDT or BMBL — Which of these Social Networking stocks has the greater upside potential? Let’s find out.

Reddit is benefiting from the continued expansion of its advertising business, higher user engagement, and the company’s growing artificial intelligence (AI) initiatives. Ad revenues increased 61% year over year to $358.6 million in the first quarter of 2025.

In the reported quarter, weekly active users grew 31% to 401 million, and daily active users rose 31% to 108 million, increasing engagement and ad impressions.

Reddit enhanced its search capabilities, making it easier for users to find relevant content and communities. In the first quarter of 2025, Reddit Answers, RDDT’s AI-powered search tool, reached one million weekly users and expanded globally, starting with Australia and the United Kingdom.

The company’s expanding portfolio has been a key catalyst. In May 2025, RDDT enhanced Reddit Pro with streamlined profile setup and new tools that allow businesses to showcase community conversations. These updates make it easier for brands to build trust, connect authentically, and engage with Reddit’s vast network of communities.

BMBL is benefiting from enhanced user experience through new features, AI-driven personalized matching, and strong growth in its Bumble BFF friendship platform.

Building on this momentum, the company is investing in new features like the Discover tab, safety tools like ID verification, date review, and an upcoming coaching hub, which are designed to improve user experience and engagement. It is also investing in Bumble BFF to grow its friendship platform, expanding the brand beyond just dating.

The focus on Bumble BFF has been noteworthy, as it has become a key growth area with more than one million active users, especially popular with Gen Z and young professionals, further expanding the brand’s reach.

The company is also rapidly enhancing its personalized matching algorithm using AI and machine learning to deliver more relevant matches, which is already showing positive early results.

Moreover, BMBL is actively removing bots, scammers, and low-quality profiles while fostering a verified, trusted community. This effort increases member trust and encourages better engagement, which is critical for long-term sustainable growth.

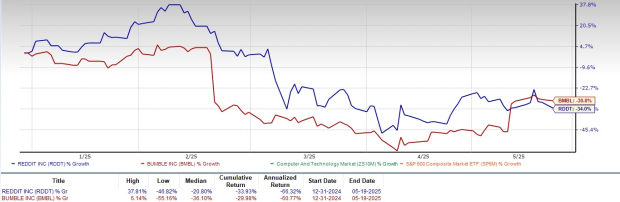

In the year-to-date period, shares of RDDT and BMBL have lost 34% and 30%, respectively. The dip in RDDT and BMBL’s share price is due to the challenging macroeconomic environment. A broader market weakness in the tech sector and persistent fear over mounting tariffs have added to the pressure. Intense competition also remained a headwind.

Valuation-wise, RDDT shares are currently overvalued as suggested by a Value Score of F. BMBL shares are trading cheap as suggested by a Value Score of A.

In terms of the forward 12-month Price/Sales, RDDT shares are trading at 9.71X, which is higher than BMBL’s 0.62X.

The Zacks Consensus Estimate for RDDT’s 2025 earnings is pegged at $1.21 per share, which has increased 16.3% over the past 30 days, indicating a 136.34% rise year over year.

Reddit Inc. price-consensus-chart | Reddit Inc. Quote

The Zacks Consensus Estimate for BMBL’s 2025 earnings is pegged at 86 cents per share, which has risen 32.3% over the past 30 days, indicating a 118.66% increase year over year.

Bumble Inc. price-consensus-chart | Bumble Inc. Quote

While both RDDT and BMBL stand to benefit from the booming social networking market, BMBL offers greater upside potential with stronger earnings growth, cheaper valuation, and expanding platforms beyond dating. Its focus on expanding portfolio, AI-driven personalization, and Gen Z engagement positions it well for long-term success.

Despite RDDT’s expanding advertising business increasing international reach, and improving the user experience with upgraded search and discovery features, the company is suffering from intense competition from other social media platforms, which is consistently affecting user engagement and market share in advertising. Stretched valuation also remains a concern.

Currently, Bumble carries a Zacks Rank #2 (Buy), making the stock a stronger pick than Reddit, which has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 7 hours | |

| 10 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-15 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite